Virco Manufacturing Corporation

$ 6.25

3.31%

24 Feb - close price

- Market Cap 98,507,000 USD

- Current Price $ 6.25

- High / Low $ 6.26 / 6.05

- Stock P/E 24.04

- Book Value 7.21

- EPS 0.26

- Next Earning Report 2026-04-13

- Dividend Per Share $0.10

- Dividend Yield 1.65 %

- Next Dividend Date -

- ROA 0.02 %

- ROE 0.03 %

- 52 Week High 10.51

- 52 Week Low 5.99

About

Virco Mfg. The company is headquartered in Torrance, California.

Analyst Target Price

$7.30

Quarterly Earnings

| Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Oct 2023 | Jul 2023 | Apr 2023 | Jan 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-12-15 | 2025-09-05 | 2025-06-05 | 2025-04-10 | 2024-12-06 | 2024-09-09 | 2024-06-07 | 2024-04-12 | 2023-12-08 | 2023-09-11 | 2023-06-12 | 2023-04-28 |

| Reported EPS | -0.08 | 0.65 | 0.05 | -0.35 | 0.52 | 1.04 | 0.13 | -0.14 | 0.62 | 0.95 | -0.09 | 0.25 |

| Estimated EPS | 0.4654 | 0.84 | -0.13 | -0.15 | 0.87 | 1 | -0.13 | -0.13 | 0.39 | 0.64 | -0.17 | -0.05 |

| Surprise | -0.5454 | -0.19 | 0.18 | -0.2 | -0.35 | 0.04 | 0.26 | -0.01 | 0.23 | 0.31 | 0.08 | 0.3 |

| Surprise Percentage | -117.1895% | -22.619% | 138.4615% | -133.3333% | -40.2299% | 4% | 200% | -7.6923% | 58.9744% | 48.4375% | 47.0588% | 600% |

Next Quarterly Earnings

| Jan 2026 | |

|---|---|

| Reported Date | 2026-04-13 |

| Fiscal Date Ending | 2026-01-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-01-09 | 2025-10-10 | 2025-07-11 | 2025-04-11 | 2025-01-10 | 2024-10-11 | 2024-07-12 | 2024-04-10 | 2024-01-10 | None |

| Amount | $0.025 | $0.025 | $0.025 | $0.025 | $0.025 | $0.025 | $0.02 | $0.02 | $0.02 | $0.015 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: VIRC

2026-02-17 20:57:54

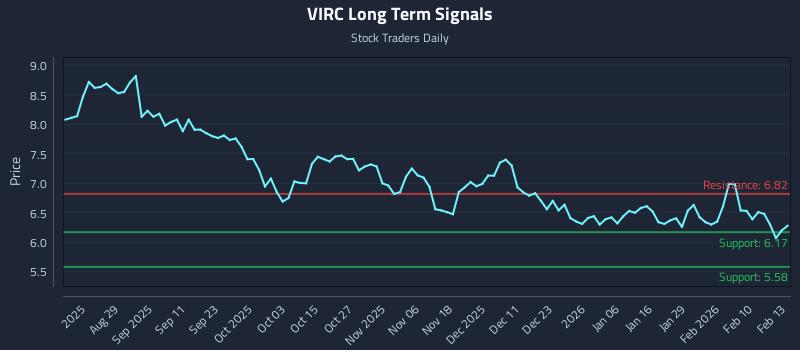

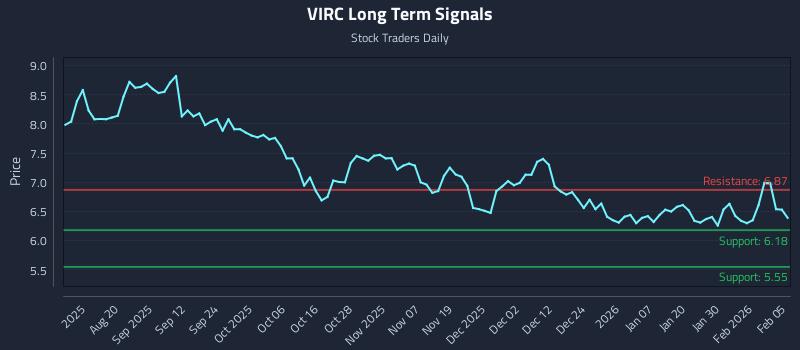

This article analyzes Virco Manufacturing Corporation (VIRC) using AI models, indicating weak sentiment across all time horizons and supporting a short bias. It outlines detailed institutional trading strategies including position, momentum breakout, and risk hedging, complete with entry zones, target prices, and stop losses. The analysis also highlights a significant risk-reward setup for potential gains.

2026-02-05 23:08:00

This article provides an in-depth analysis of Virco Manufacturing Corporation (NASDAQ: VIRC), highlighting a near-term weak sentiment that could test mid-term strength within a broader long-term weak bias. It outlines distinct institutional trading strategies, including position, momentum breakout, and risk hedging, along with detailed multi-timeframe signal analysis. The analysis suggests an exceptional 34.5:1 risk-reward setup, targeting an 11.2% gain versus 0.3% risk.

2026-02-04 22:57:57

Multiple insiders buying Virco Mfg. Corporation (NASDAQ:VIRC) stock is a positive sign for shareholders, suggesting confidence in the company's future. While recent insider purchases of US$29k are not individually substantial, the overall trend over the last year shows buying but no selling, with insiders owning 34% of the company, indicating reasonable alignment with shareholder interests.

2026-02-03 22:28:27

Virco Manufacturing (NASDAQ:VIRC) reported a net loss for the third quarter of fiscal year 2025. This contrasts with a net income in the prior-year period. The results indicate a challenging quarter for the company.

2026-02-02 10:59:07

Multiple insiders at Virco Mfg. Corporation recently purchased stock, suggesting confidence in the company's future, as evidenced by a significant buy from President & Director Douglas Virtue earlier at a higher price. While recent insider buying totals US$29k, the overall trend of buying over the last year without selling indicates a positive sentiment among insiders, who collectively own 34% of the company. However, the article advises considering these transactions as part of a broader analysis, as the recent buying volume was not substantial enough to be a standalone encouraging factor.

2026-01-25 23:57:50

This article analyzes Virco Manufacturing Corporation (NASDAQ: VIRC) using AI models, highlighting a positive near-term sentiment with a potential shift, a mid-channel oscillation pattern, and an exceptional risk-reward setup targeting a 10.5% gain. It presents three distinct trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—tailored for different risk profiles, along with multi-timeframe signal analysis, including support and resistance levels.