Watts Water Technologies Inc

$ 330.77

2.09%

24 Feb - close price

- Market Cap 10,806,681,000 USD

- Current Price $ 330.77

- High / Low $ 331.94 / 326.00

- Stock P/E 31.89

- Book Value 60.81

- EPS 10.16

- Next Earning Report -

- Dividend Per Share $1.99

- Dividend Yield 0.61 %

- Next Dividend Date 2026-03-13

- ROA 0.11 %

- ROE 0.18 %

- 52 Week High 345.17

- 52 Week Low 176.55

About

Watts Water Technologies, Inc. designs, manufactures and sells products and systems that manage and conserve the flow of fluids and energy to, through and from buildings in the commercial and residential markets of the Americas, Europe, Asia-Pacific, the Middle East and Africa. . The company is headquartered in North Andover, Massachusetts.

Analyst Target Price

$338.56

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-16 | 2025-10-29 | 2025-08-06 | 2025-05-07 | 2025-02-10 | 2024-10-30 | 2024-08-07 | 2024-05-08 | 2024-02-12 | 2023-11-01 | 2023-08-02 | 2023-05-03 |

| Reported EPS | 2.62 | 2.5 | 3.09 | 2.37 | 2.02 | 2.03 | 2.46 | 2.33 | 1.97 | 2.04 | 2.34 | 1.92 |

| Estimated EPS | 2.32 | 2.26 | 2.63 | 2.13 | 1.87 | 1.99 | 2.33 | 2.1 | 1.78 | 1.83 | 2.04 | 1.64 |

| Surprise | 0.3 | 0.24 | 0.46 | 0.24 | 0.15 | 0.04 | 0.13 | 0.23 | 0.19 | 0.21 | 0.3 | 0.28 |

| Surprise Percentage | 12.931% | 10.6195% | 17.4905% | 11.2676% | 8.0214% | 2.0101% | 5.5794% | 10.9524% | 10.6742% | 11.4754% | 14.7059% | 17.0732% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-13 | 2025-12-15 | 2025-09-15 | 2025-06-13 | 2025-03-14 | 2024-12-13 | 2024-09-13 | 2024-06-14 | 2024-03-15 | 2023-12-15 |

| Amount | $0.52 | $0.52 | $0.52 | $0.52 | $0.43 | $0.43 | $0.43 | $0.43 | $0.36 | $0.36 |

Next Dividend Records

| Dividend per share (year): | $1.99 |

| Dividend Yield | 0.61% |

| Next Dividend Date | 2026-03-13 |

| Ex-Dividend Date | 2026-02-27 |

Recent News: WTS

2026-02-23 22:53:07

Watts Water Technologies (WTS) director, Timothy P. Horne, sold 7,500 shares of Class A Common Stock for $2,475,300 on February 20, 2026. This transaction occurred despite the stock's strong 53% return over the past year, with an InvestingPro analysis suggesting the stock is currently overvalued. The company also recently announced a quarterly dividend and received various analyst ratings and price targets.

2026-02-23 19:42:04

Watts Water Technologies Inc. has released its 2025 Form 10-K report, detailing robust financial performance with significant increases in net sales, gross profit, operating income, and diluted EPS. The report highlights strategic initiatives including new product launches, manufacturing expansions, and five strategic acquisitions in 2025. It also outlines key challenges such as market competition, technological risks, economic cycles, supply chain disruptions, and geopolitical factors.

2026-02-23 17:38:41

A director at Watts Water Technologies (WTS), Timothy P. Horne, sold 7,500 shares of Class A Common Stock for $2.47 million on February 20, 2026. This transaction occurred at prices ranging from $330.00 to $330.90 per share. Despite the sale, Watts Water Technologies has seen a strong 53% return over the past year, though InvestingPro analysis suggests the stock is currently overvalued.

2026-02-22 23:20:00

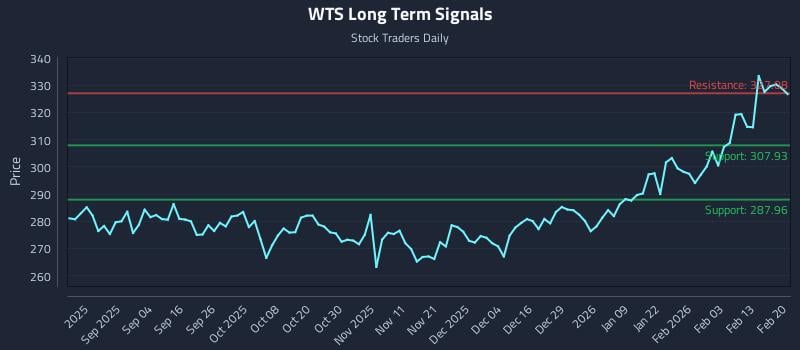

This article provides an analysis of Watts Water Technologies Inc. Class A (NYSE: WTS), highlighting a weak near-term sentiment that could precede shifts in its mid and long-term outlook. It details specific institutional trading strategies, including long, breakout, and short setups, with defined entry zones, targets, and stop losses. The analysis also includes multi-timeframe signal strengths, support, and resistance levels for WTS.

2026-02-21 17:03:09

Robert J. Pagano Jr., CEO of Watts Water Technologies Inc, sold 14,266 shares of Class A Common Stock for $5.26 million on February 19, 2026. This transaction occurred as the stock neared its 52-week high, having returned 51% in the past year. Despite the sale, Pagano still directly owns 191,202 shares, and the company maintains strong fundamentals even though InvestingPro considers the stock overvalued.

2026-02-20 18:38:41

Robert J. Pagano Jr., President and CEO of Watts Water Technologies Inc, sold 14,266 shares of Class A Common Stock for $5.26 million on February 19, 2026. This transaction occurred as the stock neared its 52-week high, having returned 51% in the past year, though InvestingPro analysis suggests it is currently overvalued. The company also recently announced a quarterly dividend and received various analyst ratings, including an upgrade to Overweight by KeyBanc.