Vertex Pharmaceuticals Inc

$ 459.78

-0.67%

29 Dec - close price

- Market Cap 118,683,230,000 USD

- Current Price $ 459.78

- High / Low $ 463.55 / 457.45

- Stock P/E 32.58

- Book Value 68.20

- EPS 14.21

- Next Earning Report 2026-02-09

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.12 %

- ROE 0.22 %

- 52 Week High 519.68

- 52 Week Low 362.50

About

Vertex Pharmaceuticals Inc. is a premier biopharmaceutical company based in Boston, Massachusetts, dedicated to pioneering transformative therapies for serious diseases, with a primary focus on cystic fibrosis (CF). The company has established itself as a leader in the industry through its groundbreaking therapies that have significantly enhanced the quality of life for patients with CF. Beyond its current successes, Vertex is expanding its R&D initiatives into additional therapeutic areas, underscoring its commitment to innovation and addressing unmet medical needs. With a robust financial standing and a strategic focus on growth, Vertex is poised to continue delivering value and advancing healthcare solutions in a dynamic market.

Analyst Target Price

$491.92

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-10 | 2025-08-04 | 2025-05-05 | 2025-02-10 | 2024-11-04 | 2024-08-01 | 2024-05-06 | 2024-02-05 | 2023-11-06 | 2023-08-01 | 2023-05-01 | 2023-02-07 |

| Reported EPS | 4.8 | 4.52 | 4.06 | 3.98 | 4.38 | -12.83 | 4.76 | 4.2 | 4.08 | 3.89 | 3.05 | 3.76 |

| Estimated EPS | 4.61 | 4.25 | 4.29 | 4.02 | 4.13 | 2.94 | 4.06 | 4.1 | 3.97 | 3.88 | 3 | 3.51 |

| Surprise | 0.19 | 0.27 | -0.23 | -0.04 | 0.25 | -15.77 | 0.7 | 0.1 | 0.11 | 0.01 | 0.05 | 0.25 |

| Surprise Percentage | 4.1215% | 6.3529% | -5.3613% | -0.995% | 6.0533% | -536.3946% | 17.2414% | 2.439% | 2.7708% | 0.2577% | 1.6667% | 7.1225% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-09 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 4.35 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: VRTX

2025-12-29 14:15:12

Leerink Partners has increased its price target for Vertex Pharmaceuticals (NASDAQ:VRTX) to $525.00, maintaining an "outperform" rating, which suggests a 13.4% upside. This follows Vertex's strong quarterly performance, where it exceeded EPS and revenue expectations. Despite recent insider selling, institutional ownership remains high, with major investors increasing their stakes.

2025-12-29 13:50:57

Hardman Johnston Global Advisors maintained confidence in Vertex Pharmaceuticals Incorporated (VRTX) despite recent setbacks in its pain franchise, citing the company's high-margin CF franchise, strong balance sheet, and promising late-stage pipeline assets. The investment firm's Q3 2025 investor letter highlighted positive developments in other therapeutic areas like kidney disease and type 1 diabetes, along with the successful launch of Alyftrek for cystic fibrosis. While the portfolio underperformed the MSCI AC World Net Index, Vertex Pharmaceuticals (VRTX) saw an 8.76% one-month return and 15.91% increase over the last 52 weeks, closing at $462.90 on December 26, 2025.

2025-12-29 09:08:19

The global liver fibrosis treatment market is projected to reach US$ 14.7 billion in 2022 and exhibit a CAGR of 10.8% during the forecast period (2022-2030), driven by increasing industry demand and technological advancements. A new report by Coherent Market Insights analyzes market size, revenue trends, and key growth factors from 2025 to 2032, providing actionable insights for strategic decision-making. The study highlights key players like Gilead Sciences Inc. and Merck & Co. Inc., alongside market segmentation and regional analysis.

2025-12-29 06:42:00

Vertex Pharmaceuticals' blockbuster cystic fibrosis drug, Trikafta, is not only transforming patient outcomes but also serves as the financial engine funding the company's ambitious pipeline in other high-risk, high-reward therapies. The article examines Trikafta's market dominance, its financial impact, Wall Street consensus, and recent news flow, highlighting how its sustained success is crucial for Vertex's future growth in areas like gene editing, pain, and diabetes. As of today, the stock trades near its 52-week high, reflecting investor confidence in its durable cash flows and pipeline potential, despite concerns about valuation and long-term CF growth.

2025-12-29 00:09:19

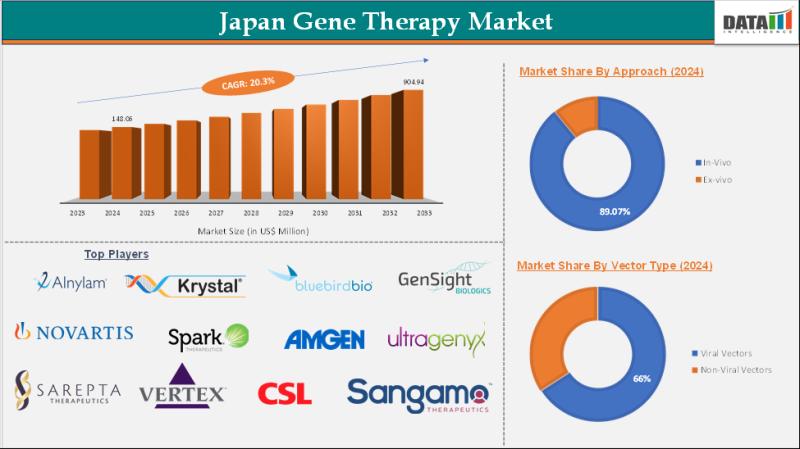

The Japan Gene Therapy Market was valued at US$ 148.06 Million in 2024 and is projected to grow to US$ 904.94 Million by 2033, exhibiting a CAGR of 20.3%. This growth is fueled by increasing R&D, regulatory support, and advancements in personalized medicine. Key players in this market include Alnylam Pharmaceuticals, Inc., Novartis AG, Sarepta Therapeutics, Inc., and Krystal Biotech, Inc.

2025-12-28 07:00:19

Vertex Pharmaceuticals has shown quiet outperformance among its peers, driven by dominance in cystic fibrosis and promising developments in gene editing and pain management. The company's stock has seen significant gains, with upbeat analyst calls contributing to a bullish outlook. With a strong R&D pipeline and solid financial positioning, Vertex is strategically expanding beyond its core franchise into new high-growth areas.