Virginia National Bankshares Corp

$ 40.76

-0.29%

29 Dec - close price

- Market Cap 219,824,000 USD

- Current Price $ 40.76

- High / Low $ 42.34 / 40.36

- Stock P/E 12.35

- Book Value 32.89

- EPS 3.30

- Next Earning Report 2026-01-22

- Dividend Per Share $1.38

- Dividend Yield 3.38 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.10 %

- 52 Week High 44.17

- 52 Week Low 32.44

About

Virginia National Bankshares Corporation (VABK) serves as the holding company for Virginia National Bank, strategically located in Charlottesville, Virginia. The company offers a comprehensive suite of commercial banking solutions, including lending, deposit accounts, and wealth management, tailored to meet the diverse needs of both individuals and businesses. VABK is dedicated to community banking with a focus on establishing long-term relationships that promote regional economic development. By leveraging a strong local footprint alongside advanced banking technology, the firm delivers personalized services while ensuring operational excellence, positioning itself favorably for sustained growth and value creation in its markets.

Analyst Target Price

N/A

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-23 | 2025-07-17 | 2025-04-24 | 2025-01-23 | 2024-10-17 | 2024-07-19 | 2024-04-23 | 2024-01-26 | 2023-10-20 | 2023-07-17 | 2023-04-18 | 2023-01-31 |

| Reported EPS | 0.8436 | 0.78 | 0.8308 | 0.85 | 0.8523 | 0.7722 | 0.6777 | 0.5872 | 0.8624 | 1.0513 | 1.08 | 1.32 |

| Estimated EPS | None | None | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-01-22 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Nov 2025 | Aug 2025 | May 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-11-28 | 2025-08-29 | 2025-05-30 | 2025-03-28 | 2024-12-20 | 2024-09-20 | 2024-06-28 | 2024-03-28 | 2023-12-22 | 2023-09-22 |

| Amount | $0.36 | $0.36 | $0.36 | $0.33 | $0.33 | $0.33 | $0.33 | $0.33 | $0.33 | $0.33 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: VABK

2025-12-26 10:48:00

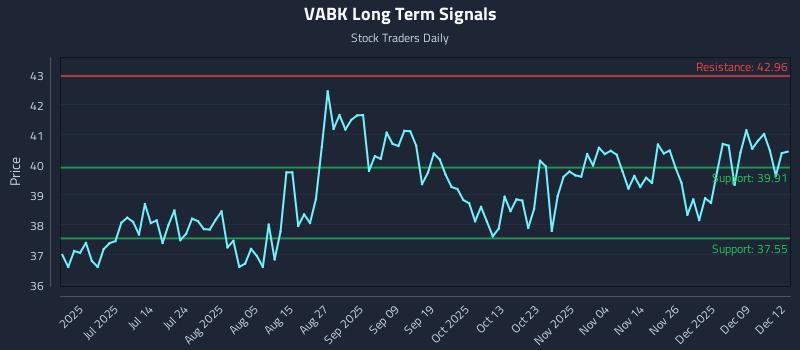

This article provides a detailed analysis for Virginia National Bankshares Corporation (VABK), highlighting a weak near-term sentiment but strong mid and long-term outlooks. It outlines three distinct AI-generated trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss zones. The analysis emphasizes an exceptional risk-reward setup, targeting a 7.1% gain versus 0.3% risk.

2025-12-15 09:09:09

Virginia National Bankshares Corporation (VABK) shows a near-term neutral sentiment but mid and long-term strength, with support being tested. AI models suggest specific trading strategies, including a long position strategy targeting a 7.6% gain against a 0.3% risk. The analysis provides key findings, risk-reward setups, and multi-timeframe signal analysis for VABK.

2025-12-05 05:03:28

This article provides an in-depth analysis of Virginia National Bankshares Corporation (NASDAQ: VABK), focusing on its neutral sentiment and a mid-channel oscillation pattern. It outlines three AI-generated trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss levels. The analysis also includes multi-timeframe signal analysis, identifying support and resistance levels, and highlights an exceptional 26.5:1 risk-reward short setup.

2025-11-23 17:09:36

Virginia National Bankshares (NASDAQ: VABK) announced that Cathy W. Liles will become the new Chief Financial Officer effective November 21, 2025, succeeding Tara Y. Harrison who will retire and serve as a Senior Advisor. Under Ms. Harrison's tenure, the bank's assets grew from $800 million to $1.6 billion. Ms. Liles brings extensive banking finance and audit experience to her new role.

2025-11-20 18:09:24

Tara Y. Harrison, CFO of Virginia National Bank, is retiring after nine years, effective Friday, November 22, 2025. She will be succeeded by Cathy W. Liles, formerly of Old Point National Bank and American National Bankshares. Harrison oversaw significant growth and challenges, including a merger, during her tenure, while Liles brings extensive experience from previous CFO and chief accounting officer roles.

2025-11-17 18:09:24

Virginia National Bankshares Corporation reported net income of $4.6 million, or $0.84 per diluted share, for the third quarter of 2025, consistent with the prior year's quarter. Year-to-date net income increased to $13.3 million due to decreased interest expense, and the company's Board of Directors declared a quarterly cash dividend of $0.36 per share. Key performance indicators such as return on average assets, return on average equity, net interest margin, and efficiency ratio all showed improvement.