ServisFirst Bancshares Inc

$ 83.68

0.58%

24 Feb - close price

- Market Cap 4,571,016,000 USD

- Current Price $ 83.68

- High / Low $ 84.32 / 82.69

- Stock P/E 16.54

- Book Value 33.87

- EPS 5.06

- Next Earning Report 2026-04-20

- Dividend Per Share $1.38

- Dividend Yield 1.66 %

- Next Dividend Date -

- ROA 0.02 %

- ROE 0.16 %

- 52 Week High 91.78

- 52 Week Low 65.57

About

ServisFirst Bancshares, Inc. is the banking holding company for ServisFirst Bank providing various banking services to individual and corporate clients. The company is headquartered in Birmingham, Alabama.

Analyst Target Price

$92.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-20 | 2025-10-20 | 2025-07-21 | 2025-04-21 | 2025-01-27 | 2024-10-21 | 2024-07-15 | 2024-04-22 | 2024-01-29 | 2023-10-16 | 2023-07-20 | 2023-04-17 |

| Reported EPS | 1.58 | 1.3 | 1.21 | 1.16 | 1.19 | 1.1 | 0.95 | 0.94 | 0.91 | 0.98 | 0.98 | 1.06 |

| Estimated EPS | 1.38 | 1.34 | 1.21 | 1.18 | 1.11 | 0.98 | 0.91 | 0.86 | 0.88 | 0.96 | 0.89 | 1.05 |

| Surprise | 0.2 | -0.04 | 0 | -0.02 | 0.08 | 0.12 | 0.04 | 0.08 | 0.03 | 0.02 | 0.09 | 0.01 |

| Surprise Percentage | 14.4928% | -2.9851% | 0% | -1.6949% | 7.2072% | 12.2449% | 4.3956% | 9.3023% | 3.4091% | 2.0833% | 10.1124% | 0.9524% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-20 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 1.51 |

| Currency | USD |

Previous Dividend Records

| Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Oct 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-01-13 | 2025-10-10 | 2025-07-09 | 2025-04-09 | 2025-01-10 | 2024-10-08 | 2024-07-09 | 2024-04-09 | 2024-01-08 | 2023-10-10 |

| Amount | $0.38 | $0.335 | $0.335 | $0.335 | $0.335 | $0.3 | $0.3 | $0.3 | $0.3 | $0.28 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: SFBS

2026-02-24 10:53:58

JPMorgan Chase & Co. significantly increased its stake in ServisFirst Bancshares, Inc. (NYSE:SFBS) by 26.2%, bringing its total holdings to 962,164 shares valued at $77.48 million. ServisFirst Bancshares recently surpassed revenue and EPS expectations, reporting $1.58 EPS against a $1.38 consensus and $162.21M in revenue against $151.82M expected. The company also raised its quarterly dividend to $0.38 per share, and analysts have issued several upgrades, setting a consensus "Buy" rating with an average target price of $91.00.

2026-02-19 13:41:50

Envestnet Asset Management Inc. reduced its holdings in ServisFirst Bancshares (NYSE:SFBS) by 9% in Q3, now owning 136,559 shares valued at approximately $11 million. Despite the reduction, other institutional investors increased their stakes, and analysts have a consensus "Buy" rating for SFBS with an average price target of $91.00. ServisFirst Bancshares recently reported strong earnings, exceeding expectations, and increased its quarterly dividend to $0.38 per share.

2026-02-16 14:58:10

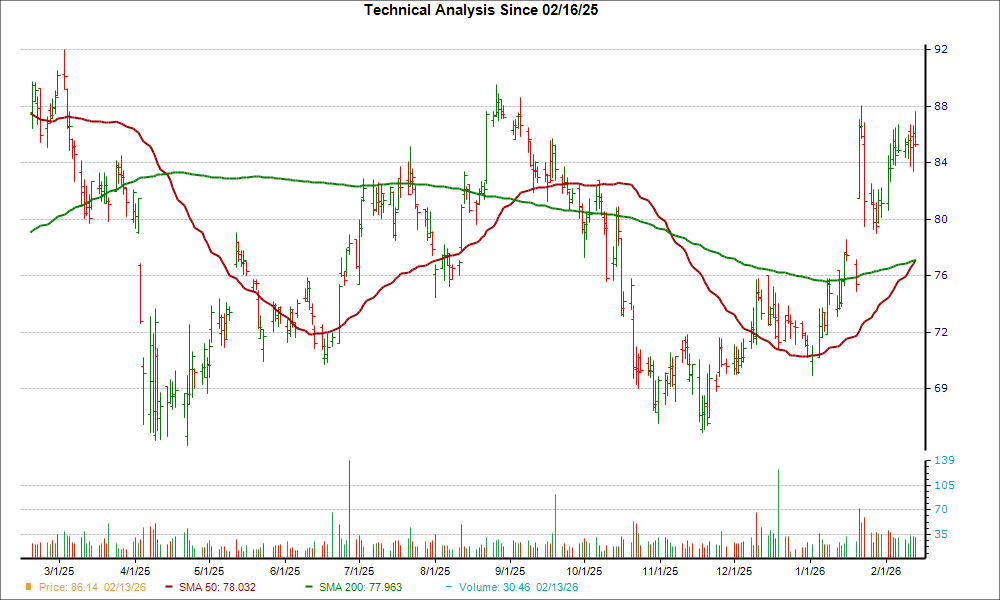

ServisFirst Bancshares (SFBS) is showing a strong technical outlook due to a recent "golden cross," where its 50-day simple moving average crossed above its 200-day moving average. This pattern often signals a bullish breakout and potential uptrend. Combined with its #1 (Strong Buy) Zacks Rank and positive earnings estimate revisions, SFBS appears poised for further gains.

2026-02-16 09:55:00

ServisFirst Bancshares (SFBS) is showing a bright technical outlook after its 50-day simple moving average crossed above its 200-day moving average, a pattern known as a "golden cross," signaling a potential bullish breakout. The company is also rated as a #1 (Strong Buy) on the Zacks Rank, with recent positive revisions in earnings expectations for the current quarter. Investors are advised to watch SFBS for potential future gains due to this combination of technical and fundamental strength.

2026-02-16 05:58:10

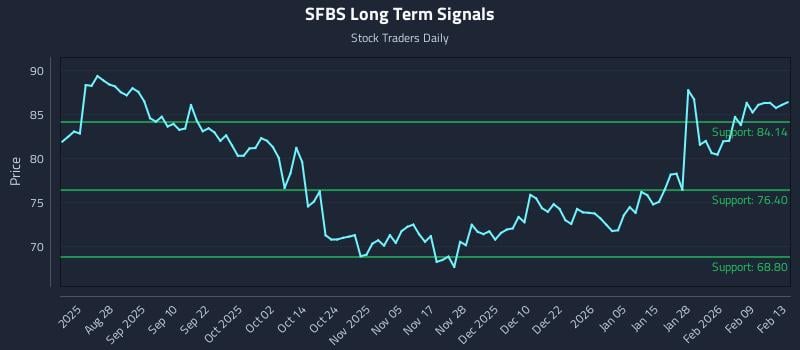

An algorithmic analysis of Servisfirst Bancshares Inc. (NASDAQ: SFBS) reveals a neutral sentiment across all time horizons, suggesting a wait-and-see approach. The analysis outlines three distinct trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss levels. Key findings highlight elevated downside risk due to the absence of additional long-term support signals.

2026-02-15 12:27:45

The Public Sector Pension Investment Board significantly increased its stake in ServisFirst Bancshares (NYSE:SFBS) by 14.4%, now holding 195,976 shares valued at $15.78 million. ServisFirst Bancshares recently surpassed earnings expectations, reporting $1.58 EPS against a $1.38 consensus, and raised its quarterly dividend to $0.38. Analysts maintain a "Buy" consensus rating for SFBS, with an average target price of $91.00.