Tiptree Inc

$ 16.93

2.05%

25 Feb - close price

- Market Cap 720,542,000 USD

- Current Price $ 16.93

- High / Low $ 16.96 / 16.41

- Stock P/E 16.57

- Book Value 13.36

- EPS 1.15

- Next Earning Report -

- Dividend Per Share $0.24

- Dividend Yield 1.26 %

- Next Dividend Date -

- ROA 0.02 %

- ROE 0.13 %

- 52 Week High 27.32

- 52 Week Low 16.41

About

Tiptree Inc., underwrites and manages specialty insurance products primarily in the United States. The company is headquartered in New York, New York.

Analyst Target Price

N/A

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-29 | 2025-07-29 | 2025-04-29 | 2025-02-26 | 2024-10-30 | 2024-07-31 | 2024-05-01 | 2024-02-29 | 2023-11-02 | 2023-08-03 | 2023-05-04 | 2023-03-09 |

| Reported EPS | 0.1254 | 0.37 | 0.1289 | 0.4719 | 0.2874 | 0.3077 | 0.2213 | 0.876 | 0.04 | 0.1585 | -0.03 | 0.0234 |

| Estimated EPS | None | None | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Previous Dividend Records

| Nov 2025 | Aug 2025 | May 2025 | Mar 2025 | Dec 2024 | Nov 2024 | Aug 2024 | May 2024 | Mar 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-11-24 | 2025-08-25 | 2025-05-19 | 2025-03-17 | 2024-12-19 | 2024-11-25 | 2024-08-26 | 2024-05-28 | 2024-03-18 | 2023-11-27 |

| Amount | $0.06 | $0.06 | $0.06 | $0.06 | $0.25 | $0.06 | $0.06 | $0.06 | $0.06 | $0.05 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: TIPT

2026-02-17 11:57:13

Heartland Advisors Inc. has significantly increased its stake in Tiptree Financial Inc. (NASDAQ:TIPT) by acquiring an additional 84,155 shares, bringing its total holdings to 384,155 shares, valued at approximately $7.36 million. Other institutional investors like Millennium Management also raised their positions, with hedge funds and institutions collectively owning about 37.78% of the stock. Tiptree Financial, a specialty finance company, is currently trading around $17.67, and analysts have a consensus "Hold" rating on the stock.

2026-02-16 15:56:00

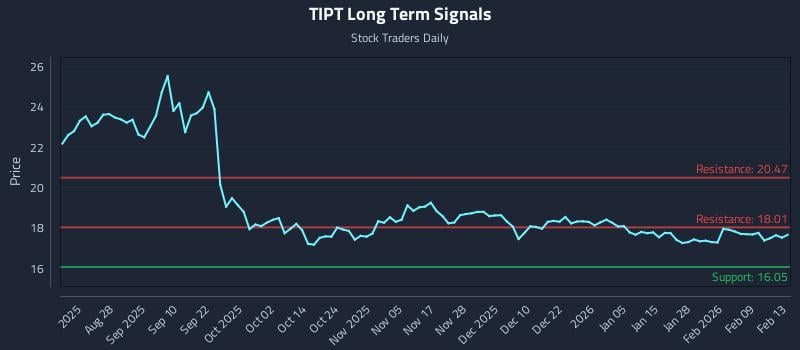

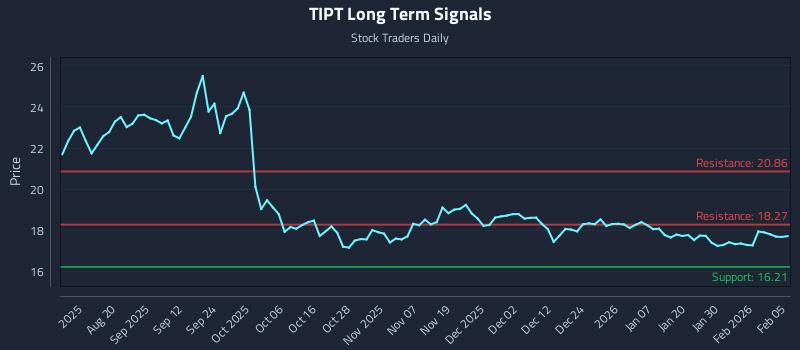

This article provides an AI-driven analysis for Tiptree Inc. (NASDAQ: TIPT), highlighting stable neutral readings in shorter horizons that could suggest an easing of a long-term weak bias. It details an exceptional risk-reward short setup and outlines three distinct institutional trading strategies—Position, Momentum Breakout, and Risk Hedging—along with multi-timeframe signal analysis. The piece emphasizes the benefits of real-time AI signals, risk-reward ratios, and personalized alerts for investors.

2026-02-07 08:58:42

Tiptree Financial (NASDAQ:TIPT) stock recently fell below its 200-day moving average, trading at $17.74 with a volume of 159,157 shares. Analyst sentiment has shifted to a "Hold" rating, following a downgrade from Wall Street Zen. Despite this, institutional investors like the State of Alaska Department of Revenue have increased their stakes in the financial services provider.

2026-02-05 14:48:00

This article analyzes Tiptree Inc. (NASDAQ: TIPT), highlighting a mid-channel oscillation pattern and a potential shift in positive near-term sentiment. It provides AI-generated trading strategies including long, short, and momentum breakouts, along with multi-timeframe signal analysis and risk management parameters. The report forecasts a strong downside potential with an exceptional risk-reward ratio for a short setup.

2026-01-29 13:59:48

Tiptree Inc. (TIPT) has shown steady stock growth, outperforming broader financial peers over the past year, despite its quiet presence in mainstream financial headlines. Analysts view its specialty insurance and investment income model constructively, often rating it as "Buy" or "Overweight" with anticipated double-digit percentage upside. The company's future prospects hinge on disciplined underwriting, strong investment performance, and strategic capital allocation to maximize shareholder returns.

2026-01-29 09:59:29

Tiptree Inc. (TIPT) has shown a quiet but steady climb in its stock value over the past year, outperforming broader financial peers. The company, a hybrid of specialty insurance and investment income, demonstrates a constructive trading pattern supported by analyst recommendations and a macro backdrop favorable to its business model. Its future hinges on underwriting discipline, investment performance, and strategic capital allocation.