CVR Partners LP

$ 113.00

-4.70%

16 Jan - close price

- Market Cap 1,034,239,000 USD

- Current Price $ 113.00

- High / Low $ 117.92 / 111.78

- Stock P/E 8.13

- Book Value 30.13

- EPS 12.04

- Next Earning Report 2026-02-17

- Dividend Per Share $11.92

- Dividend Yield 12.3 %

- Next Dividend Date -

- ROA 0.11 %

- ROE 0.42 %

- 52 Week High 119.90

- 52 Week Low 56.84

About

CVR Partners, LP (UAN) is a prominent manufacturer and supplier of nitrogen fertilizer products in the United States, specializing in urea ammonium nitrate (UAN) and ammonia, essential for bolstering agricultural productivity. Based in Sugar Land, Texas, the company optimally utilizes its strategic location and comprehensive distribution network to cater to the increasing global demand for fertilizers driven by the need for enhanced food production. Committed to operational excellence and sustainability, CVR Partners is strategically positioned to thrive amid positive agronomic trends and to leverage its critical role in the agricultural input sector.

Analyst Target Price

$9.50

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-27 | 2025-07-28 | 2025-04-28 | 2025-02-18 | 2024-10-28 | 2024-07-29 | 2024-04-29 | 2024-02-21 | 2023-10-31 | 2023-08-01 | 2023-05-02 | 2023-02-21 |

| Reported EPS | 4.0749 | 3.67 | 2.5627 | 1.7308 | 0.3602 | 2.4805 | 1.1901 | 0.9437 | 0.07 | 5.66 | 9.64 | 9.02 |

| Estimated EPS | 0 | None | None | None | None | None | 1.19 | None | 0.07 | None | None | -1.87 |

| Surprise | 4.0749 | 0 | 0 | 0 | 0 | 0 | 0.0001 | 0 | 0 | 0 | 0 | 10.89 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | 0.0084% | None% | 0% | None% | None% | 582.3529% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-17 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Nov 2025 | Aug 2025 | May 2025 | Mar 2025 | Nov 2024 | Aug 2024 | May 2024 | Mar 2024 | Nov 2023 | Aug 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-11-17 | 2025-08-18 | 2025-05-19 | 2025-03-10 | 2024-11-18 | 2024-08-19 | 2024-05-20 | 2024-03-11 | 2023-11-20 | 2023-08-21 |

| Amount | $4.02 | $3.89 | $2.26 | $1.75 | $1.19 | $1.9 | $1.92 | $1.68 | $1.55 | $4.14 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: UAN

2026-01-14 16:08:00

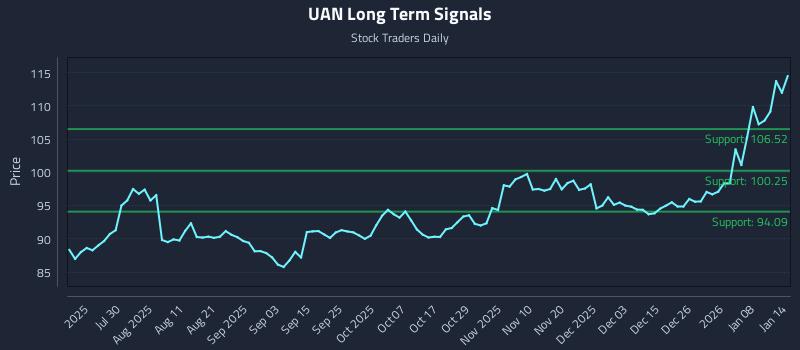

This article provides an AI-driven analysis for CVR Partners LP (UAN), highlighting strong sentiment across all horizons and an overweight bias despite elevated downside risk. It details three institutional trading strategies tailored to different risk profiles: Position Trading, Momentum Breakout, and Risk Hedging, along with a multi-timeframe signal analysis indicating strong support and resistance levels. The analysis aims to help traders optimize position sizing and minimize drawdown risk.

2026-01-13 10:30:23

CVR Partners LP stock achieved a new 52-week high of $110.79, reflecting a strong performance with a 38.37% increase over the past year. This milestone follows the company's robust Q3 2025 financial results, where it significantly exceeded market expectations with an EPS of $4.08 and net sales of $164 million. The positive financial performance has bolstered investor confidence and positioned the company strongly in the market.

2026-01-13 08:58:16

CVR Partners LP stock achieved a new 52-week high of $110.79, reflecting a 38.37% increase over the past year and strong investor confidence. This performance follows the company's robust Q3 2025 financial results, where it significantly exceeded analyst expectations with an EPS of $4.08 and net sales of $164 million. Market analysts are closely monitoring if this momentum will continue.

2026-01-12 15:28:24

Cvr Partners LP (UAN) stock recently hit a new 52-week high of $110.79, marking a significant 38.37% increase over the past year and indicating strong investor confidence. This performance follows the company's robust third-quarter 2025 financial results, where it exceeded market expectations with an EPS of $4.08 and net sales of $164 million. The company's strong financial health and market position are under close observation by analysts and investors.

2026-01-06 23:08:55

CVR Partners (NYSE:UAN), a subsidiary of CVR Energy (NYSE:CVI), has announced a preliminary capital spending plan of $60 million to $75 million for 2026, targeting maintenance and growth projects. This includes $35-$45 million for maintenance and $25-$30 million for growth initiatives, focusing on improving reliability and production rates at its Coffeyville, Kansas, and East Dubuque, Illinois, facilities. Key projects involve ammonia expansion, feedstock diversification, water quality upgrades, and increased diesel exhaust fluid production.

2026-01-06 18:09:28

CVR Partners (UAN) has outlined a preliminary 2026 capital spending plan of US$60 million to US$75 million, focusing on ammonia expansion, feedstock diversification, water quality upgrades, and increased diesel exhaust fluid production. The company's strategy emphasizes achieving utilization rates above 95% of nameplate capacity, indicating a preference for asset efficiency and reliability over new facility expansion. This approach aims to make cash flows less volatile, but investors must weigh this against the potential for tying up capital and interacting with already elevated debt levels.