Weyco Group Inc

$ 32.49

1.85%

26 Feb - close price

- Market Cap 304,594,000 USD

- Current Price $ 32.49

- High / Low $ 32.49 / 31.70

- Stock P/E 12.41

- Book Value 26.61

- EPS 2.57

- Next Earning Report 2026-03-03

- Dividend Per Share $1.07

- Dividend Yield 3.4 %

- Next Dividend Date -

- ROA 0.06 %

- ROE 0.10 %

- 52 Week High 34.65

- 52 Week Low 24.88

About

Weyco Group, Inc. designs and distributes footwear for men, women and children. The company is headquartered in Milwaukee, Wisconsin.

Analyst Target Price

$26.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-04 | 2025-08-07 | 2025-05-05 | 2025-03-03 | 2024-11-05 | 2024-08-06 | 2024-05-07 | 2024-03-05 | 2023-11-08 | 2023-08-01 | 2023-05-02 | 2023-03-07 |

| Reported EPS | 0.6907 | 0.24 | 0.5736 | 1.0343 | 0.84 | 0.5872 | 0.6942 | 0.897 | 0.98 | 0.5 | 0.78 | 1.06 |

| Estimated EPS | None | None | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-03 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Jan 2026 | Sep 2025 | Jun 2025 | Mar 2025 | Jan 2025 | Sep 2024 | Jun 2024 | Mar 2024 | Jan 2024 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-01-09 | 2025-09-30 | 2025-06-30 | 2025-03-31 | 2025-01-02 | 2024-09-30 | 2024-06-28 | 2024-03-29 | 2024-01-02 | 2023-09-29 |

| Amount | $2.27 | $0.27 | $0.27 | $0.26 | $2.26 | $0.26 | $0.26 | $0.25 | $0.25 | $0.25 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: WEYS

2026-02-20 12:24:21

Weyco Group (NASDAQ:WEYS) shares have crossed above their 200-day moving average, reaching $32.01 with a volume of 5,841 shares. The company has a market cap of $305.70 million and a P/E ratio of 12.60. Analysts currently have a "Buy" rating on the stock, and insider activity shows a recent sale by VP Dustin Combs.

2026-02-17 04:14:00

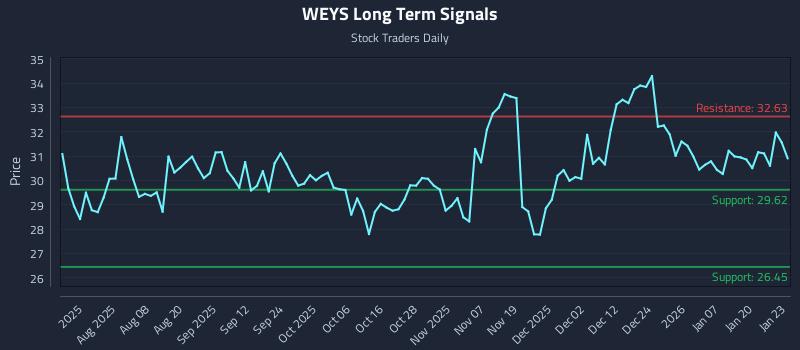

This article analyzes Weyco Group Inc. (NASDAQ: WEYS), highlighting a weak near-term sentiment with a mid-channel oscillation pattern. It presents an exceptional 30.8:1 risk-reward setup targeting a 9.1% gain, alongside institutional trading strategies including position trading, momentum breakout, and risk hedging. The analysis is supported by AI-generated signal data across multiple timeframes.

2026-02-06 03:29:25

The article analyzes Weyco Group Inc. (NASDAQ: WEYS), highlighting strong near and mid-term positive sentiment and testing resistance levels. It presents institutional trading strategies for various risk profiles, including long positions, breakout plays, and risk hedging, along with multi-timeframe signal analysis and an exceptional risk-reward short setup.

2026-01-26 01:58:00

This article provides an in-depth AI-driven analysis for Weyco Group Inc. (NASDAQ: WEYS), highlighting a neutral sentiment with a strong risk-reward setup targeting a 10.2% gain versus 0.3% risk. It outlines distinct institutional trading strategies—Position, Momentum Breakout, and Risk Hedging—tailored for different risk profiles, and includes multi-timeframe signal analysis with support and resistance levels. The report emphasizes the use of predictive AI for optimizing positions and minimizing drawdowns.

2026-01-17 05:56:58

Short interest in Weyco Group, Inc. (NASDAQ:WEYS) decreased by 28.7% to 67,269 shares as of December 31st, representing 1.1% of the float and a 5.0-day days-to-cover ratio. This decline occurred amidst a VP selling a portion of his shares and institutional investors adjusting their stakes. The company maintains a "Buy" consensus rating from analysts, offers a 3.5% annual dividend yield, and reported Q3 EPS of $0.69 on $73.12 million in revenue.

2026-01-16 17:00:00

Weyco Group (NASDAQ:WEYS) shareholders have experienced a 20% Compound Annual Growth Rate (CAGR) over the last five years, with a total shareholder return (TSR) of 150% over the same period, outperforming the market. The company recently became profitable, which is generally seen as a positive indicator for share price appreciation. Although the stock is down 2.2% this past year (including dividends), its long-term growth suggests a potential buying opportunity should fundamental data continue to show sustainable growth.