Standard Motor Products Inc

$ 39.14

-2.44%

16 Jan - close price

- Market Cap 861,048,000 USD

- Current Price $ 39.14

- High / Low $ 40.49 / 39.12

- Stock P/E 12.75

- Book Value 30.79

- EPS 3.07

- Next Earning Report 2026-02-26

- Dividend Per Share $1.24

- Dividend Yield 3.09 %

- Next Dividend Date -

- ROA 0.06 %

- ROE 0.10 %

- 52 Week High 41.79

- 52 Week Low 20.82

About

Standard Motor Products, Inc. (SMP) is a prominent player in the automotive aftermarket, specializing in the manufacture and distribution of high-quality replacement parts, with its headquarters situated in Long Island City, New York. Boasting over a century of expertise, SMP has established itself as a leader in engine management and climate control products, continually evolving to address the needs of a varied global clientele. The company's relentless focus on innovation and quality, combined with a robust product portfolio and expansive distribution channels, positions SMP favorably for sustained growth and stability, making it an attractive investment prospect for institutional investors seeking reliable opportunities in a critical sector.

Analyst Target Price

$47.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-31 | 2025-07-30 | 2025-04-29 | 2025-02-20 | 2024-10-30 | 2024-08-01 | 2024-05-01 | 2024-02-22 | 2023-10-27 | 2023-08-02 | 2023-05-03 | 2023-02-22 |

| Reported EPS | 1.36 | 1.29 | 0.81 | 0.47 | 1.28 | 0.98 | 0.45 | 0.37 | 1.11 | 0.84 | 0.61 | 0.69 |

| Estimated EPS | 1.23 | 0.95 | 0.44 | 0.435 | 1.11 | 0.78 | 0.37 | 0.63 | 0.98 | 0.98 | 0.57 | 0.56 |

| Surprise | 0.13 | 0.34 | 0.37 | 0.035 | 0.17 | 0.2 | 0.08 | -0.26 | 0.13 | -0.14 | 0.04 | 0.13 |

| Surprise Percentage | 10.5691% | 35.7895% | 84.0909% | 8.046% | 15.3153% | 25.641% | 21.6216% | -41.2698% | 13.2653% | -14.2857% | 7.0175% | 23.2143% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.44 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-01 | 2025-09-02 | 2025-06-02 | 2025-03-03 | 2024-12-02 | 2024-09-03 | 2024-06-03 | 2024-03-01 | 2023-12-01 | 2023-09-01 |

| Amount | $0.31 | $0.31 | $0.31 | $0.31 | $0.29 | $0.29 | $0.29 | $0.29 | $0.29 | $0.29 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: SMP

2026-01-15 12:59:10

Standard Motor Products Inc. (SMP) is expanding its evaporative emissions (EVAP) program for the automotive aftermarket to over 1,150 part numbers, driven by stricter emissions regulations. The company emphasizes precision manufacturing, rigorous testing, and North American production for nearly 80% of its EVAP components to meet the growing demand for these parts. SMP aims to provide a single-source solution for distributors, ensuring confidence for professional technicians with its industry-leading coverage and quality.

2026-01-14 11:58:46

Standard Motor Products (SMP) has expanded its Evaporative Emissions (EVAP) program, offering over 1,150 precision-engineered components. This expansion addresses rising demand due to stricter emission guidelines and increased EVAP-related check engine lights. The majority of these Standard® EVAP components are manufactured in SMP's North American facilities, ensuring durability and OE-matching performance after rigorous testing.

2026-01-14 05:32:00

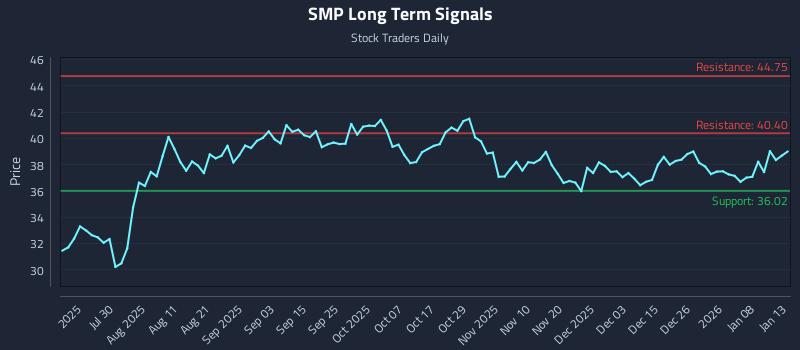

This article analyzes Standard Motor Products Inc. (NYSE: SMP), highlighting a strong near-term sentiment shifting to a mid-term neutral and long-term positive bias. It identifies a mid-channel oscillation pattern and presents a short setup with an exceptional 36.5:1 risk-reward ratio. The report further details three distinct AI-generated trading strategies (Position, Momentum Breakout, Risk Hedging) tailored for different risk profiles and holding periods.

2026-01-13 14:17:00

Standard Motor Products (SMP) has expanded its Evaporative Emissions (EVAP) program, which now includes over 1,150 components. This expansion addresses rising demand driven by stricter emission standards and vehicle manufacturers' improved leak detection systems. Most of the Standard® EVAP components are manufactured in SMP's North American facilities, ensuring precision engineering and rigorous testing for OE-matching performance.

2026-01-13 10:59:08

Standard Motor Products (NYSE:SMP) stock has moved above its 200-day moving average, signaling a short-term bullish trend. Despite this technical indicator, analysts maintain a "Hold" rating with a tempered price target of $49.00. The company recently exceeded EPS estimates but slightly missed revenue, and its high dividend payout ratio raises questions about sustainability.

2026-01-05 16:09:20

Standard Motor Products (SMP) has expanded its Positive Crankcase Ventilation Program, which now includes breather hoses, filters, PCV valves, engine oil separators, and PCV grommets. These components support the company's broader emissions control efforts and undergo rigorous testing. The program aims to provide technicians with a comprehensive selection of these crucial components.