Sonos Inc

$ 14.91

-3.24%

23 Feb - close price

- Market Cap 1,802,325,000 USD

- Current Price $ 14.91

- High / Low $ 15.45 / 14.61

- Stock P/E N/A

- Book Value 3.67

- EPS -0.16

- Next Earning Report 2026-05-06

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.02 %

- ROE -0.04 %

- 52 Week High 19.82

- 52 Week Low 7.62

About

Sonos, Inc. designs, develops, manufactures, and sells multi-room audio products in the Americas, Europe, the Middle East, Africa, and Asia Pacific. The company is headquartered in Santa Barbara, California.

Analyst Target Price

$19.38

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-03 | 2025-11-05 | 2025-08-06 | 2025-05-07 | 2025-02-06 | 2024-11-13 | 2024-08-07 | 2024-05-07 | 2024-02-06 | 2023-11-15 | 2023-08-09 | 2023-05-10 |

| Reported EPS | 0.93 | -0.06 | 0.19 | -0.18 | 0.64 | -0.18 | 0.23 | -0.34 | 0.84 | -0.07 | 0.16 | 0.04 |

| Estimated EPS | 0.68 | 0.05 | 0.15 | -0.14 | 0.3 | -0.18 | 0.17 | -0.25 | 0.54 | -0.1 | -0.07 | 0.01 |

| Surprise | 0.25 | -0.11 | 0.04 | -0.04 | 0.34 | 0 | 0.06 | -0.09 | 0.3 | 0.03 | 0.23 | 0.03 |

| Surprise Percentage | 36.7647% | -220% | 26.6667% | -28.5714% | 113.3333% | 0% | 35.2941% | -36% | 55.5556% | 30% | 328.5714% | 300% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-06 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.01 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: SONO

2026-02-22 10:36:49

The original Sonos Beam, launched in 2018, is praised for its compact design, powerful sound, and multi-room audio capabilities, even though it lacks modern features like Dolby Atmos. While the newer Sonos Beam (Gen 2) offers significant upgrades, the original still provides impressive audio performance and smart assistant integration at a more accessible price point. Its setup is straightforward, especially with HDMI ARC, making it a strong contender for those seeking an affordable yet high-quality soundbar.

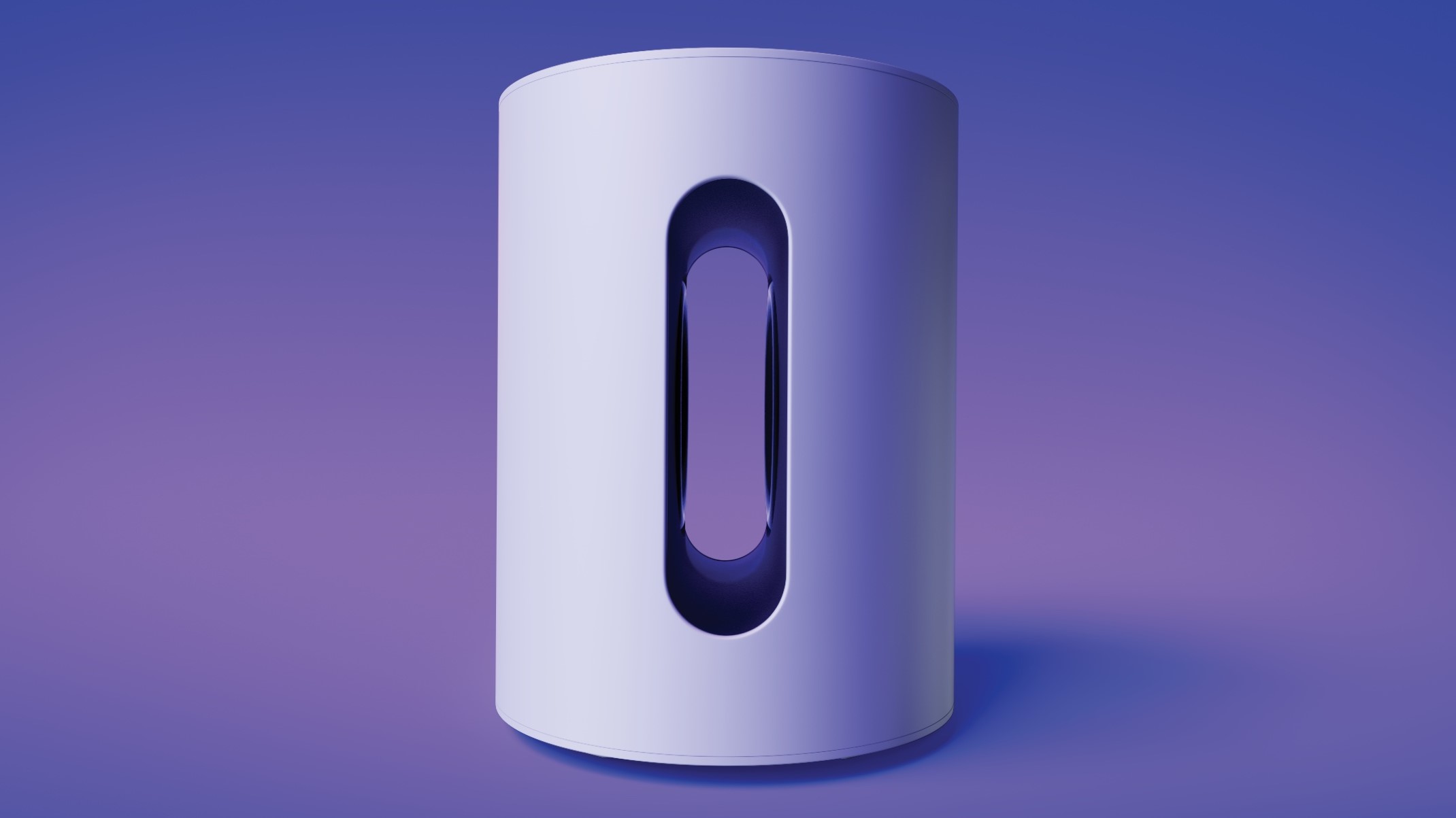

2026-02-22 08:37:54

Sonos has officially launched the Sub Mini, a compact wireless subwoofer designed for smaller rooms. Despite its aim to be a more affordable option in the Sonos lineup, the Sub Mini's price of £429 / $429 / AU$699 is considered disappointingly expensive, especially when compared to Sonos's budget soundbars like the Ray. The article highlights its features including force-cancelling woofers and Trueplay tuning, but raises questions about customer willingness to invest in it given its cost relative to the products it's designed to complement.

2026-02-21 17:34:51

XGen AI, a new startup, has launched with the goal of simplifying the creation of custom AI tools for retailers. The company offers a library of e-commerce-specific AI models that enable businesses like Golden Goose and Sonos to build their own AI platforms, leading to improved customer experience through better search results and product recommendations. XGen AI was founded by Frank Faricy to address the cost and complexity of fine-tuning custom AI models for retail.

2026-02-21 06:31:09

Sonos's new interim CEO, Tom Conrad, addressed employees in an email following the resignation of previous CEO Patrick Spence. Conrad's email directly acknowledged the company's recent failings due to a poorly received app update, stating, "When it all works, it’s absolute magic." This phrase highlights the core appeal of Sonos products and suggests a renewed focus on product reliability and user experience.

2026-02-20 17:02:22

Sonos, Inc. reported its Q1 2026 financial results, revealing a slight revenue decline but a significant increase in profits due to aggressive cost-cutting measures, including layoffs and reduced R&D and marketing spending. CEO Tom Conrad outlined a five-point turnaround strategy focusing on product innovation, customer advocacy, intentional marketing, geo-expansion, and AI integration, though the article questions the feasibility and clarity of some aspects. The company's immediate future remains uncertain, with guidance for Q2 2026 suggesting flat revenue growth.

2026-02-20 13:12:22

NewEdge Wealth LLC significantly reduced its stake in Sonos (NASDAQ:SONO) by 24.3% in the third quarter, now holding 287,261 shares valued at $4.78 million, despite other institutional investors increasing their positions. Sonos reported stronger-than-expected earnings and revenue but saw a year-over-year revenue decline and a negative net margin. Analysts maintain a "Moderate Buy" consensus with an average price target of $20.00, while the stock trades around $15.66.