Insulet Corporation

$ 288.63

-0.07%

26 Dec - close price

- Market Cap 20,317,397,000 USD

- Current Price $ 288.63

- High / Low $ 290.12 / 286.66

- Stock P/E 84.15

- Book Value 19.68

- EPS 3.43

- Next Earning Report 2026-02-19

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.09 %

- ROE 0.20 %

- 52 Week High 354.88

- 52 Week Low 230.05

About

Insulet Corporation (PODD) is a pioneering leader in insulin delivery solutions, known for transforming diabetes management through its innovative Omnipod® Insulin Management System. Headquartered in Acton, Massachusetts, the company has developed a groundbreaking tubeless and wearable design that significantly enhances patient experience and flexibility for those with insulin-dependent diabetes. With a steadfast commitment to innovation and a strategic focus on expanding its global reach, Insulet is at the vanguard of the healthcare sector, aiming to elevate the standard of care for diabetes patients worldwide.

Analyst Target Price

$377.72

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-08-07 | 2025-05-08 | 2025-02-20 | 2024-11-07 | 2024-08-08 | 2024-05-09 | 2024-02-22 | 2023-11-02 | 2023-08-08 | 2023-05-04 | 2023-02-23 |

| Reported EPS | 1.24 | 1.17 | 1.02 | 1.15 | 0.9 | 0.55 | 0.73 | 1.4 | 0.71 | 0.38 | 0.23 | 0.24 |

| Estimated EPS | 1.14 | 0.92 | 0.79 | 1.021 | 0.76 | 0.56 | 0.39 | 0.66 | 0.4 | 0.26 | 0.11 | 0.21 |

| Surprise | 0.1 | 0.25 | 0.23 | 0.129 | 0.14 | -0.01 | 0.34 | 0.74 | 0.31 | 0.12 | 0.12 | 0.03 |

| Surprise Percentage | 8.7719% | 27.1739% | 29.1139% | 12.6347% | 18.4211% | -1.7857% | 87.1795% | 112.1212% | 77.5% | 46.1538% | 109.0909% | 14.2857% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-19 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.48 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: PODD

2025-12-27 10:49:38

Swedbank AB increased its stake in Insulet Corporation by 6.9% in Q3, purchasing 5,000 shares to own 77,488 shares valued at approximately $23.9 million. Insulet (NASDAQ:PODD) holds a "Moderate Buy" consensus rating from analysts, with various price target adjustments from firms like JPMorgan and Truist. The company recently exceeded EPS expectations but fell short on revenue estimates in its latest earnings report.

2025-12-27 10:17:38

Osaic Holdings Inc. significantly increased its stake in Insulet Corporation by 152.9% in Q2, acquiring 5,309 additional shares to hold a total of 8,781 shares valued at approximately $2.709 million. Wall Street analysts maintain a "Moderate Buy" consensus rating for Insulet, with several firms recently raising their price targets. Insulet also reported Q1 EPS of $1.24, beating estimates, and revenue growth of 29.9% year-over-year.

2025-12-27 08:08:38

Beacon Investment Advisory Services Inc. reduced its stake in Insulet Corporation (NASDAQ:PODD) by 8.2% in the third quarter, holding 81,340 shares valued at $25.11 million. Despite this reduction and a revenue miss, several other institutional investors increased their holdings, and Wall Street analysts generally maintain a "Moderate Buy" rating with an average price target of $379. Insulet recently reported strong Q1 earnings, beating EPS estimates, and its stock shows a market capitalization of $20.31 billion.

2025-12-26 16:07:52

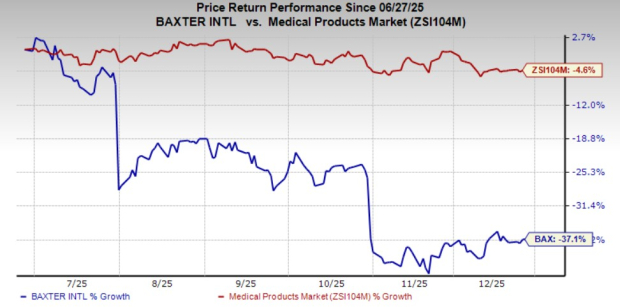

Baxter International (BAX) is undergoing a transition post-Kidney Care divestiture, facing challenges such as the Novum Infusion Pump disruption and soft IV solutions demand, yet exhibiting strength in Advanced Surgery and Healthcare Systems. The company is actively focusing on deleveraging and operational discipline through initiatives like Baxter GPS. Despite near-term headwinds, BAX is working towards improving its financial flexibility and long-term shareholder returns, making it a current "Hold" according to Zacks.

2025-12-26 12:07:28

Baxter International (BAX) is undergoing a transition post-divestiture of Kidney Care, facing near-term challenges but also long-term opportunities. The company exhibits resilience in its Advanced Surgery and Healthcare Systems businesses, alongside a strong focus on balance sheet deleveraging and operational discipline. Despite headwinds like the prolonged Novum Infusion Pump disruption and soft IV Solutions demand, these positive factors drive prospects and justify retaining the stock.

2025-12-25 10:20:18

Squarepoint Ops LLC significantly reduced its stake in Insulet Corporation (NASDAQ:PODD) by 93.0% in Q2, now holding 1,893 shares valued at approximately $595,000. Despite this, several analysts have raised their price targets for Insulet, contributing to a consensus "Moderate Buy" rating and a target price of $379.00. The company recently reported Q3 EPS of $1.24, beating estimates, though revenue of $521.7 million missed analyst expectations but still represented a 29.9% year-over-year increase.