Retractable Technologies Inc

$ 0.66

0.15%

24 Feb - close price

- Market Cap 24,249,100 USD

- Current Price $ 0.66

- High / Low $ 0.69 / 0.65

- Stock P/E N/A

- Book Value 2.55

- EPS -0.30

- Next Earning Report 2026-03-27

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.09 %

- ROE -0.11 %

- 52 Week High 1.14

- 52 Week Low 0.62

About

Retractable Technologies, Inc. designs, develops, manufactures, and markets safety syringes and other medical products for the healthcare industry in the United States, the rest of North and South America, and internationally. The company is headquartered in Little Elm, Texas.

Analyst Target Price

N/A

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-14 | 2025-08-14 | 2025-05-13 | 2025-03-27 | 2024-11-12 | 2024-08-14 | 2024-05-15 | 2024-03-29 | 2023-11-14 | 2023-08-14 | 2023-05-15 | 2023-03-30 |

| Reported EPS | 0.01 | -0.0048 | -0.3527 | 0.124 | -0.0661 | -0.4751 | 0.0124 | -0.0044 | -0.1376 | -0.1302 | -0.145 | -0.13 |

| Estimated EPS | None | 0 | None | None | None | None | None | None | None | None | None | None |

| Surprise | 0 | -0.0048 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-27 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: RVP

2026-02-15 15:09:07

CCPA Purchasing Partners (CCPAPP) has signed a new contract with Retractable Technologies, Inc. (RTI) to offer significant discounts on RTI's safety medical devices, including the VanishPoint Syringe and EasyPoint Retractable Needle, to its members. This initiative aims to reduce needlestick injuries and associated costs in healthcare facilities. The contract provides independent physicians within CCPAPP access to automated retraction technology designed to improve workplace safety and mitigate financial burdens from such injuries.

2026-02-13 22:03:08

CCPA Purchasing Partners (CCPAPP) has launched a new Premier contract offering with Retractable Technologies, Inc. (RTI) to provide member physicians with significant discounts on safety medical devices. These devices, including the VanishPoint Syringe and EasyPoint Retractable Needle, feature automated retraction technology designed to prevent needlestick injuries and reduce disposal costs. The partnership aims to enhance safety and economic efficiency for healthcare facilities.

2026-02-12 16:57:37

CCPA Purchasing Partners (CCPAPP) has announced a new Premier contract offering with Retractable Technologies, Inc. (RTI) to provide significant discounts on retractable syringes for its member physicians. This partnership aims to reduce needlestick injuries and lower disposal costs in healthcare facilities by offering products like the VanishPoint Syringe and EasyPoint Retractable Needle. These devices are designed for automated retraction, enhancing safety and efficiency in medical practices.

2026-02-12 15:57:19

CCPA Purchasing Partners, LLC (CCPAPP) announced a new Premier contract offering with Retractable Technologies, Inc. (RTI) to provide significant discounts on retractable syringes. This partnership aims to reduce needlestick injuries and lower healthcare facility costs through RTI's VanishPoint Syringes and EasyPoint Retractable Needles. These products offer benefits like disposal savings and crucial injury prevention for medical staff.

2026-02-05 12:59:54

DataM Intelligence has published a new research report on the Smart Syringe Pumps Market, examining key factors such as segmentation, CAGR, competitive positioning, and financial performance. The report highlights recent developments like AI-enabled smart syringe pumps, wireless platforms, and compact devices for home healthcare, alongside significant mergers and acquisitions. The market is projected to grow considerably between 2024 and 2031, with key players including Cardinal Health, Baxter Healthcare Corporation, and Medtronic.

2026-01-14 10:02:00

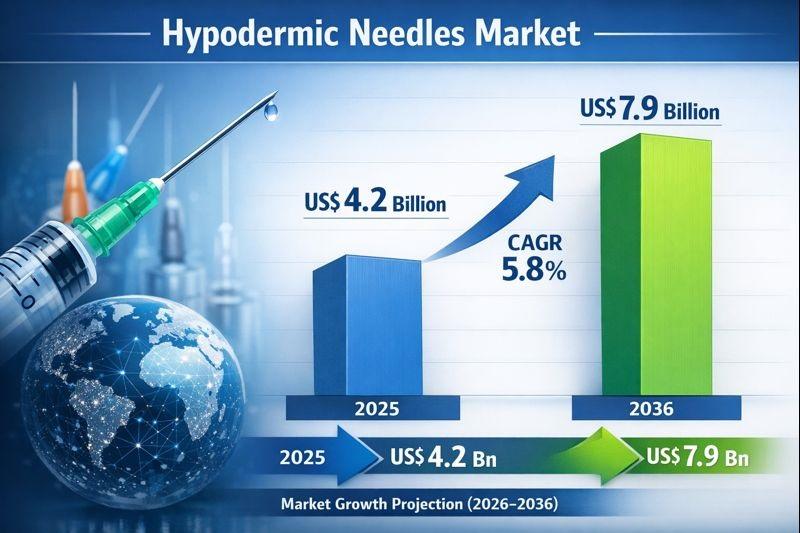

The global hypodermic needles market is projected to grow from approximately US$ 4.2 billion in 2025 to US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8%. This growth is driven by the increasing prevalence of chronic diseases, a rising demand for injectable drugs and biologics, and the expansion of global vaccination programs. Key market drivers include the growing elderly population and advancements in safety-engineered and disposable needles.