GeneDx Holdings Corp.

$ 80.70

-7.33%

24 Feb - close price

- Market Cap 2,517,012,000 USD

- Current Price $ 80.70

- High / Low $ 85.34 / 80.15

- Stock P/E 791.64

- Book Value 10.61

- EPS 0.11

- Next Earning Report 2026-05-13

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.02 %

- ROE -0.08 %

- 52 Week High 170.87

- 52 Week Low 55.17

About

Sema4 Holdings Corp. The company is headquartered in Stamford, Connecticut.

Analyst Target Price

$163.33

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-23 | 2025-10-28 | 2025-07-28 | 2025-04-28 | 2025-02-18 | 2024-10-29 | 2024-07-30 | 2024-04-29 | 2024-02-20 | 2023-10-30 | 2023-08-08 | 2023-05-09 |

| Reported EPS | 0.14 | 0.49 | 0.5 | 0.2732 | 0.6353 | 0.04 | -0.1 | -0.33 | -0.69 | -0.82 | -1.64 | -2.44 |

| Estimated EPS | 0.0886 | 0.41 | 0.118 | -0.67 | 0.1033 | -0.21 | -0.3 | -0.67 | -0.75 | -1.31 | -1.31 | -2.14 |

| Surprise | 0.0514 | 0.08 | 0.382 | 0.9432 | 0.532 | 0.25 | 0.2 | 0.34 | 0.06 | 0.49 | -0.33 | -0.3 |

| Surprise Percentage | 58.0135% | 19.5122% | 323.7288% | 140.7761% | 515.0048% | 119.0476% | 66.6667% | 50.7463% | 8% | 37.4046% | -25.1908% | -14.0187% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-13 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | -0.0495 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: WGS

2026-02-07 19:29:03

GeneDx Holdings Corp.'s COO, Bryan Dechairo, sold 6,061 shares of Class A Common Stock for over $510,000 on February 4, 2026, as part of a pre-arranged trading plan. This transaction leaves him with zero direct shares, occurring amidst recent stock volatility. Despite the sales, analysts maintain optimistic price targets for GeneDx, which projects significant revenue growth for 2026 and has announced new strategic partnerships and product launches.

2026-02-06 21:32:02

GeneDx Holdings Corp. COO Bryan Dechairo sold 6,061 shares of Class A Common Stock for over $510,000 on February 4, 2026, as part of a pre-arranged trading plan, leaving him with no direct ownership. Despite a recent stock decline, analysts remain optimistic about WGS, with price targets ranging from $153 to $200. The company anticipates strong revenue growth for 2025 and 2026, is launching a new prenatal test, and has appointed a new Chief Medical Officer.

2026-01-30 09:59:09

GeneDx Holdings (WGS) recently reported strong revenue growth of 51.90%, driven by increasing demand for its AI-powered genetic testing services focused on pediatric and rare disease diagnostics. While this growth and FDA Breakthrough status strengthen its investment thesis, significant share price pullback, high sales multiples, and insider selling introduce execution and valuation risks. Despite the optimism, investors hold widely divergent fair value estimates, emphasizing the importance of comprehensive research beyond the headlines.

2026-01-21 22:57:40

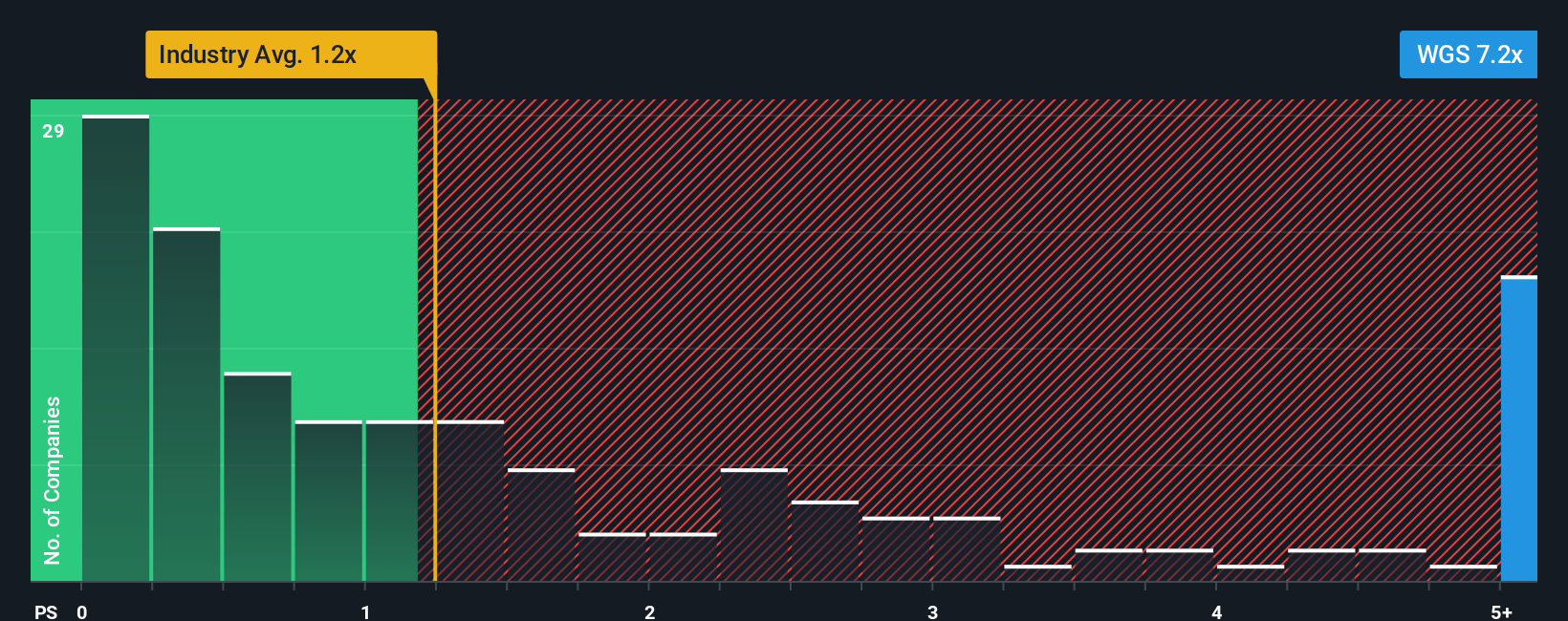

GeneDx Holdings Corp.'s shares dropped 29% over the past month, though the stock still shows a 34% gain over the last year. Despite the recent dip, the company maintains a high price-to-sales ratio of 7.2x, significantly above the industry average, driven by strong revenue growth of 51% last year and a forecast of 22% annual growth for the next three years. This anticipated strong performance relative to the Healthcare industry's 6.1% growth appears to be sustaining investor confidence and the elevated P/S ratio.

2026-01-13 18:58:20

Halper Sadeh LLC, an investor rights law firm, is investigating whether officers and directors of GeneDx Holdings Corp. (NASDAQ: WGS) breached their fiduciary duties to shareholders. The firm encourages long-term GeneDx shareholders to contact them to explore legal options such as seeking corporate governance reforms, fund recovery, or financial incentives. Halper Sadeh LLC handles actions on a contingent fee basis, and shareholder participation is highlighted as important for improving company policies and enhancing shareholder value.

2026-01-10 12:57:32

GeneDx Holdings (WGS) has launched GenomeDx Prenatal, a new whole genome sequencing test, and appointed Dr. Linda Genen as Chief Medical Officer. Despite recent stock fluctuations, the company shows strong long-term momentum, trading at a significant discount to analyst price targets and estimated fair value. The article explores the valuation gap and potential factors influencing its future growth and profitability, highlighting both opportunities and challenges.