RXO Inc.

$ 12.57

-1.10%

29 Dec - close price

- Market Cap 2,085,862,000 USD

- Current Price $ 12.57

- High / Low $ 12.75 / 12.33

- Stock P/E N/A

- Book Value 9.63

- EPS -0.34

- Next Earning Report 2026-02-04

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA N/A %

- ROE -0.05 %

- 52 Week High 26.92

- 52 Week Low 10.43

About

None

Analyst Target Price

$15.65

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-08-07 | 2025-05-07 | 2025-02-05 | 2024-11-07 | 2024-08-07 | 2024-05-02 | 2024-02-08 | 2023-11-07 | 2023-08-02 | 2023-05-03 | 2023-02-07 |

| Reported EPS | -0.08 | 0.04 | -0.03 | -0.12 | -1.81 | -0.06 | -0.13 | 0.06 | 0.05 | 0.08 | 0.11 | 0.28 |

| Estimated EPS | -0.04 | 0.03 | -0.02 | -0.06 | 0.05 | -0.01 | -0.1 | 0.04 | 0.01 | 0.08 | 0.07 | 0.23 |

| Surprise | -0.04 | 0.01 | -0.01 | -0.06 | -1.86 | -0.05 | -0.03 | 0.02 | 0.04 | 0 | 0.04 | 0.05 |

| Surprise Percentage | -100% | 33.3333% | -50% | -100% | -3720% | -500% | -30% | 50% | 400% | 0% | 57.1429% | 21.7391% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-04 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.03 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: RXO

2025-12-23 17:08:39

Oppenheimer analyst Scott Schneeberger has maintained a "Hold" rating on RXO Inc (RXO.US). According to TipRanks data, Schneeberger has a 59.7% success rate and an average return of 11.0% over the past year. TipRanks provides analysis data from financial analysts and calculates their success rates and average returns.

2025-12-22 21:06:00

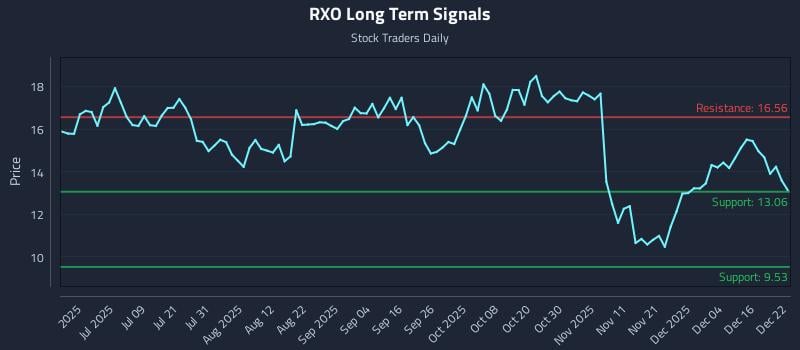

Rxo Inc. (NYSE: RXO) is currently experiencing weak near-term sentiment while mid-term strength is being tested within a broader long-term weak bias. The article outlines three institutional trading strategies (Position, Momentum Breakout, and Risk Hedging) with specific entry, target, and stop-loss zones. It also provides a multi-timeframe signal analysis, showing support and resistance levels across near-term, mid-term, and long-term horizons, and an exceptional 87.5:1 risk-reward setup.

2025-12-22 17:09:26

RXO (RXO) is facing challenges with margin pressures and a negative S&P Global outlook, leading to significant share price declines despite a perceived undervaluation based on AI-powered productivity gains. The market is questioning whether the current price reflects a contrarian opportunity or expectations of slower growth. The article also provides a fair value estimate of $15.59 for RXO.

2025-12-22 11:09:53

RXO (RXO) is facing challenges with margin pressures and a negative S&P outlook, prompting a valuation check. Despite recent share price declines, the company is considered 13% undervalued against a fair value of $15.59 due to its investment in AI-powered digital freight matching technology, which is expected to drive future margin and EBITDA growth. However, persistent automotive sector weakness and freight market softness could delay this recovery and challenge the optimistic AI-driven earnings narrative.

2025-12-21 17:09:29

Douglas Lane & Associates LLC increased its stake in RXO Inc. (NYSE:RXO) by 3.4% during the third quarter, bringing their total holdings to 3,866,005 shares valued at approximately $59.46 million. Institutional investors now own about 92.73% of the company. RXO’s stock performance shows a negative net margin of 1.25% despite a 34.6% year-over-year revenue increase in its last earnings report, which still missed EPS estimates.

2025-12-21 17:09:26

Rxo Inc (NYSE:RXO) has received an average "Hold" rating from nineteen analysts, with an average one-year price target of $16.62. The company recently missed quarterly EPS and revenue estimates, reporting $0.01 EPS against an expected $0.03, and $1.42B revenue against $1.44B. Insider buying activity includes purchases by the director and CEO, while institutional ownership stands at approximately 92.7%.