Piedmont Office Realty Trust Inc

$ 7.62

-4.51%

23 Feb - close price

- Market Cap 951,353,000 USD

- Current Price $ 7.62

- High / Low $ 7.97 / 7.53

- Stock P/E N/A

- Book Value 12.01

- EPS -0.67

- Next Earning Report 2026-05-04

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.01 %

- ROE -0.05 %

- 52 Week High 9.19

- 52 Week Low 5.46

About

Piedmont Office Realty Trust, Inc. (NYSE: PDM) is the owner, manager, developer, remodeler, and operator of high-quality Class A office properties located primarily in select submarkets within the seven major eastern US office markets. Most of your income is generated at Sunbelt.

Analyst Target Price

$10.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-11 | 2025-10-22 | 2025-07-28 | 2025-04-28 | 2025-02-05 | 2024-10-24 | 2024-07-31 | 2024-04-30 | 2024-02-07 | 2023-10-30 | 2023-07-18 | 2023-05-01 |

| Reported EPS | -0.35 | -0.11 | -0.14 | -0.08 | -0.24 | -0.09 | -0.08 | -0.22 | -0.23 | -0.14 | -0.02 | -0.01 |

| Estimated EPS | -0.0382 | -0.025 | -0.05 | -0.067 | -0.0306 | -0.05 | -0.05 | -0.09 | -0.02 | -0.04 | -0.01 | -0.01 |

| Surprise | -0.3118 | -0.085 | -0.09 | -0.013 | -0.2094 | -0.04 | -0.03 | -0.13 | -0.21 | -0.1 | -0.01 | 0 |

| Surprise Percentage | -816.2304% | -340% | -180% | -19.403% | -684.3137% | -80% | -60% | -144.4444% | -1050% | -250% | -100% | 0% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-04 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0 |

| Currency | USD |

Previous Dividend Records

| Mar 2025 | Jan 2025 | Sep 2024 | Jun 2024 | Mar 2024 | Jan 2024 | Sep 2023 | Jun 2023 | Mar 2023 | Jan 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-03-14 | 2025-01-02 | 2024-09-20 | 2024-06-14 | 2024-03-15 | 2024-01-02 | 2023-09-15 | 2023-06-16 | 2023-03-17 | 2023-01-03 |

| Amount | $0.125 | $0.125 | $0.125 | $0.125 | $0.125 | $0.125 | $0.125 | $0.21 | $0.21 | $0.21 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: PDM

2026-02-15 15:58:12

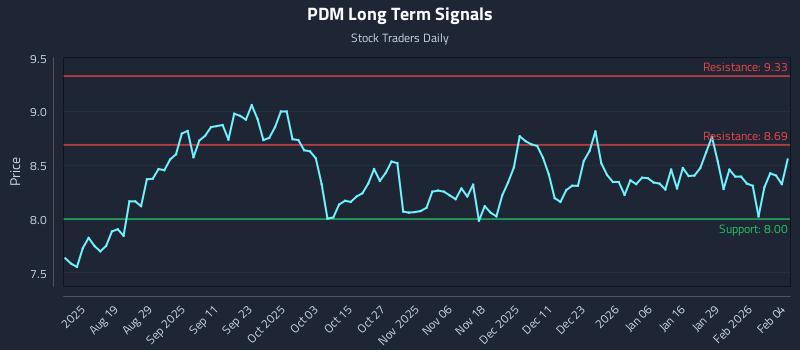

This article analyzes Piedmont Office Realty Trust Inc. Class A (NYSE: PDM) using AI models to identify behavioral patterns and institutional flows. It highlights weak near-term sentiment but strong long-term potential, presenting three distinct trading strategies for different risk profiles. The analysis includes multi-timeframe signal assessments, risk-reward setups, and support/resistance levels to guide trading decisions.

2026-02-04 14:24:00

This article analyzes Piedmont Office Realty Trust Inc. (NYSE: PDM) using AI models, identifying strong near-term sentiment and a mid-channel oscillation pattern. It presents three distinct trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss levels. The analysis also highlights an exceptional 23.0:1 risk-reward short setup and multi-timeframe signal strengths.

2026-01-15 08:29:20

Piedmont Realty Trust, Inc. (NYSE:PDM) announced a successful 2025 leasing year, securing 2.5 million square feet of leases, representing approximately 16% of its portfolio. This included 679,000 square feet leased in the fourth quarter. The company attributed this success to accelerated demand in Sunbelt markets, driven by renovated buildings and a customer-centric approach, resulting in record-high rental rates and a 1.2% increase in the leased percentage of its in-service portfolio.

2026-01-13 11:57:46

This article analyzes Piedmont Office Realty Trust Inc. Class A (NYSE: PDM) volatility using AI models, offering three trading strategies (Position, Momentum Breakout, Risk Hedging) tailored to different risk profiles. It highlights current positive sentiment, resistance testing, and an exceptional short setup with a 42.0:1 risk-reward ratio, aiming for a 9.9% downside. The analysis provides near, mid, and long-term signal strengths, support, and resistance levels for PDM.

2026-01-13 11:57:16

Piedmont Realty Trust (NYSE: PDM) announced that it will release its fourth quarter and annual financial results on February 11, 2026, after the New York Stock Exchange closes. A conference call will follow on February 12, 2026, at 9:00 a.m. ET, during which management will discuss performance and recent events. Details for accessing the webcast and conference call are provided for investors and analysts.

2026-01-12 20:58:35

Piedmont Realty Trust (NYSE: PDM) announced it will release its fourth quarter and annual 2025 financial results on Wednesday, February 11, 2026, after the close of trading. A conference call is scheduled for Thursday, February 12, 2026, at 9:00 a.m. ET to review performance, discuss events, and hold a Q&A session. Information for webcast and telephonic access for analysts and replays is provided.