Semrush Holdings Inc

$ 11.79

-0.08%

24 Feb - close price

- Market Cap 1,785,666,000 USD

- Current Price $ 11.79

- High / Low $ 11.81 / 11.79

- Stock P/E N/A

- Book Value 1.94

- EPS -0.02

- Next Earning Report 2026-02-25

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -0.02 %

- 52 Week High 15.44

- 52 Week Low 6.56

About

SEMrush Holdings, Inc. develops online visibility management software as a platform of service (SaaS). The company is headquartered in Boston, Massachusetts with additional offices in Pennsylvania, Texas, Czech Republic, Cyprus, Poland, and Russia.

Analyst Target Price

$12.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-05 | 2025-08-07 | 2025-05-05 | 2025-03-03 | 2024-11-07 | 2024-08-05 | 2024-05-06 | 2024-03-04 | 2023-11-01 | 2023-08-03 | 2023-05-08 | 2023-03-13 |

| Reported EPS | -0.01 | -0.04 | 0.0186 | 0.0699 | 0.05 | 0.06 | 0.05 | 0.08 | 0.06 | 0.02 | -0.05 | -0.08 |

| Estimated EPS | 0.08 | 0.08 | 0.0742 | 0.0691 | 0.07 | 0.07 | 0.05 | 0.04 | 0.02 | -0.01 | -0.05 | -0.08 |

| Surprise | -0.09 | -0.12 | -0.0556 | 0.0008 | -0.02 | -0.01 | 0 | 0.04 | 0.04 | 0.03 | 0 | 0 |

| Surprise Percentage | -112.5% | -150% | -74.9326% | 1.1577% | -28.5714% | -14.2857% | 0% | 100% | 200% | 300% | 0% | 0% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-25 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.0 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: SEMR

2026-02-21 09:32:44

Semrush, a leading online visibility management SaaS platform, has acquired Third Door Media, which includes MarTech, Search Engine Land, and the MarTech Conference. This acquisition aims to expand Semrush's content and educational offerings for marketers, integrating Third Door Media's established publications and events into its ecosystem. The editorial and conference teams of MarTech will remain in place, continuing their mission to inform marketing and marketing operations professionals about marketing technology.

2026-02-16 06:28:05

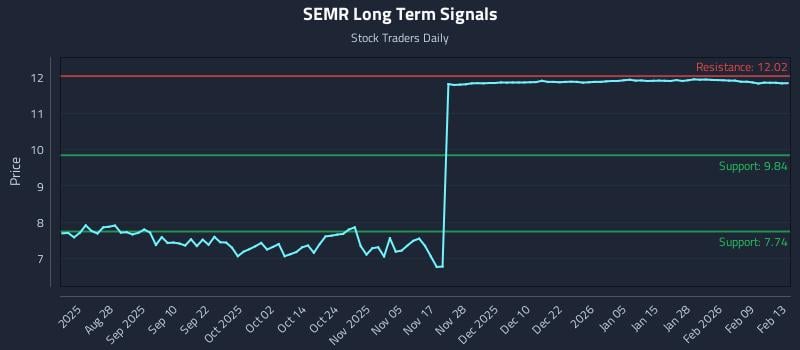

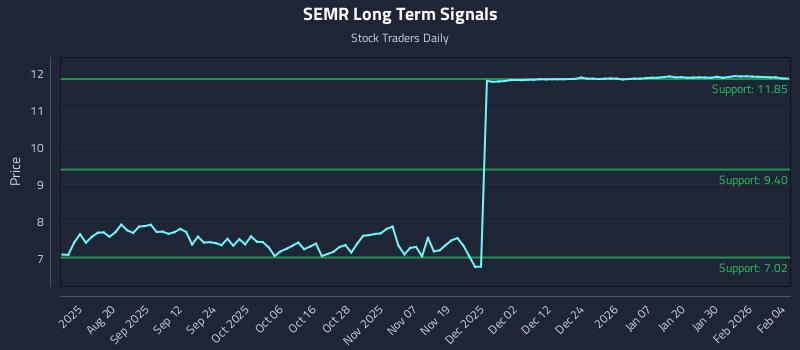

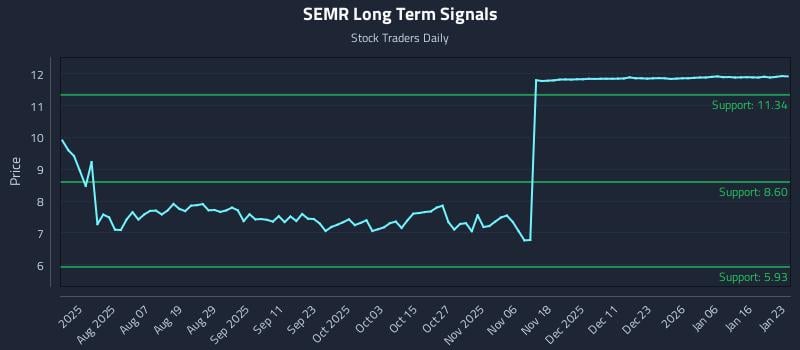

This article provides an AI-driven analysis of Semrush Holdings Inc. (NASDAQ: SEMR), highlighting a neutral sentiment across all time horizons. It outlines distinct trading strategies (Position, Momentum Breakout, Risk Hedging) with specific entry, target, and stop-loss levels, and emphasizes a wait-and-see approach due to resistance testing. The analysis points to an exceptional 72.7:1 risk-reward short setup if resistance holds.

2026-02-05 04:54:00

This article provides an AI-generated analysis of Semrush Holdings Inc. (NASDAQ: SEMR), identifying stable neutral readings in shorter horizons but a weak long-term bias. It outlines three institutional trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss zones. The analysis also includes multi-timeframe signal analysis indicating support and resistance levels.

2026-02-04 19:58:31

SEMrush Holdings, Inc. (NYSE:SEMR) has received a consensus "Reduce" rating from analysts, with one sell and five hold recommendations, following several downgrades from "strong-buy" or "moderate-buy." The company's shares opened at $11.88, with a negative P/E ratio of -594 and a market cap of $1.77 billion, despite reporting Q3 EPS in line with estimates and revenues slightly above expectations. Financial performance also shows negative net margin and return on equity, indicating ongoing challenges for the online visibility management provider.

2026-01-25 03:46:00

This article provides a price-driven analysis for Semrush Holdings Inc. Class A (NASDAQ: SEMR), highlighting neutral sentiment in shorter horizons but a weak long-term bias. It outlines three AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop loss points. The analysis also presents multi-timeframe signal data, indicating support and resistance levels for various holding periods.

2026-01-22 23:57:37

VELA Investment Management LLC significantly reduced its stake in Semrush Holdings (NASDAQ:SEMR) by 92.4% in Q3, now holding shares worth $87,000. Company insiders have also sold a substantial amount of stock recently, though they still retain a majority ownership. Analysts have a consensus "Hold" rating on Semrush, with the stock currently trading above the average target price.