Olympic Steel Inc

$ 47.86

0.00%

26 Feb - close price

- Market Cap 538,984,000 USD

- Current Price $ 47.86

- High / Low $ 47.86 / 47.86

- Stock P/E 40.91

- Book Value 51.72

- EPS 1.17

- Next Earning Report 2026-04-30

- Dividend Per Share $0.63

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.02 %

- ROE 0.02 %

- 52 Week High 52.65

- 52 Week Low 25.94

About

Olympic Steel, Inc. processes and distributes metal products in the United States and internationally. The company is headquartered in Bedford Heights, Ohio.

Analyst Target Price

$38.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-19 | 2025-10-30 | 2025-07-30 | 2025-04-30 | 2025-02-20 | 2024-10-31 | 2024-08-01 | 2024-05-02 | 2024-02-22 | 2023-11-02 | 2023-08-03 | 2023-05-04 |

| Reported EPS | 0 | 0.19 | 0.5 | 0.21 | 0.3326 | 0.23 | 0.66 | 0.75 | 0.64 | 0.81 | 1.3 | 0.8 |

| Estimated EPS | 0.07 | 0.16 | 0.4333 | 0.24 | 0.33 | 0.31 | 0.55 | 0.72 | 0.3 | 0.85 | 1.22 | 0.71 |

| Surprise | -0.07 | 0.03 | 0.0667 | -0.03 | 0.0026 | -0.08 | 0.11 | 0.03 | 0.34 | -0.04 | 0.08 | 0.09 |

| Surprise Percentage | -100% | 18.75% | 15.3935% | -12.5% | 0.7879% | -25.8065% | 20% | 4.1667% | 113.3333% | -4.7059% | 6.5574% | 12.6761% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-30 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.78 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-15 | 2025-09-15 | 2025-06-16 | 2025-03-17 | 2024-12-16 | 2024-09-16 | 2024-06-17 | 2024-03-15 | 2023-12-15 | 2023-09-15 |

| Amount | $0.16 | $0.16 | $0.16 | $0.16 | $0.15 | $0.15 | $0.15 | $0.15 | $0.125 | $0.125 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ZEUS

2026-02-20 10:45:05

Ryerson Holding Corp's stock surged by 17.03% following its successful merger with Olympic Steel, completed on February 13, 2026. This merger is projected to generate $120 million in annual run-rate synergies by 2028, positioning Ryerson as the second-largest metals service center in North America. Despite a Q4 2025 earnings miss, the company saw a 9.7% year-over-year increase in net sales, indicating resilience and potential for enhanced shareholder value through improved profitability and operational efficiency.

2026-02-19 21:28:10

Ryerson Holding Corporation (RYI) reported that its fourth-quarter revenue met guidance despite margin compression and a net loss. The company's merger with Olympic Steel and an expanded credit facility are expected to position it for future growth. While full-year sales were flat, Adjusted EBITDA improved year-over-year, and the Q1 2026 outlook anticipates higher revenue and margin recovery.

2026-02-19 17:28:10

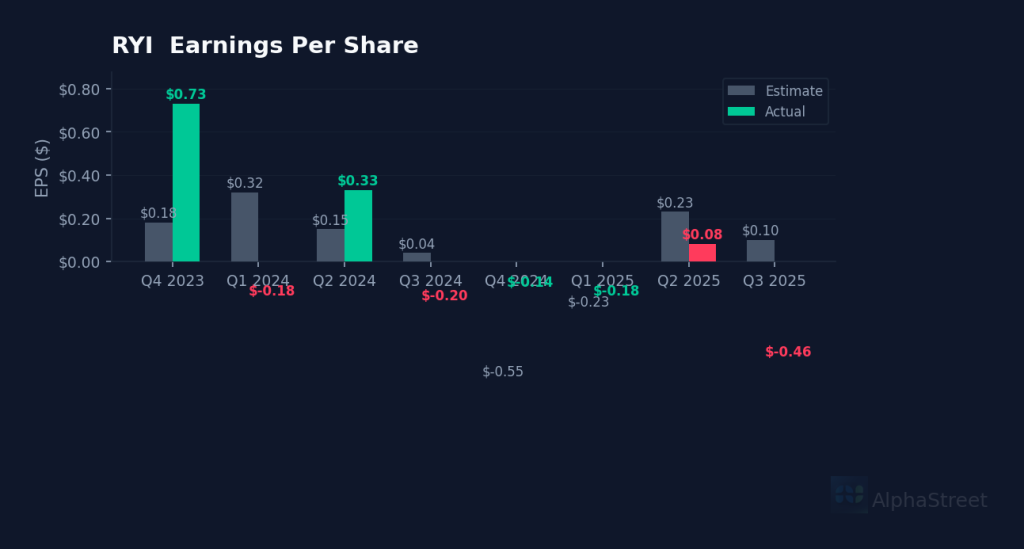

Ryerson Holding Corp (RYI) reported a Q4 EPS of -$0.46, significantly missing estimates by 560%, and announced a merger with Olympic Steel to counter margin compression and declining volumes. Despite revenue growth, the stock fell, reflecting investor concerns over profitability issues highlighted by a negative profit margin and net income. Management expects further volume softening but anticipates a positive cash flow from working capital release.

2026-02-18 18:57:32

A Bridgeport man has been arrested in connection with the theft of 26 tons of aluminum from Olympic Steel in Milford. Ramon Penalo-Villar turned himself in to police on charges including third-degree burglary and first-degree larceny, with his bond set at $150,000. Another suspect, Eddy Ramirez, was previously arrested last month for the same theft.

2026-02-17 21:55:56

A Bridgeport man, Ramon Penali-Villar, has been accused of stealing 26 tons of aluminum from Olympic Steel Company. He turned himself in after allegedly committing the theft in November with Eddy Ramirez, who was arrested in January. Authorities successfully recovered all of the stolen aluminum.

2026-02-16 20:27:20

Ryerson Holding has completed its merger with Olympic Steel, creating a combined entity that strengthens Ryerson's position as the second-largest metals service center in North America. The merger is expected to generate approximately $120 million in annual synergies by early 2028 and will trade on the NYSE under the symbol "RYZ" starting February 24. Key leadership roles have been announced, including former Olympic Steel CEO Richard T. Marabito becoming President and COO of Ryerson, and Michael D. Siegal chairing the Ryerson Board.