U.S. Bancorp

$ 51.37

0.86%

04 Dec - close price

- Market Cap 79,941,452,000 USD

- Current Price $ 51.37

- High / Low $ 51.51 / 50.90

- Stock P/E 11.76

- Book Value 36.32

- EPS 4.37

- Next Earning Report 2026-01-15

- Dividend Per Share $2.02

- Dividend Yield 3.97 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.12 %

- 52 Week High 51.51

- 52 Week Low 34.43

About

U.S. Bancorp (USB) is a prominent American bank holding company based in Minneapolis, Minnesota, and is recognized for its extensive range of financial services, including commercial and consumer banking, investment management, mortgage, trust, and payment solutions. The company emphasizes innovation and customer service, serving a diverse base of individuals, businesses, and governmental entities. With a solid reputation for effective risk management and community engagement, U.S. Bancorp is positioned as a pivotal player in the U.S. banking industry, dedicated to sustainable growth and enhancing shareholder value. Its strategic focus on digital transformation and operational efficiency offers significant opportunities for long-term performance enhancement in a competitive market.

Analyst Target Price

$55.63

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-16 | 2025-07-17 | 2025-04-16 | 2025-01-15 | 2024-10-16 | 2024-07-17 | 2024-04-17 | 2024-01-17 | 2023-10-18 | 2023-07-19 | 2023-04-19 | 2023-01-25 |

| Reported EPS | 1.22 | 1.11 | 1.03 | 1.07 | 1.03 | 0.98 | 0.9 | 0.99 | 1.05 | 1.12 | 1.16 | 1.2 |

| Estimated EPS | 1.11 | 1.07 | 0.97 | 1.05 | 0.99 | 0.94 | 0.88 | 0.98 | 1.02 | 1.12 | 1.12 | 1.17 |

| Surprise | 0.11 | 0.04 | 0.06 | 0.02 | 0.04 | 0.04 | 0.02 | 0.01 | 0.03 | 0 | 0.04 | 0.03 |

| Surprise Percentage | 9.9099% | 3.7383% | 6.1856% | 1.9048% | 4.0404% | 4.2553% | 2.2727% | 1.0204% | 2.9412% | 0% | 3.5714% | 2.5641% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-01-15 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.18 |

| Currency | USD |

Previous Dividend Records

| Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Oct 2023 | Jul 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-10-15 | 2025-07-15 | 2025-04-15 | 2025-01-15 | 2024-10-15 | 2024-07-15 | 2024-04-15 | 2024-01-16 | 2023-10-16 | 2023-07-17 |

| Amount | $0.52 | $0.5 | $0.5 | $0.5 | $0.5 | $0.49 | $0.49 | $0.49 | $0.48 | $0.48 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: USB

2025-12-05 09:11:40

Franklin Resources Inc. acquired a new stake of 40,910 Chewy shares, worth approximately $1.74 million, in the second quarter. Chewy reported Q2 EPS of $0.33, matching estimates, with revenue up 8.6% year-over-year to $3.10 billion, and has a consensus "Moderate Buy" rating from analysts with an average target price of $46.17. Institutional investors hold 93.09% of Chewy's stock, while insiders have recently sold shares totaling about $2.8 million.

2025-12-04 21:22:50

Fifth Third Bank is the 18th-largest bank in the U.S., operating over 1,000 branches in 12 states across the East Coast and Midwest. It offers a full range of banking services, including checking and savings accounts, CDs, credit cards, and various loans, with notable customer-friendly overdraft protection policies. However, its savings and CD APYs are often uncompetitive, and its services are exclusively available to residents within its operational footprint.

2025-12-04 21:07:26

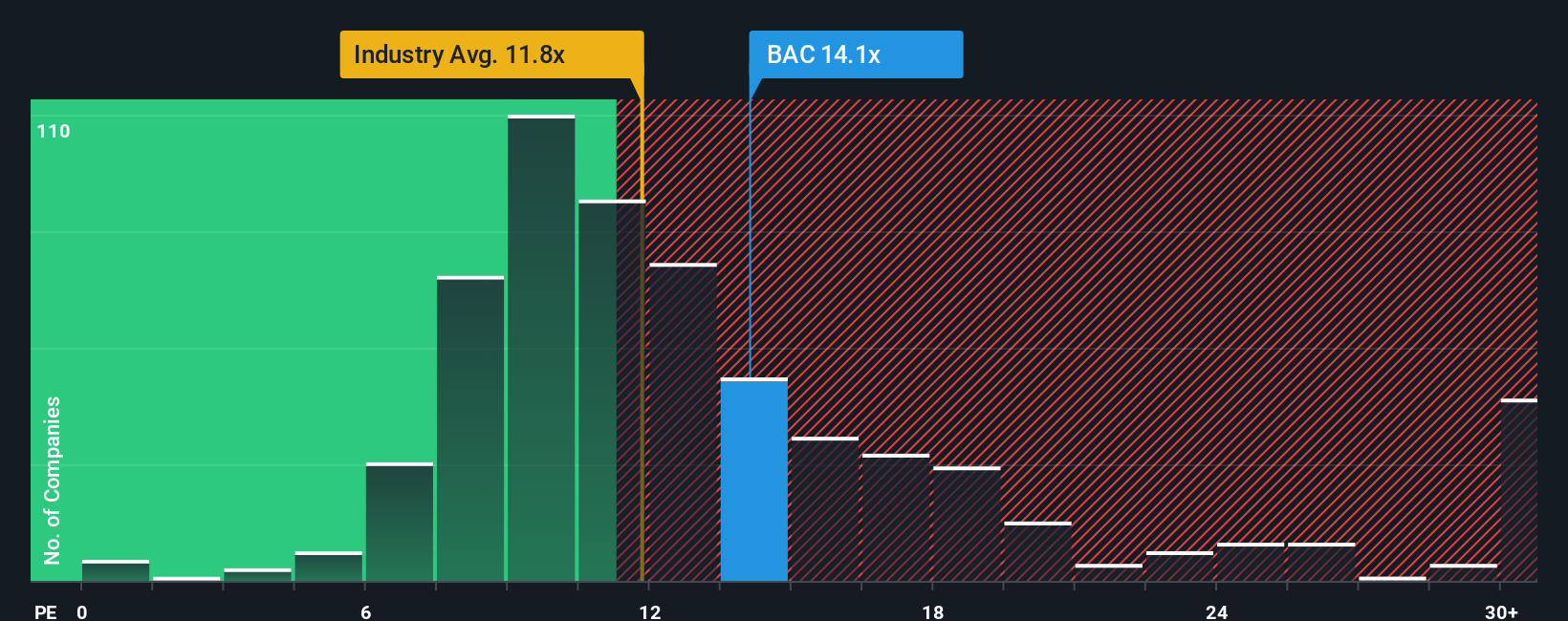

Bank of America (BAC) has seen its shares rise 22% year-to-date, prompting a valuation assessment. The company is currently considered modestly undervalued with a fair value near $58.90, despite its P/E ratio being higher than peers and the broader US banks sector. Analysts have a consensus price target of $53.52, but there is disagreement due to potential risks like inflation and economic slowdowns.

2025-12-04 19:38:22

US Bancorp (USB) is experiencing significantly high call option volume, with 16,255 calls traded, five times the expected amount. This activity has led to an increase in implied volatility to 20.78%. The most active options are December 5th weekly 52 calls and March 26th 55 calls, and the Put/Call Ratio currently stands at 0.09.

2025-12-04 19:00:00

This article highlights US Bancorp as a strong investment choice in the banking sector, backed by a positive analyst rating. A video analysis provides insights into market trends and investment opportunities for U.S. Bancorp (USB), with current stock information as of December 4, 2025.

)

2025-12-04 18:09:33

Indian IT services majors like TCS, Wipro, Cognizant, and ANSR are key bidders for a mandate from US Bancorp to establish two global capability centers (GCCs) in India. The fifth-largest US bank plans to insource a significant portion of its technology work and is looking to build centers in Hyderabad and Chennai. The Hyderabad unit is expected to be wholly owned, while the Chennai facility may operate under a build-operate-transfer model.