QuinStreet Inc

$ 14.43

-1.50%

26 Dec - close price

- Market Cap 818,925,000 USD

- Current Price $ 14.43

- High / Low $ 14.67 / 14.38

- Stock P/E 80.17

- Book Value 4.30

- EPS 0.18

- Next Earning Report 2026-02-05

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.04 %

- ROE 0.05 %

- 52 Week High 25.50

- 52 Week Low 12.98

About

QuinStreet Inc. is a premier online performance marketing company headquartered in Foster City, California, that excels in client acquisition services across diverse sectors such as financial services, education, and home services. Utilizing cutting-edge technology and robust data analytics, QuinStreet optimizes customer engagement to deliver tangible results for its clients in the U.S. and internationally. With a steadfast commitment to performance metrics, the company is strategically positioned to benefit from the increasing demand for innovative digital marketing solutions in a highly competitive landscape, making it an attractive opportunity for institutional investors.

Analyst Target Price

$21.75

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-08-07 | 2025-05-07 | 2025-02-06 | 2024-11-04 | 2024-08-08 | 2024-05-08 | 2024-02-07 | 2023-11-01 | 2023-08-09 | 2023-05-03 | 2023-02-08 |

| Reported EPS | 0.22 | 0.25 | 0.21 | 0.2 | 0.22 | 0.11 | 0.06 | -0.04 | -0.03 | -0.01 | 0.11 | -0.02 |

| Estimated EPS | 0.21 | 0.25 | 0.2 | 0.2 | 0.16 | 0.1 | 0.06 | -0.05 | -0.03 | -0.02 | 0.07 | -0.03 |

| Surprise | 0.01 | 0 | 0.01 | 0 | 0.06 | 0.01 | 0 | 0.01 | 0 | 0.01 | 0.04 | 0.01 |

| Surprise Percentage | 4.7619% | 0% | 5% | 0% | 37.5% | 10% | 0% | 20% | 0% | 50% | 57.1429% | 33.3333% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-05 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.06 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: QNST

2025-12-23 08:09:07

The Zacks Internet - Delivery Services industry faces challenges from macroeconomic uncertainty, high interest rates, tariffs, and increased costs from hiring and marketing. Despite these headwinds, companies like GoDaddy, MakeMyTrip, and QuinStreet are positioned for growth by adapting to consumer preferences, leveraging smartphone penetration, and expanding into new markets. Technological innovations in routing and tracking also provide a competitive edge.

2025-12-22 16:10:02

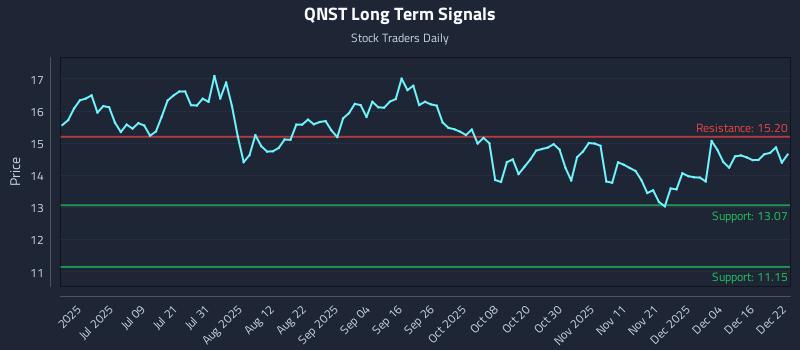

This article analyzes Quinstreet Inc. (NASDAQ: QNST), highlighting a mixed sentiment and mid-channel oscillation pattern. It presents exceptional risk-reward short setup opportunities and provides distinct trading strategies (Position, Momentum Breakout, and Risk Hedging) tailored for different risk profiles. The analysis includes multi-timeframe signal analysis, support, and resistance levels for QNST.

2025-12-20 08:09:39

Assenagon Asset Management S.A. significantly increased its stake in QuinStreet, Inc. by 1,443.4% in the third quarter, acquiring 1,063,107 additional shares to hold a total of 1,136,759 shares, representing approximately 1.98% of the company. This move, alongside other institutional investors boosting their positions, highlights growing institutional interest in QuinStreet, with institutional ownership now at 97.83%. Analysts have a "Moderate Buy" consensus rating for QNST, with an average price target of $24.50, significantly higher than its current trading price, following a strong earnings report where the company beat EPS estimates and reported revenue growth.

2025-12-14 12:09:07

Ranger Investment Management L.P. increased its stake in QuinStreet, Inc. (NASDAQ: QNST) by 26.4%, purchasing 75,174 additional shares to own a total of 360,194 shares valued at $5.799 million. QuinStreet, an online performance marketing company, has high institutional ownership at 97.83%, with other funds also adding or initiating positions. Analysts have a mixed view on QNST, with a consensus "Hold" rating and an average price target of $24.50, despite the stock trading around $14.50 and recently beating EPS estimates.

2025-12-11 13:52:00

This article analyzes Quinstreet Inc. (NASDAQ: QNST) behavior, noting current weak sentiment but a mid-channel oscillation pattern. It highlights an exceptional short setup with a 53.5:1 risk-reward ratio targeting substantial downside. The article also outlines three AI-generated institutional trading strategies for different risk profiles.

2025-12-11 10:08:38

Marshall Wace LLP significantly increased its stake in QuinStreet, Inc. (NASDAQ:QNST) by 46.7%, purchasing an additional 280,942 shares and bringing its total holdings to 882,021 shares valued at approximately $14.2 million. This move comes as QuinStreet reported stronger-than-expected quarterly earnings and revenue, though analysts maintain a "Hold" rating with an average target price of $24.50. The technology company's stock currently trades around $14.61 with a P/E ratio of 76.90.