Zoetis Inc

$ 122.57

-1.50%

03 Dec - close price

- Market Cap 54,321,000,000 USD

- Current Price $ 122.57

- High / Low $ 125.80 / 121.25

- Stock P/E 20.95

- Book Value 12.23

- EPS 5.85

- Next Earning Report 2026-02-17

- Dividend Per Share $1.93

- Dividend Yield 1.55 %

- Next Dividend Date -

- ROA 0.15 %

- ROE 0.50 %

- 52 Week High 179.46

- 52 Week Low 115.25

About

Zoetis Inc. (ZTS) is a leading global animal health company dedicated to improving the health and well-being of livestock and companion animals. As the largest manufacturer of medicines and vaccines for animals, Zoetis leverages advanced research and development to offer a comprehensive range of innovative products that enhance productivity in animal agriculture and support the well-being of pets globally. Committed to sustainability and animal welfare, Zoetis is well-positioned to meet the increasing demand for premium animal health solutions in an expanding market, making it an attractive investment opportunity for institutional investors.

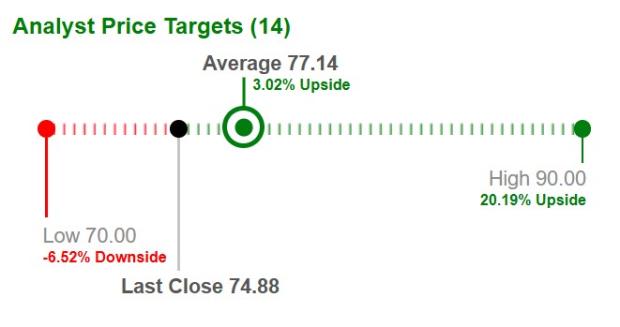

Analyst Target Price

$165.36

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-03 | 2025-08-05 | 2025-05-06 | 2025-02-13 | 2024-11-04 | 2024-08-06 | 2024-05-02 | 2024-02-13 | 2023-11-02 | 2023-08-08 | 2023-05-04 | 2023-02-14 |

| Reported EPS | 1.7 | 1.61 | 1.48 | 1.4 | 1.58 | 1.56 | 1.38 | 1.24 | 1.36 | 1.41 | 1.31 | 1.15 |

| Estimated EPS | 1.64 | 1.52 | 1.4 | 1.36 | 1.46 | 1.49 | 1.34 | 1.32 | 1.36 | 1.32 | 1.26 | 1.05 |

| Surprise | 0.06 | 0.09 | 0.08 | 0.04 | 0.12 | 0.07 | 0.04 | -0.08 | 0 | 0.09 | 0.05 | 0.1 |

| Surprise Percentage | 3.6585% | 5.9211% | 5.7143% | 2.9412% | 8.2192% | 4.698% | 2.9851% | -6.0606% | 0% | 6.8182% | 3.9683% | 9.5238% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-17 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.41 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-02 | 2025-09-03 | 2025-06-03 | 2025-03-04 | 2024-12-03 | 2024-09-04 | 2024-06-04 | 2024-03-01 | 2023-12-01 | 2023-09-01 |

| Amount | $0.5 | $0.5 | $0.5 | $0.5 | $0.432 | $0.432 | $0.432 | $0.432 | $0.375 | $0.375 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ZTS

2025-12-01 23:38:00

This article analyzes Zoetis Inc. Class A (ZTS) focusing on its impact on rotational strategy timing, identifying strong near and mid-term sentiment but a weak long-term outlook. It details specific institutional trading strategies, including position trading, momentum breakout, and risk hedging, with corresponding entry, target, and stop-loss levels. The analysis also provides multi-timeframe signal analysis, showing support and resistance levels for ZTS.

2025-12-01 17:21:58

This page provides financial data for Zoetis, Inc. Class A (SIX:ZTS) specifically focusing on total equity. It serves as a financial overview for investors interested in the company's balance sheet information. The content lists the company's name and stock symbol, alongside a table for total equity value, change, and change percentage over various periods.

2025-11-30 08:55:00

Moderna (MRNA) surged 16.19% last week, leading the S&P 500 healthcare sector amidst a broader market rally. Despite strong liquidity and low debt, the company faces significant challenges with negative revenue growth and profitability, indicated by a low Piotroski F-Score and mid-range Altman Z-Score. Its valuation shows mixed signals with a neutral RSI-14 and a GF Score of 55, classifying it as a distressed stock.

2025-11-29 07:22:30

This page provides real-time stock price information for Zoetis Inc. Class A (ZTS), including a live quote and chart. It also includes information on analyst ratings and notes that earnings information is not currently available for the company.

2025-11-27 15:06:32

This article compares Hologic (HOLX) and Quest Diagnostics (DGX), two prominent players in the healthcare diagnostics market, to determine which offers a better investment opportunity. Hologic specializes in women's health diagnostics and has seen growth in breast health, GYN surgical, and molecular diagnostics. Quest Diagnostics focuses on broad diagnostic testing and is experiencing tailwinds from advanced diagnostics, strategic acquisitions, and operational excellence initiatives. While both companies show solid footing, Quest Diagnostics is presented as the more compelling option due to its impressive year-to-date performance and valuation.

2025-11-23 09:33:03

Entropy Technologies LP has made a new investment in CVS Health Corporation, purchasing 36,699 shares valued at approximately $2.53 million in the second quarter. CVS Health reported strong Q3 earnings, exceeding revenue and EPS estimates, and provided positive FY2025 guidance. Analysts maintain a "Moderate Buy" rating for CVS, which also offers a significant quarterly dividend with a 3.4% yield.