Regional Management Corp

$ 40.12

-1.06%

26 Dec - close price

- Market Cap 393,139,000 USD

- Current Price $ 40.12

- High / Low $ 40.70 / 39.67

- Stock P/E 9.71

- Book Value 37.94

- EPS 4.13

- Next Earning Report 2026-02-04

- Dividend Per Share $1.20

- Dividend Yield 2.96 %

- Next Dividend Date -

- ROA 0.04 %

- ROE 0.11 %

- 52 Week High 45.63

- 52 Week Low 24.74

About

Regional Management Corp (RM), based in Greer, South Carolina, is a prominent provider of consumer finance solutions, specializing in lending to underserved markets that typically encounter obstacles to accessing traditional credit. The company offers a diverse range of installment loan products tailored to meet the unique financial needs of its customers, all while adhering to responsible lending practices. With its commitment to exceptional customer service and promoting financial inclusivity, RM is strategically positioned to accelerate growth and elevate the financial resilience of the communities it serves, thereby solidifying its role as a key player in the consumer lending industry.

Analyst Target Price

$46.33

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-05 | 2025-07-30 | 2025-04-30 | 2025-02-05 | 2024-11-06 | 2024-07-31 | 2024-05-01 | 2024-02-07 | 2023-11-01 | 2023-08-02 | 2023-05-03 | 2023-02-08 |

| Reported EPS | 1.42 | 1.03 | 0.7 | 0.98 | 0.76 | 0.86 | 1.56 | 0.54 | 0.91 | 0.63 | 0.9 | 0.25 |

| Estimated EPS | 1.47 | 0.72 | 0.68 | 0.89 | 1.05 | 0.57 | 0.87 | 0.43 | 0.79 | 0.52 | 0.55 | 0.73 |

| Surprise | -0.05 | 0.31 | 0.02 | 0.09 | -0.29 | 0.29 | 0.69 | 0.11 | 0.12 | 0.11 | 0.35 | -0.48 |

| Surprise Percentage | -3.4014% | 43.0556% | 2.9412% | 10.1124% | -27.619% | 50.8772% | 79.3103% | 25.5814% | 15.1899% | 21.1538% | 63.6364% | -65.7534% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-04 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.23 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-16 | 2025-09-10 | 2025-06-11 | 2025-03-13 | 2024-12-11 | 2024-09-12 | 2024-06-12 | 2024-03-14 | 2023-12-13 | 2023-09-14 |

| Amount | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 | $0.3 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: RM

2025-12-22 18:56:00

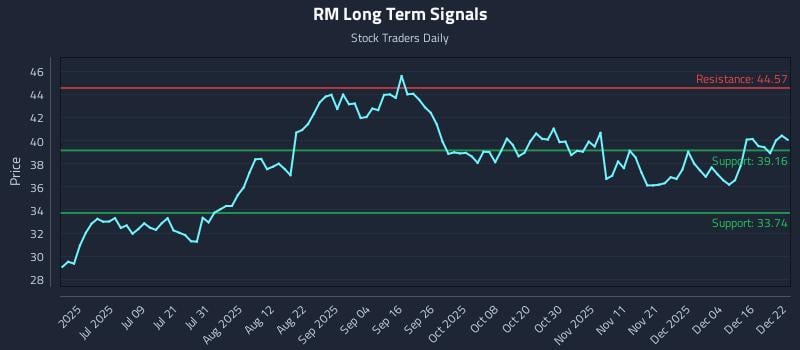

This article provides a detailed analysis of Regional Management Corp. (NYSE: RM), highlighting strong sentiment across all time horizons and an exceptional 49.2:1 risk-reward setup. It outlines three distinct AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—tailored for different risk profiles. The analysis also includes multi-timeframe signal analysis with support and resistance levels.

2025-12-16 12:09:11

Regional Management (NYSE:RM) shares have crossed above their 200-day moving average, trading at $39.55 against an average of $36.47. Despite this technical breakout, analyst sentiment is largely negative with an average "Reduce" rating and a price target of $30.00. Adding to concerns, company insiders have recently sold over $435,000 worth of shares.

2025-12-15 12:09:11

Regional Management Corp. (NYSE:RM) currently has a low P/E ratio of 9.4x, which suggests investors may be wary despite its recent earnings growth. Although the company's EPS grew an exceptional 75% in the last year, its three-year EPS shrank by 43%, and analysts predict a 31% EPS climb in the coming year, outperforming the broader market. This situation implies that investors are skeptical of future performance or perceive significant risks, preventing the stock from reflecting its strong growth prospects.

2025-12-15 10:09:18

Regional Management Corp. (NYSE:RM) currently has a low price-to-earnings (P/E) ratio of 9.4x, suggesting investors are holding back despite strong recent earnings growth. While the company's EPS grew 75% in the last year and is projected to climb 31% in the coming year, significantly outpacing the market, its three-year EPS has shrunk by 43%. This discrepancy suggests that shareholders may be skeptical of future forecasts or anticipating earnings instability, leading to a lower valuation.

2025-12-12 00:08:48

Basswood Capital Management and its affiliates sold approximately $2.3 million worth of Regional Management Corp (NASDAQ:RM) shares on December 9 and 10, 2025. These transactions involved sales at prices ranging from $36.68 to $37.8 per share, with Basswood Capital continuing to hold a significant number of shares in the company. This news follows Regional Management Corp.'s strong Q3 2025 earnings, which showed an 87% increase in diluted EPS and a 13% rise in total revenue.

2025-12-06 14:09:49

Regional Management (NYSE:RM) Director Michael Dunn sold 4,420 shares of the company's stock on December 2nd at an average price of $37.44, totaling $165,484.80. This transaction reduced his stake by 3.91% to 108,689 shares. The credit services provider recently announced a quarterly dividend of $0.30 per share, yielding 3.2% annually, and has an average analyst rating of "Reduce" with a consensus price target of $30.00.