Priority Technology Holdings Inc

$ 5.38

-2.36%

23 Feb - close price

- Market Cap 440,469,000 USD

- Current Price $ 5.38

- High / Low $ 5.50 / 5.26

- Stock P/E 10.15

- Book Value -1.35

- EPS 0.53

- Next Earning Report 2026-03-05

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.56 %

- 52 Week High 10.92

- 52 Week Low 4.44

About

Priority Technology Holdings, Inc. offers merchant acquisition, integrated payment software, and merchant payment solutions in the United States. The company is headquartered in Alpharetta, Georgia.

Analyst Target Price

$10.20

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-08-07 | 2025-05-07 | 2025-03-10 | 2024-11-07 | 2024-08-08 | 2024-05-09 | 2024-03-12 | 2023-11-09 | 2023-08-10 | 2023-05-11 | 2023-03-23 |

| Reported EPS | 0.28 | 0.14 | 0.1035 | -0.0211 | 0.07 | -0.23 | -0.1 | -0.12 | -0.16 | -0.16 | -0.15 | -0.15 |

| Estimated EPS | 0.23 | 0.17 | 0.175 | 0.09 | 0.01 | -0.06 | -0.09 | -0.1 | -0.14 | -0.12 | -0.14 | -0.07 |

| Surprise | 0.05 | -0.03 | -0.0715 | -0.1111 | 0.06 | -0.17 | -0.01 | -0.02 | -0.02 | -0.04 | -0.01 | -0.08 |

| Surprise Percentage | 21.7391% | -17.6471% | -40.8571% | -123.4444% | 600% | -283.3333% | -11.1111% | -20% | -14.2857% | -33.3333% | -7.1429% | -114.2857% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-05 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.29 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: PRTH

2026-02-13 13:28:11

Kaskela Law LLC has initiated an investigation into Priority Technology Holdings (PRTH) following a significant stock decline of over 50% since February 2025, which has severely impacted shareholder value. The investigation will determine if the company or its executives violated securities laws or breached fiduciary duties, and shareholders are encouraged to contact Kaskela Law for more information on their legal rights. Potential legal consequences could arise for Priority if violations are found, impacting its future operations and investor confidence.

2026-02-13 13:28:11

Kaskela Law LLC is investigating Priority Technology Holdings, Inc. (NASDAQ: PRTH) on behalf of its current stockholders. This investigation follows a significant decline of over 50% in the company's stock value since February 2025. The firm aims to determine if Priority or its officers breached fiduciary duties or violated securities laws.

2026-02-13 08:00:00

Kaskela Law LLC has initiated an investigation into Priority Technology Holdings, Inc. (NASDAQ: PRTH) following a significant decline in its stock value, which has fallen over 50% since February 2025. The firm is examining whether Priority and its officers or directors violated securities laws or breached fiduciary duties. Shareholders are urged to contact Kaskela Law for more information regarding their legal options.

2026-02-08 10:03:04

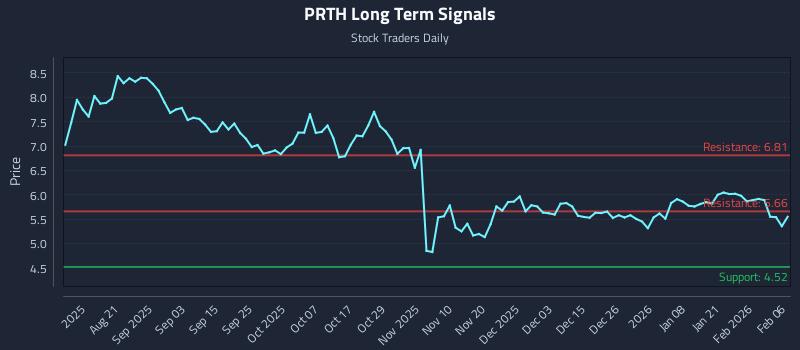

This article analyzes Priority Technology Holdings Inc. (NASDAQ: PRTH), identifying weak sentiment across all time horizons and suggesting a short bias. It outlines institutional trading strategies, including a position trading strategy, a momentum breakout strategy, and a risk hedging strategy, supported by multi-timeframe signal analysis. The report highlights an exceptional 57.0:1 risk-reward short setup targeting 20.1% downside.

2026-02-08 05:29:09

Priority Technology Holdings is at a pivotal point, balancing strategic operational advancements with a significant management-led buyout proposal. CEO Thomas Priore has made a non-binding offer of $6.00 to $6.15 per share for all outstanding common shares not already owned by him, with a special committee evaluating this and other strategic alternatives. The company continues to grow through partnerships, like Priority Rollfi's new client win with Axos Bank and the integration of acquired Dealer Merchant Services, while awaiting crucial 2025 financial results that will impact the buyout negotiations.

2026-02-07 16:43:04

Priority Technology Holdings is at a pivotal moment, with CEO Thomas Priore offering a non-binding buyout bid of $6.00 to $6.15 per share for outstanding common shares. A special committee is evaluating this and other strategic alternatives to maximize shareholder value. Concurrently, the company continues its operational expansion through new client wins with Priority Rollfi and the successful integration of Dealer Merchant Services, with upcoming Q4 and full-year 2025 financial results anticipated to provide further context.