Westinghouse Air Brake Technologies Corp

$ 244.68

-2.74%

06 Mar - close price

- Market Cap 43,009,409,000 USD

- Current Price $ 244.68

- High / Low $ 247.31 / 243.07

- Stock P/E 36.89

- Book Value 65.31

- EPS 6.82

- Next Earning Report 2026-04-22

- Dividend Per Share $1.00

- Dividend Yield 0.38 %

- Next Dividend Date -

- ROA 0.06 %

- ROE 0.11 %

- 52 Week High 266.27

- 52 Week Low 151.06

About

Wabtec Corporation (derived from Westinghouse Air Brake Technologies Corporation) is an American company formed by the merger of the Westinghouse Air Brake Company (WABCO) and MotivePower Industries Corporation in 1999. It is headquartered in Pittsburgh, Pennsylvania.

Analyst Target Price

$289.75

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-18 | 2025-10-22 | 2025-07-22 | 2025-04-22 | 2025-02-12 | 2024-10-23 | 2024-07-24 | 2024-04-24 | 2024-02-14 | 2023-10-25 | 2023-07-27 | 2023-04-26 |

| Reported EPS | 2.1 | 2.32 | 2.27 | 2.28 | 1.68 | 2 | 1.96 | 1.89 | 1.54 | 1.7 | 1.41 | 1.28 |

| Estimated EPS | 2.08 | 2.28 | 2.17 | 2.0261 | 1.7325 | 1.9 | 1.88 | 1.49 | 1.58 | 1.46 | 1.33 | 1.19 |

| Surprise | 0.02 | 0.04 | 0.1 | 0.2539 | -0.0525 | 0.1 | 0.08 | 0.4 | -0.04 | 0.24 | 0.08 | 0.09 |

| Surprise Percentage | 0.9615% | 1.7544% | 4.6083% | 12.5315% | -3.0303% | 5.2632% | 4.2553% | 26.8456% | -2.5316% | 16.4384% | 6.015% | 7.563% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-22 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 2.52 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Nov 2025 | Aug 2025 | Jun 2025 | Mar 2025 | Nov 2024 | Aug 2024 | Jun 2024 | Mar 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-02 | 2025-11-26 | 2025-08-28 | 2025-06-10 | 2025-03-07 | 2024-11-27 | 2024-08-28 | 2024-06-11 | 2024-03-08 | 2023-11-29 |

| Amount | $0.31 | $0.25 | $0.25 | $0.25 | $0.25 | $0.2 | $0.2 | $0.2 | $0.2 | $0.17 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: WAB

2026-03-06 17:45:10

Canadian Pacific Kansas City (CP) set a new February record in 2026 for grain transport, moving 2.232 million metric tons of Canadian grain and products, and 4.501 MMT across its total network. This achievement, surpassing previous records, was driven by strong demand and strategic investments in the grain supply chain. The company maintains a Zacks Rank #3 (Hold), while other transportation stocks like Southwest Airlines (LUV) and Wabtec (WAB) are highlighted as potential considerations for investors.

2026-03-06 04:51:18

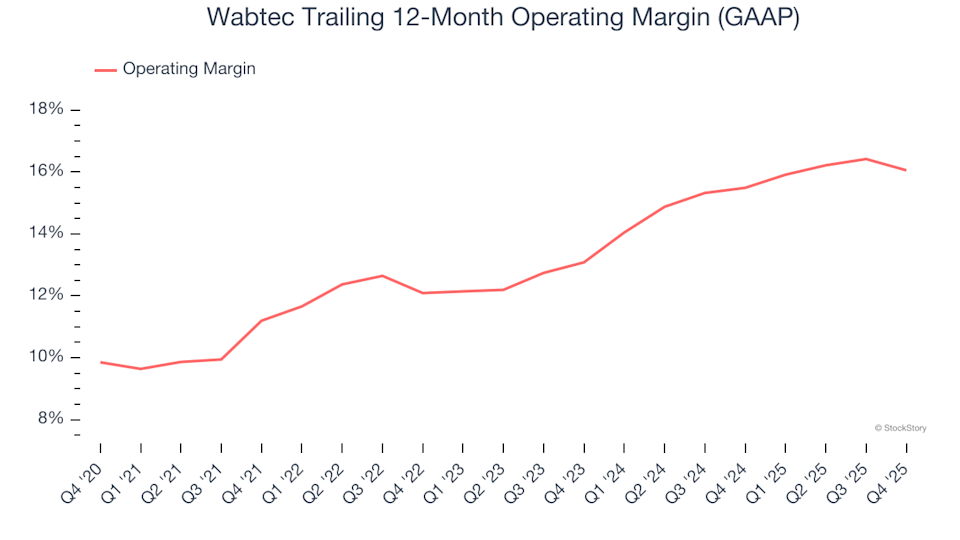

Wabtec (WAB) stock has shown a remarkable 249% return since March 2021, significantly outperforming the S&P 500's 77.3% gain during the same period. The company also demonstrates strong profitability with an operating margin of 16.1% and an 18.9% compounded annual growth in earnings per share over the last five years. While organic revenue growth slightly trails the sector average, the report concludes that Wabtec's positive financial attributes outweigh its minor shortcomings.

2026-03-06 00:51:11

Wabtec (WAB) has shown impressive financial performance, delivering a 249% return since March 2021 and outperforming the S&P 500. The company boasts expanding operating margins and strong long-term EPS growth, though it faces a challenge with sluggish organic revenue growth. The article examines whether, despite these points, Wabtec remains a good investment at its current valuation.

2026-03-05 12:52:08

Dana Inc. has announced the appointment of Byron Foster as its new Chief Executive Officer, effective July 1, 2026. Foster, currently Senior Vice President and President of Light Vehicle Systems, will succeed R. Bruce McDonald, who will remain Chairman of the board. This appointment allows for a structured transition, leveraging Foster's extensive experience and leadership in driving growth and operational improvements within the company.

2026-03-05 10:01:11

Burgundy Asset Management Ltd. significantly increased its stake in Wabtec (NYSE:WAB) by 12.1% in Q3, now owning 718,779 shares valued at $139.1 million. This increase follows Wabtec's strong quarterly performance, which beat expectations, and the company's initiation of a $1.2 billion share buyback and a dividend increase to $0.31 per share. Despite some insider selling, analysts largely maintain a "Moderate Buy" rating for Wabtec with a consensus target price of $269.

2026-03-05 08:51:16

Westinghouse Air Brake Technologies Corp (NYSE: WAB) EVP of Sales & Marketing, Gina Trombley, had 1,248 shares of common stock withheld by the company at $263.015 per share. This transaction was for tax withholding purposes upon the vesting of restricted shares, not an open-market sale or purchase. After this event, Trombley directly owns 16,011 shares of WAB.