Rivian Automotive Inc

$ 15.12

1.07%

24 Feb - close price

- Market Cap 18,565,208,000 USD

- Current Price $ 15.12

- High / Low $ 15.35 / 14.73

- Stock P/E N/A

- Book Value 3.68

- EPS -3.07

- Next Earning Report 2026-05-12

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.15 %

- ROE -0.65 %

- 52 Week High 22.69

- 52 Week Low 10.36

About

Rivian Automotive, Inc. (Ticker: RIVN) is a U.S.–based electric vehicle (EV) and automotive technology company that designs, develops, manufactures, and sells battery-powered vehicles and related products. Headquartered in Irvine, California, Rivian is known for its electric pickup truck (R1T), SUV (R1S), and commercial vans, along with software services, charging infrastructure, and vehicle accessories. The company aims to serve both consumer and commercial markets with innovative EV platforms and is traded on the NASDAQ stock exchange under the ticker RIVN.

Analyst Target Price

$18.04

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-12 | 2025-11-04 | 2025-08-05 | 2025-05-05 | 2025-02-19 | 2024-11-07 | 2024-08-06 | 2024-05-07 | 2024-02-21 | 2023-11-07 | 2023-08-08 | 2023-05-09 |

| Reported EPS | -0.7 | -0.65 | -0.7994 | -0.48 | -0.7 | -0.98 | -1.13 | -1.24 | -1.36 | -1.19 | -1.08 | -1.25 |

| Estimated EPS | -0.71 | -0.74 | -0.66 | -1.17 | -0.7749 | -0.92 | -1.21 | -1.17 | -1.32 | -1.32 | -1.41 | -1.59 |

| Surprise | 0.01 | 0.09 | -0.1394 | 0.69 | 0.0749 | -0.06 | 0.08 | -0.07 | -0.04 | 0.13 | 0.33 | 0.34 |

| Surprise Percentage | 1.4085% | 12.1622% | -21.1212% | 58.9744% | 9.6658% | -6.5217% | 6.6116% | -5.9829% | -3.0303% | 9.8485% | 23.4043% | 21.3836% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-12 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | -0.6412 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: RIVN

2026-02-22 02:00:42

This article identifies top SUVs and crossovers for 2023 based on ground clearance, a crucial factor for off-roading. It highlights models like the Rivian R1S and Mercedes G-class 4x4², detailing their clearance measurements and features that enhance off-road capability. The piece also includes other contenders such as the Ford Bronco, Jeep Wrangler, and various Land Rover models, noting that high clearance alone is not sufficient for safe off-roading without proper angles and driving techniques.

2026-02-17 17:27:47

Rivian Automotive, Inc. (NasdaqGS:RIVN) has reached a proposed $250 million settlement in a securities class action lawsuit related to its IPO, with a court hearing scheduled for May 2026. This settlement aims to reduce headline risk and could be a positive factor for the stock, which has experienced significant volatility and remains unprofitable. Despite trading below analyst targets and estimated fair value, investors will need to monitor the financial impact of the settlement and Rivian’s ongoing efforts to achieve profitability amid dilution concerns.

2026-02-16 05:27:47

This article analyzes Rivian Automotive (RIVN) stock after its recent price volatility and Volkswagen joint venture, exploring whether its current valuation around US$17.73 presents a value opportunity. Using Discounted Cash Flow and Price vs Sales models, the article suggests Rivian appears undervalued by DCF but overvalued by P/S compared to industry averages and its "Fair Ratio." It also presents two valuation narratives, highlighting differing views on Rivian's future prospects and risks.

2026-02-13 18:28:07

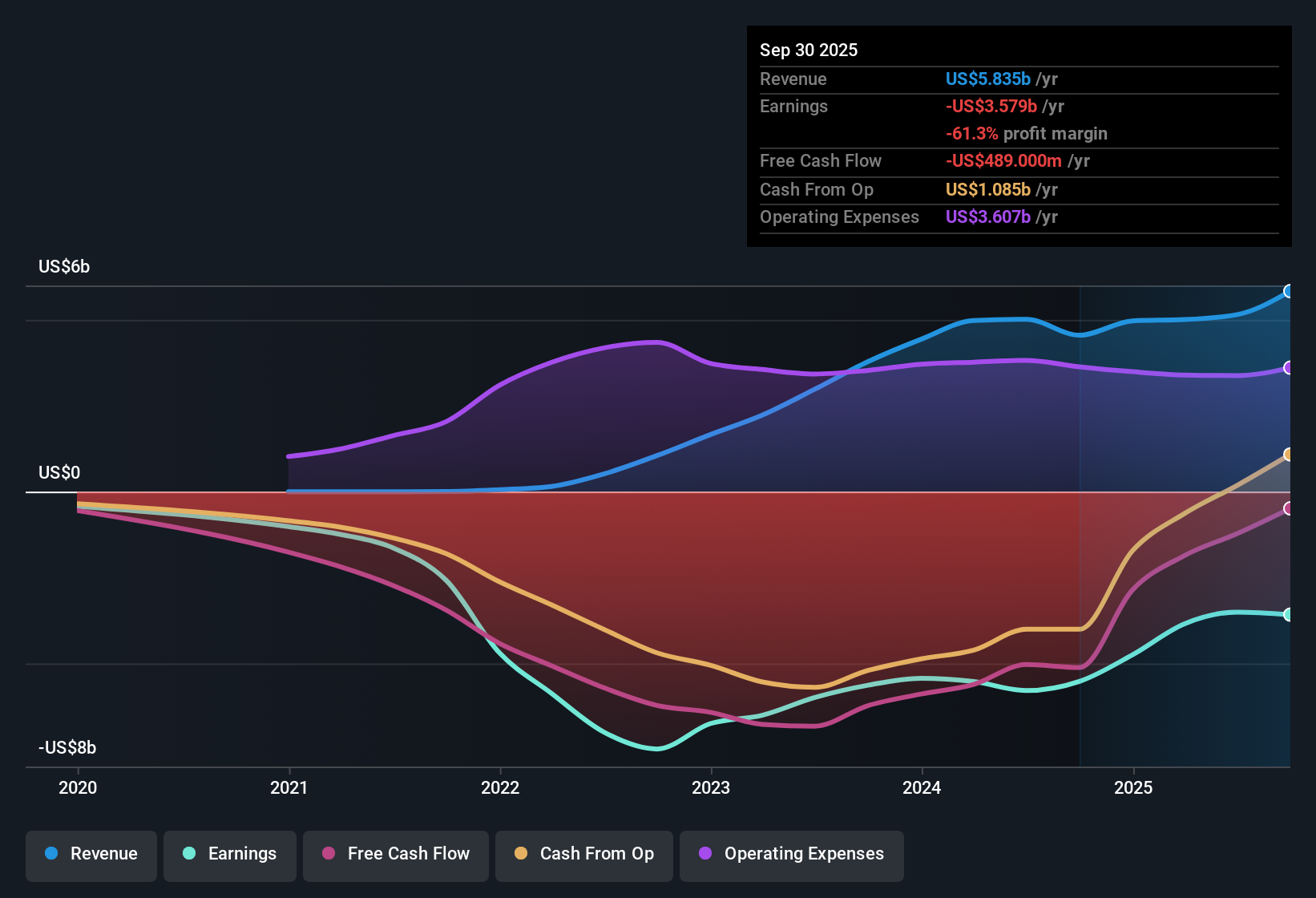

Rivian Automotive has settled a $250 million lawsuit related to its 2021 IPO, which investors claimed misrepresented manufacturing costs. Despite this setback, the company is showing significant progress, including its first consolidated gross profit in Q3 2025, a $5.8 billion joint venture with Volkswagen, and advancements in custom silicon and self-driving technology. Analysts hold a cautious "Hold" rating but acknowledge the potential upside from future product launches and technological innovations.

2026-02-13 17:27:31

Rivian Automotive reported a US$811 million Q4 loss and US$3.6 billion in TTM net losses for FY 2025, despite generating US$1.3 billion in Q4 revenue. While bullish investors highlight growth expectations and a DCF fair value of US$42.55, critics point to the ongoing heavy losses, potential dilution, and a P/S ratio of 4.1x compared to peers at 1.7x, questioning the company's path to profitability within the next three years.

2026-02-13 06:28:07

A proposed US$250 million class action settlement for Rivian Automotive investors is awaiting court approval, adding a legal dimension to the company's investment profile. While this settlement is considered manageable, investors are more focused on Rivian's upcoming earnings, liquidity, R2 platform execution, and ambitions in autonomous driving. The article suggests that Rivian needs to convert high upfront investments into significant revenue to avoid further funding pressure.