Xencor Inc

$ 11.57

1.40%

23 Feb - close price

- Market Cap 826,219,000 USD

- Current Price $ 11.57

- High / Low $ 11.79 / 11.23

- Stock P/E N/A

- Book Value 8.77

- EPS -1.73

- Next Earning Report 2026-02-26

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.09 %

- ROE -0.20 %

- 52 Week High 18.69

- 52 Week Low 6.92

About

Xencor, Inc., a clinical-stage biopharmaceutical company, focuses on the discovery and development of cytokine and monoclonal antibody therapies designed to treat cancer patients and autoimmune diseases in the United States and internationally. The company is headquartered in Monrovia, California.

Analyst Target Price

$28.83

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-05 | 2025-08-06 | 2025-05-07 | 2025-02-25 | 2024-11-05 | 2024-08-05 | 2024-05-09 | 2024-02-27 | 2023-11-07 | 2023-08-03 | 2023-05-08 | 2023-02-23 |

| Reported EPS | -0.08 | -0.41 | -0.66 | -0.62 | -0.71 | -1.07 | -1.11 | -0.31 | -0.4 | -0.37 | -1.02 | -0.2 |

| Estimated EPS | -0.69 | -0.72 | -0.581 | -0.7862 | -0.98 | -0.88 | -0.79 | -0.09 | -0.73 | -0.8 | -0.66 | -0.79 |

| Surprise | 0.61 | 0.31 | -0.079 | 0.1662 | 0.27 | -0.19 | -0.32 | -0.22 | 0.33 | 0.43 | -0.36 | 0.59 |

| Surprise Percentage | 88.4058% | 43.0556% | -13.5972% | 21.1397% | 27.551% | -21.5909% | -40.5063% | -244.4444% | 45.2055% | 53.75% | -54.5455% | 74.6835% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.64 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: XNCR

2026-02-23 14:32:11

Xencor Inc is projected to report a loss of 60 cents per share according to an earnings preview. This financial outlook is based on Reuters data. Investors and analysts will be watching for the official earnings release to confirm these predictions.

2026-02-19 10:34:45

Xencor (NASDAQ:XNCR) is set to release its Q4 2025 earnings before market open on Thursday, February 26th, with analysts projecting earnings of ($0.64) per share. The company's shares opened at $11.34, and despite recent significant insider stock sales by the CEO and VP, analysts maintain a "Moderate Buy" consensus with an average target price of $24.88.

2026-02-14 10:57:47

This article discusses Xencor Inc (XNCR), a clinical-stage biotech company focused on antibody-based drugs for cancer and immune diseases. It posits that while not a mainstream stock, it has a niche following among biotech enthusiasts due to its high-risk, high-reward nature, dependent on clinical trial success and partnerships. The piece emphasizes that XNCR is a long-term, volatile investment suitable for investors who understand the biotech pipeline and can tolerate significant risk.

2026-02-14 10:28:15

Xencor Inc (XNCR) is a clinical-stage biotech company developing antibody-based drugs for cancer and immune diseases, attracting attention from biotech enthusiasts and high-risk traders. The article emphasizes that investing in XNCR is a high-risk, high-reward play, dependent on the success of its pipeline, strategic partnerships, and FDA approvals, rather than immediate product launches or stable earnings. It advises potential investors to understand the volatility and conduct thorough due diligence, recommending it for those comfortable with significant risk and long-term speculation in a diversified biotech portfolio.

2026-02-13 09:58:25

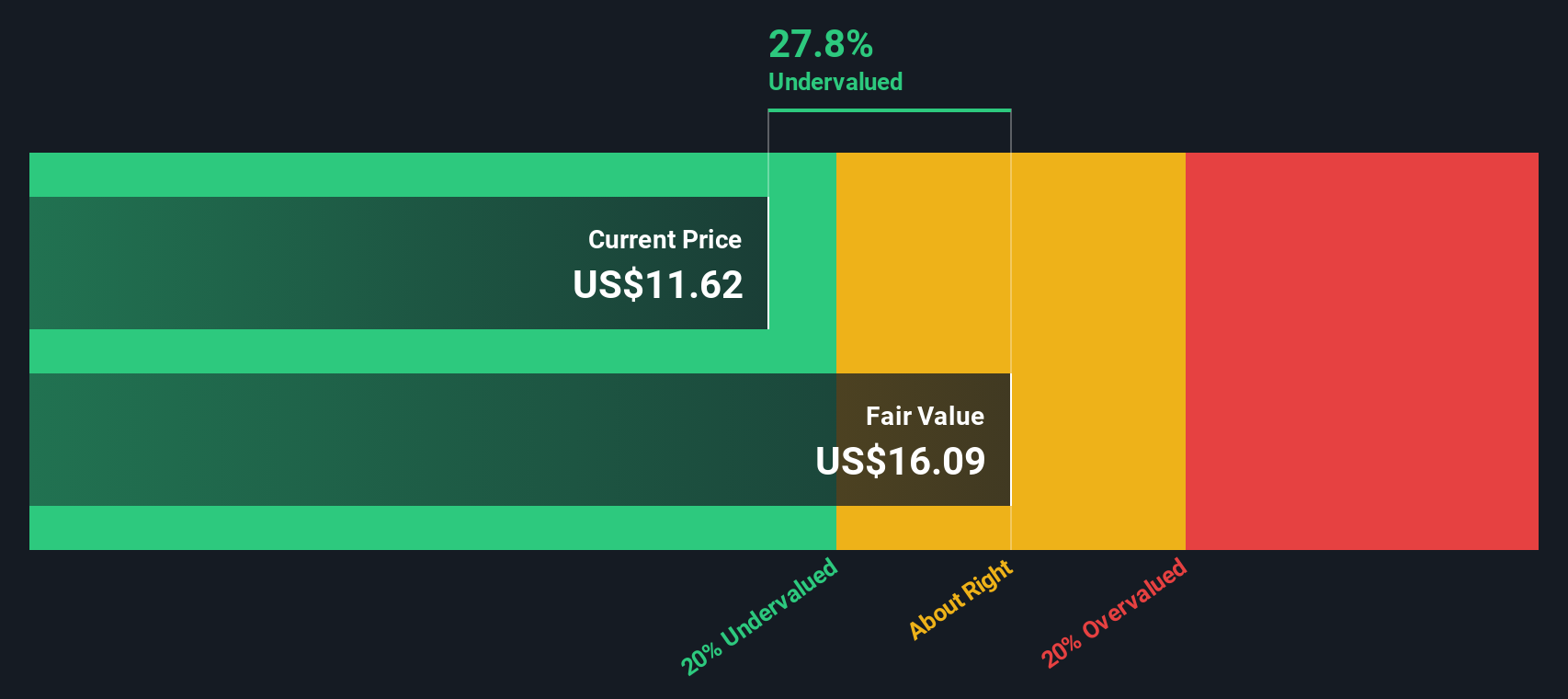

Xencor, Inc. (NASDAQ:XNCR) is estimated to be 28% undervalued based on a Discounted Cash Flow (DCF) model, with a fair value of US$16.09 compared to its current share price of US$11.62. Analysts project a price target of US$28.83 for XNCR, significantly higher than the estimated fair value. The valuation considers future cash flows over a two-stage growth period and highlights key assumptions impacting the DCF calculation.

2026-02-13 06:58:25

Xencor, Inc. (NASDAQ:XNCR) has received an average "Moderate Buy" rating from analysts, with ten firms covering the company including eight buy ratings, one hold, and one sell. The average 1-year target price from these analysts is $24.88. Recent insider selling by the CEO and VP was noted, with both reducing their stock holdings.