Sound Financial Bancorp Inc

$ 42.74

-1.88%

23 Feb - close price

- Market Cap 104,105,000 USD

- Current Price $ 42.74

- High / Low $ 43.31 / 42.40

- Stock P/E 14.52

- Book Value 42.89

- EPS 3.00

- Next Earning Report 2026-04-28

- Dividend Per Share $0.76

- Dividend Yield 1.74 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.07 %

- 52 Week High 51.12

- 52 Week Low 42.40

About

Sound Financial Bancorp, Inc. is the banking holding company for Sound Community Bank providing banking and other financial services to consumers and businesses. The company is headquartered in Seattle, Washington.

Analyst Target Price

N/A

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-29 | 2025-10-29 | 2025-07-28 | 2025-04-29 | 2025-01-29 | 2024-10-24 | 2024-07-29 | 2024-04-29 | 2024-01-26 | 2023-10-24 | 2023-07-25 | 2023-04-24 |

| Reported EPS | 0.87 | 0.6558 | 0.79 | 0.4506 | 0.7399 | 0.446 | 0.3087 | 0.2992 | 0.4702 | 0.45 | 0.98 | 0.83 |

| Estimated EPS | None | None | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-28 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-23 | 2025-11-21 | 2025-08-25 | 2025-05-23 | 2025-02-26 | 2024-11-26 | 2024-08-23 | 2024-05-22 | 2024-02-21 | 2023-11-22 |

| Amount | $0.21 | $0.19 | $0.19 | $0.19 | $0.19 | $0.19 | $0.19 | $0.19 | $0.19 | $0.19 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: SFBC

2026-02-19 08:38:00

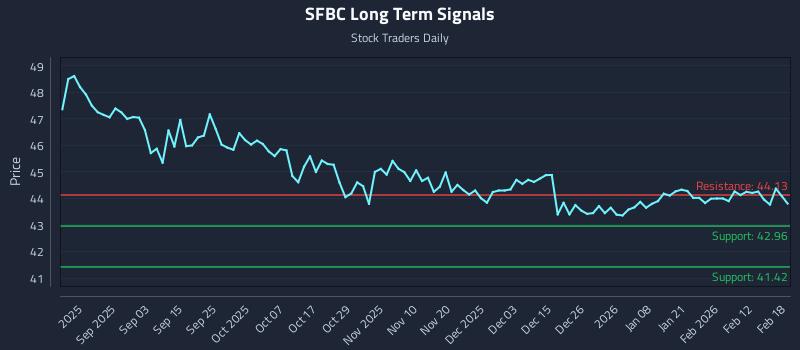

This article provides an in-depth analysis of Sound Financial Bancorp Inc. (NASDAQ: SFBC), highlighting stable neutral readings in shorter horizons alongside a mid-channel oscillation pattern. It identifies an exceptional 9.0:1 risk-reward short setup targeting a 2.7% downside with only 0.3% risk. The analysis includes three distinct AI-generated trading strategies—position, momentum breakout, and risk hedging—tailored for different risk profiles and holding periods, along with multi-timeframe signal analysis.

2026-02-13 13:27:57

Sound Financial Bancorp (SFBC) has announced that its annual shareholder meeting will be held on Tuesday, May 26, 2026, with March 31, 2026, as the record date for voting eligibility. The company, a Seattle-based bank holding company and parent of Sound Community Bank, focuses on community banking and mortgage lending. TipRanks' AI Analyst, Spark, rates SFBC as Neutral, citing improving profitability and solid cash conversion balanced by weak revenue growth.

2026-02-13 11:27:57

Sound Financial Bancorp, Inc. announced that its annual shareholders meeting will be held on May 26, 2026. The record date for voting has been set as March 31, 2026. The meeting will address company performance and future plans.

2026-02-13 06:58:07

Sound Financial Bancorp, Inc. (NASDAQ: SFBC) announced that its annual shareholders meeting will be held on Tuesday, May 26, 2026. The record date for shareholders eligible to vote is March 31, 2026. The company is the parent of Sound Community Bank, headquartered in Seattle, Washington.

2026-02-13 05:41:00

Sound Financial Bancorp, Inc. (NASDAQ: SFBC) announced that its annual shareholders meeting will take place on Tuesday, May 26, 2026. The record date for shareholders eligible to vote at this meeting is set for March 31, 2026. The company is headquartered in Seattle, Washington, and is the parent company of Sound Community Bank.

2026-02-12 21:27:34

Sound Financial Bancorp, Inc. (NASDAQ: SFBC) has announced that its annual shareholders meeting will take place on Tuesday, May 26, 2026. The record date for shareholders eligible to vote at this meeting is March 31, 2026. The company, headquartered in Seattle and parent to Sound Community Bank, made the announcement on February 12, 2026.