Westwood Holdings Group Inc

$ 16.60

2.34%

24 Feb - close price

- Market Cap 152,976,000 USD

- Current Price $ 16.60

- High / Low $ 16.72 / 16.32

- Stock P/E 19.59

- Book Value 14.86

- EPS 0.83

- Next Earning Report 2026-04-29

- Dividend Per Share $0.60

- Dividend Yield 3.7 %

- Next Dividend Date -

- ROA 0.03 %

- ROE 0.06 %

- 52 Week High 18.99

- 52 Week Low 13.49

About

Westwood Holdings Group, Inc., manages investment assets and provides services to its clients. The company is headquartered in Dallas, Texas.

Analyst Target Price

N/A

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-13 | 2025-10-29 | 2025-07-29 | 2025-04-29 | 2025-02-12 | 2024-10-30 | 2024-07-31 | 2024-05-01 | 2024-02-14 | 2023-10-31 | 2023-08-02 | 2023-04-26 |

| Reported EPS | 0.21 | 0.4137 | 0.1156 | 0.0544 | 0.2348 | 0.0124 | -0.2729 | 0.3147 | 0.32 | 0.77 | 0.7 | 0.45 |

| Estimated EPS | 0 | None | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0.21 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-29 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0 |

| Currency | USD |

Previous Dividend Records

| Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Oct 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-01-02 | 2025-10-01 | 2025-07-01 | 2025-04-01 | 2025-01-03 | 2024-10-01 | 2024-07-01 | 2024-04-03 | 2024-01-03 | 2023-10-02 |

| Amount | $0.15 | $0.15 | $0.15 | $0.15 | $0.15 | $0.15 | $0.15 | $0.15 | $0.15 | $0.15 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: WHG

2026-02-20 05:56:32

Westwood Holdings Group's Enhanced Income Series of ETFs has surpassed $250 million in assets under management, with its Salient Enhanced Midstream Income ETF (MDST) reaching $200 million. The series aims to provide distributable monthly income through a combination of dividends and options-based income overlays, targeting advisors and investors seeking robust income opportunities across various asset classes and the energy sector. This milestone underscores the firm's expanding presence in income-focused ETF offerings and its focus on energy-related strategies.

2026-02-19 21:42:00

Westwood Holdings Group announced that its Enhanced Income Series™ ETFs have surpassed $250 million in assets under management, with the Westwood Salient Enhanced Midstream Income ETF alone reaching $200 million. CEO Brian Casey stated that these ETFs offer effective income opportunities and structural durability against market volatility, underscoring the growing importance of income-generating investments. The suite aims to provide high monthly income through dividend yields and covered call options, alongside potential for equity appreciation.

2026-02-18 05:56:32

Westwood Holdings Group (NYSE: WHG) announced the liquidation of its Westwood LBRTY Global Equity ETF (NYSE Arca: BFRE) due to a review of its ETF offerings. Trading for the ETF will cease on February 27, 2026, with an anticipated liquidation date of March 6, 2026. Shareholders are advised to consult their tax advisors regarding the implications of this taxable event.

2026-02-17 21:27:39

Westwood Holdings Group announced the liquidation of its Westwood LBRTY Global Equity ETF (NYSE Arca: BFRE) following a review of its ETF offerings. The last day for trading will be February 27, 2026, with the fund ceasing operations and distributing liquidation proceeds to shareholders by March 6, 2026. Shareholders are advised to consult their tax advisors regarding the implications of this taxable event.

2026-02-17 21:27:39

Westwood Holdings Group is liquidating its LBRTY Global Equity ETF (BFRE), with trading ceasing on February 27, 2026, and liquidation distributions expected by March 6, 2026. Shareholders can sell before the closing date, and those remaining will receive cash at net asset value, which may be a taxable event. The fund will convert its holdings to cash, deviating from its original investment objective during the final period.

2026-02-17 04:27:49

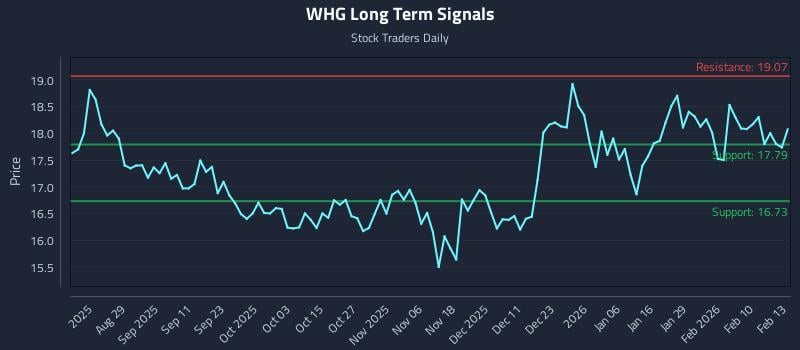

This article provides an analysis of Westwood Holdings Group Inc (NYSE: WHG) movements to inform risk allocation models. It highlights neutral near and mid-term readings that could moderate a long-term positive bias and identifies a significant risk-reward short setup. The analysis includes institutional trading strategies, multi-timeframe signal analysis, and AI-generated signals for WHG.