Pinterest Inc

$ 16.95

1.56%

24 Feb - close price

- Market Cap 11,275,060,000 USD

- Current Price $ 16.95

- High / Low $ 17.22 / 16.61

- Stock P/E 27.36

- Book Value 7.14

- EPS 0.61

- Next Earning Report 2026-05-11

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.04 %

- ROE 0.09 %

- 52 Week High 39.93

- 52 Week Low 13.84

About

Pinterest, Inc. provides a visual discovery engine in the United States and internationally. The company is headquartered in San Francisco, California.

Analyst Target Price

$23.81

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-12 | 2025-11-04 | 2025-08-07 | 2025-05-08 | 2025-02-06 | 2024-11-07 | 2024-07-30 | 2024-04-30 | 2024-02-08 | 2023-10-30 | 2023-08-01 | 2023-04-27 |

| Reported EPS | 0.67 | 0.13 | 0.06 | 0.23 | 2.68 | 0.4 | 0.29 | 0.2 | 0.53 | 0.28 | 0.21 | 0.08 |

| Estimated EPS | 0.67 | 0.11 | 0.03 | 0.26 | 0.36 | 0.34 | 0.28 | 0.13 | 0.51 | 0.2 | 0.12 | 0.02 |

| Surprise | 0 | 0.02 | 0.03 | -0.03 | 2.32 | 0.06 | 0.01 | 0.07 | 0.02 | 0.08 | 0.09 | 0.06 |

| Surprise Percentage | 0% | 18.1818% | 100% | -11.5385% | 644.4444% | 17.6471% | 3.5714% | 53.8462% | 3.9216% | 40% | 75% | 300% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-11 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.23 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: PINS

2026-02-20 00:26:42

The Schall Law Firm is investigating claims on behalf of investors of Pinterest, Inc. (NYSE: PINS) following a significant drop in its stock price. This investigation stems from the company's Q4 2025 financial results, where management expressed dissatisfaction with revenue performance and cited an "exogenous shock" related to tariffs. Shareholders who experienced losses are encouraged to contact the firm for a free consultation.

2026-02-19 20:04:00

Pomerantz LLP is investigating potential securities fraud claims against Pinterest, Inc. following a significant drop in its stock price. This investigation stems from Pinterest's announcement of a global restructuring plan, including workforce reductions and office space cuts, expected to cost $35 million to $45 million. The company aims to reallocate resources towards AI-focused initiatives and products.

2026-02-19 12:01:00

Glancy Prongay Wolke & Rotter LLP has announced a securities fraud investigation into Pinterest, Inc. (PINS) after the company reported disappointing fourth-quarter 2025 results and acknowledged issues with revenue performance. Pinterest's stock price subsequently fell by 16.83%. Shareholders who lost money are encouraged to contact the law firm to learn about potentially pursuing claims under federal securities laws.

2026-02-19 10:27:38

Pinterest reported Q4 2025 revenue of $1.32 billion, missing analyst estimates, and provided cautious guidance for Q1 2026, leading to a market sell-off. The company attributed the softness to advertising pullbacks from large retail clients facing tariffs and margin pressures. CEO Bill Ready emphasized the need to diversify the advertiser base and accelerate sales transformation, acknowledging near-term disruption from ongoing changes.

2026-02-15 17:36:00

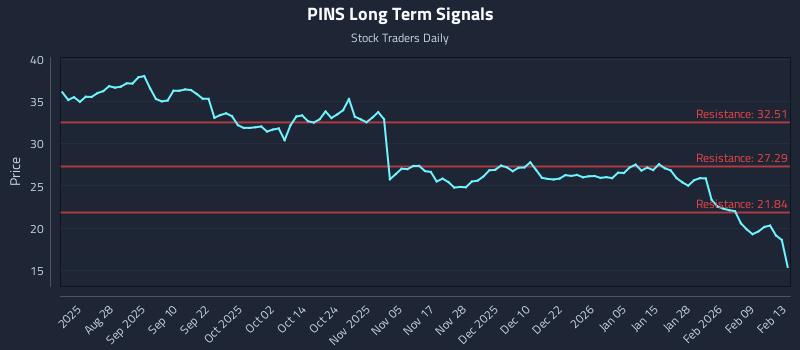

The article analyzes Pinterest Inc. Class A (PINS) using AI models, indicating weak sentiment across all time horizons, supporting a short bias. It provides specific trading strategies—Position, Momentum Breakout, and Risk Hedging (short)—with entry zones, targets, and stop losses. The analysis suggests a breakdown is underway for PINS, with elevated downside risk.

2026-02-13 20:58:04

Pinterest (PINS) shares dropped significantly after the company issued a first-quarter forecast below analyst expectations, projecting lower revenue and EBITDA despite strong user growth. This outlook raised investor concerns about a potential slowdown in advertising demand on the platform. The stock has experienced high volatility over the past year and is currently down 43.2% year-to-date and 61.8% below its 52-week high.