Radian Group Inc

$ 34.22

-1.38%

05 Mar - close price

- Market Cap 4,728,653,000 USD

- Current Price $ 34.22

- High / Low $ 34.75 / 34.08

- Stock P/E 7.90

- Book Value 35.29

- EPS 4.39

- Next Earning Report 2026-05-06

- Dividend Per Share $1.02

- Dividend Yield 2.96 %

- Next Dividend Date 2026-03-10

- ROA 0.07 %

- ROE 0.13 %

- 52 Week High 38.26

- 52 Week Low 28.46

About

Radian Group Inc. is engaged in the mortgage and real estate services business in the United States. The company is headquartered in Philadelphia, Pennsylvania.

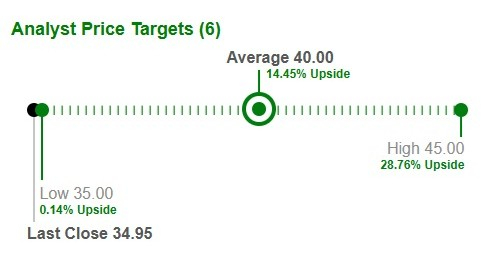

Analyst Target Price

$40.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-18 | 2025-11-05 | 2025-07-30 | 2025-04-30 | 2025-02-05 | 2024-11-06 | 2024-07-31 | 2024-05-01 | 2024-02-07 | 2023-11-01 | 2023-08-02 | 2023-05-03 |

| Reported EPS | 1.16 | 1.07 | 1.01 | 0.99 | 1.09 | 1.03 | 0.99 | 0.98 | 0.96 | 1.04 | 0.91 | 0.98 |

| Estimated EPS | 1.08 | 0.98 | 0.98 | 0.97 | 0.94 | 0.92 | 0.9 | 0.84 | 0.87 | 0.81 | 0.78 | 0.75 |

| Surprise | 0.08 | 0.09 | 0.03 | 0.02 | 0.15 | 0.11 | 0.09 | 0.14 | 0.09 | 0.23 | 0.13 | 0.23 |

| Surprise Percentage | 7.4074% | 9.1837% | 3.0612% | 2.0619% | 15.9574% | 11.9565% | 10% | 16.6667% | 10.3448% | 28.3951% | 16.6667% | 30.6667% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-06 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 1.18 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-10 | 2025-12-09 | 2025-09-09 | 2025-06-17 | 2025-03-11 | 2024-12-10 | 2024-09-11 | 2024-06-20 | 2024-03-12 | 2023-12-12 |

| Amount | $0.255 | $0.255 | $0.255 | $0.255 | $0.255 | $0.245 | $0.245 | $0.245 | $0.245 | $0.225 |

Next Dividend Records

| Dividend per share (year): | $1.02 |

| Dividend Yield | 2.96% |

| Next Dividend Date | 2026-03-10 |

| Ex-Dividend Date | 2026-02-23 |

Recent News: RDN

2026-03-04 14:51:32

Radian Group Inc. (RDN) is trading at an attractive valuation with a forward price-to-book ratio of 0.98, significantly below the industry average. The company shows strong growth prospects, with analysts projecting EPS increases for 2026 and 2027, and has outperformed its industry peers in stock performance and earnings growth. Recent strategic acquisitions, such as Inigo, and divestitures are expected to further enhance its financial health, product offerings, and capital allocation flexibility, making it a compelling investment opportunity, especially for income-focused investors due to its rising dividend.

2026-03-04 10:51:32

Quantbot Technologies LP recently acquired a new stake in Radian Group Inc. (NYSE:RDN), purchasing 59,219 shares valued at approximately $2.15 million during the third quarter. Radian, an insurance provider, surpassed quarterly earnings expectations with $1.16 EPS against an estimated $1.11 and maintains a low P/E ratio of 8.3. The company also offers an annualized dividend of $1.02, representing a 3.0% yield, and is rated a "Moderate Buy" by analysts with an average price target of $40.80.

2026-03-03 10:52:29

This article provides an in-depth look at Radian Group's (RDN) financial statements for fiscal year 2025, including its income statement, balance sheet, and cash flow. Key metrics such as revenue, net income, EPS, and debt-to-equity ratio are detailed, alongside an assessment of the company's financial health and earnings quality.

2026-03-03 02:51:37

Radian Group Inc. reported a full-year 2025 net income of $618 million and completed its $1.67 billion acquisition of Lloyd’s specialty insurer Inigo in February 2026. This acquisition is expected to expand Radian into a global multi-line specialty insurer, increasing earnings per share and return on equity in 2026. The company also saw its primary mortgage insurance in force grow to $282.5 billion and returned $576 million to stockholders.

2026-03-02 14:51:37

Radian Group Inc. (NYSE:RDN) has received an average "Moderate Buy" rating from seven analysts, with an average 12-month price target of $40.80. The company reported strong quarterly earnings, beating analyst estimates with $1.16 EPS and revenue of $300.51 million, and declared a quarterly dividend of $0.255. Despite an EVP selling shares, institutional investors hold a significant majority of the stock.

2026-02-28 10:52:03

JPMorgan Chase & Co. significantly reduced its stake in Radian Group Inc. (RDN) by 51% in the third quarter of 2025, selling over a million shares. Despite this, Radian Group exceeded Q4 earnings estimates with $1.16 EPS and declared a quarterly dividend of $0.255, reflecting strong financial performance and a "Moderate Buy" consensus target price of $40.80 from analysts. Insider sales, specifically by EVP Eric Ray, were also noted, alongside increased institutional ownership which now stands at 95.33% of the stock.