PBF Energy Inc

$ 34.32

-0.17%

23 Feb - close price

- Market Cap 4,019,944,000 USD

- Current Price $ 34.32

- High / Low $ 34.85 / 32.71

- Stock P/E N/A

- Book Value 45.49

- EPS -1.39

- Next Earning Report 2026-04-30

- Dividend Per Share $1.10

- Dividend Yield 3.24 %

- Next Dividend Date 2026-03-11

- ROA -0.04 %

- ROE -0.03 %

- 52 Week High 41.18

- 52 Week Low 13.20

About

PBF Energy Inc., is dedicated to refining and supplying petroleum products. The company is headquartered in Parsippany, New Jersey.

Analyst Target Price

$32.77

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-12 | 2025-10-30 | 2025-07-31 | 2025-05-01 | 2025-02-13 | 2024-10-31 | 2024-08-01 | 2024-05-02 | 2024-02-15 | 2023-11-02 | 2023-08-03 | 2023-05-05 |

| Reported EPS | 0.49 | -0.52 | -1.03 | -3.09 | -2.82 | -2.48 | -0.54 | 0.85 | -0.41 | 6.61 | 2.29 | 2.76 |

| Estimated EPS | -0.2014 | -0.43 | -1.21 | -3.29 | -2.78 | -1.27 | -0.15 | 0.66 | 0.06 | 4.84 | 2.21 | 2.58 |

| Surprise | 0.6914 | -0.09 | 0.18 | 0.2 | -0.04 | -1.21 | -0.39 | 0.19 | -0.47 | 1.77 | 0.08 | 0.18 |

| Surprise Percentage | 343.2969% | -20.9302% | 14.876% | 6.079% | -1.4388% | -95.2756% | -260% | 28.7879% | -783.3333% | 36.5702% | 3.6199% | 6.9767% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-30 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | -0.3757 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Nov 2025 | Aug 2025 | May 2025 | Mar 2025 | Nov 2024 | Aug 2024 | May 2024 | Mar 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-11 | 2025-11-26 | 2025-08-28 | 2025-05-29 | 2025-03-14 | 2024-11-27 | 2024-08-29 | 2024-05-30 | 2024-03-14 | 2023-11-30 |

| Amount | $0.275 | $0.275 | $0.275 | $0.275 | $0.275 | $0.275 | $0.25 | $0.25 | $0.25 | $0.25 |

Next Dividend Records

| Dividend per share (year): | $1.10 |

| Dividend Yield | 3.24% |

| Next Dividend Date | 2026-03-11 |

| Ex-Dividend Date | 2026-02-25 |

Recent News: PBF

2026-02-18 06:27:55

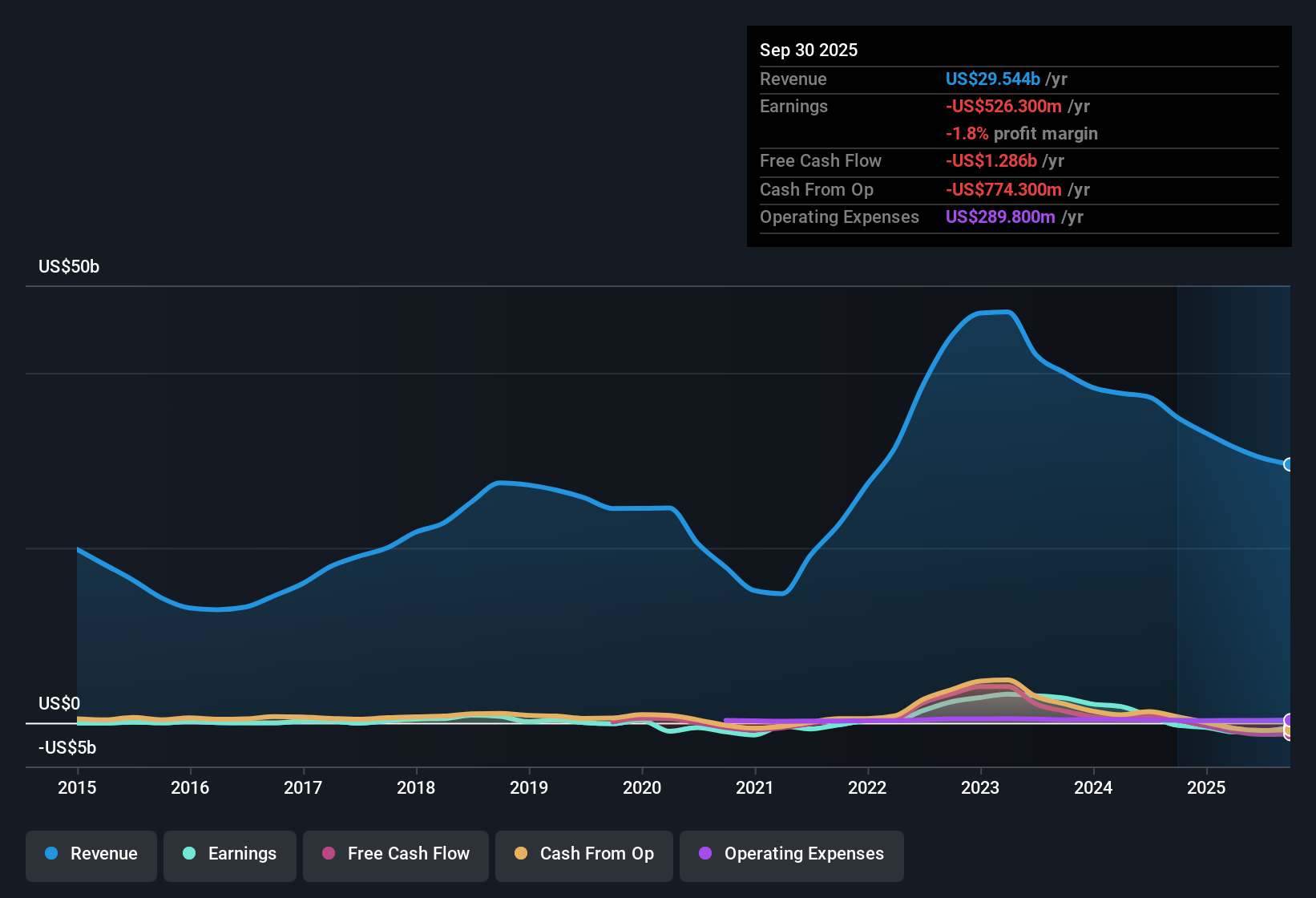

PBF Energy (PBF) has reported a significant return to profit in Q3 2025, with revenues of US$7.7 billion and EPS of US$1.47, following four consecutive quarters of losses. While this profitability challenges the recent negative trailing earnings, the company still holds a trailing twelve-month loss of US$526.3 million, leading to mixed signals for investors regarding its valuation and dividend sustainability. The article discusses both bullish and bearish perspectives, emphasizing the need for consistent future profitability to solidify investor confidence.

2026-02-16 06:57:43

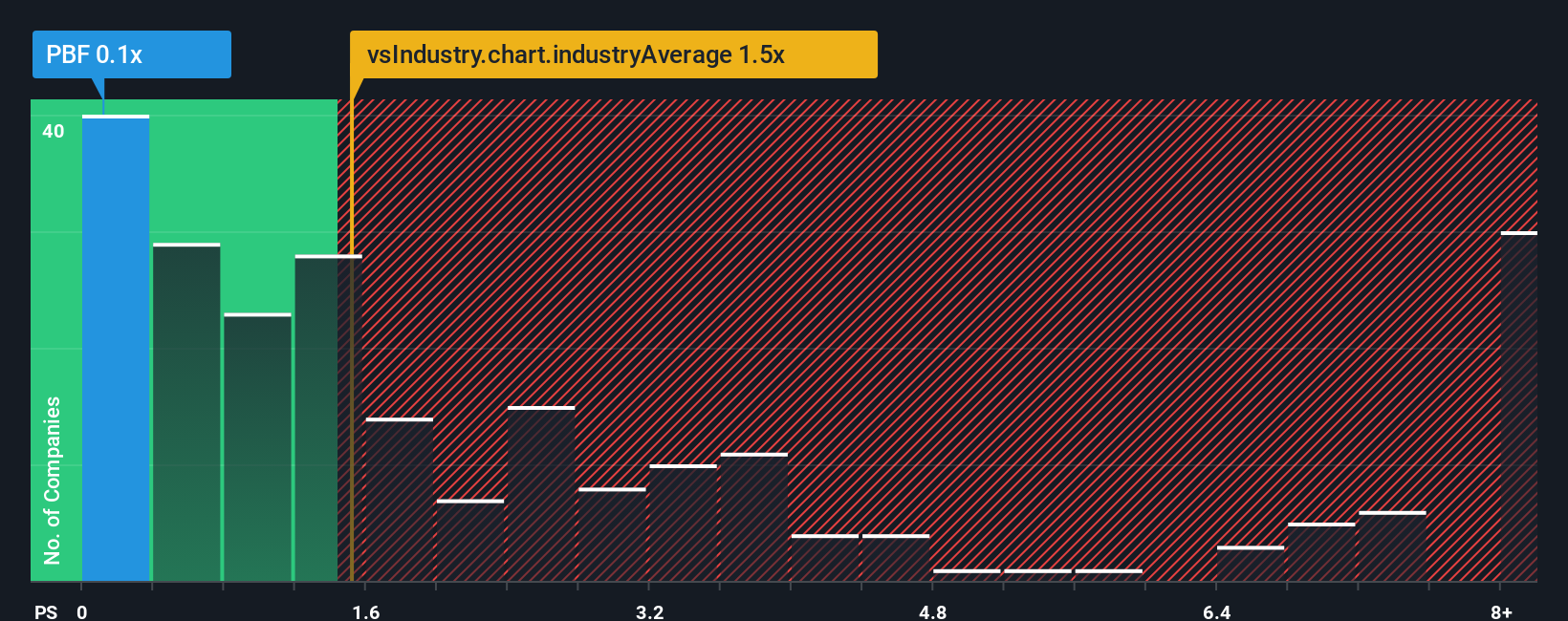

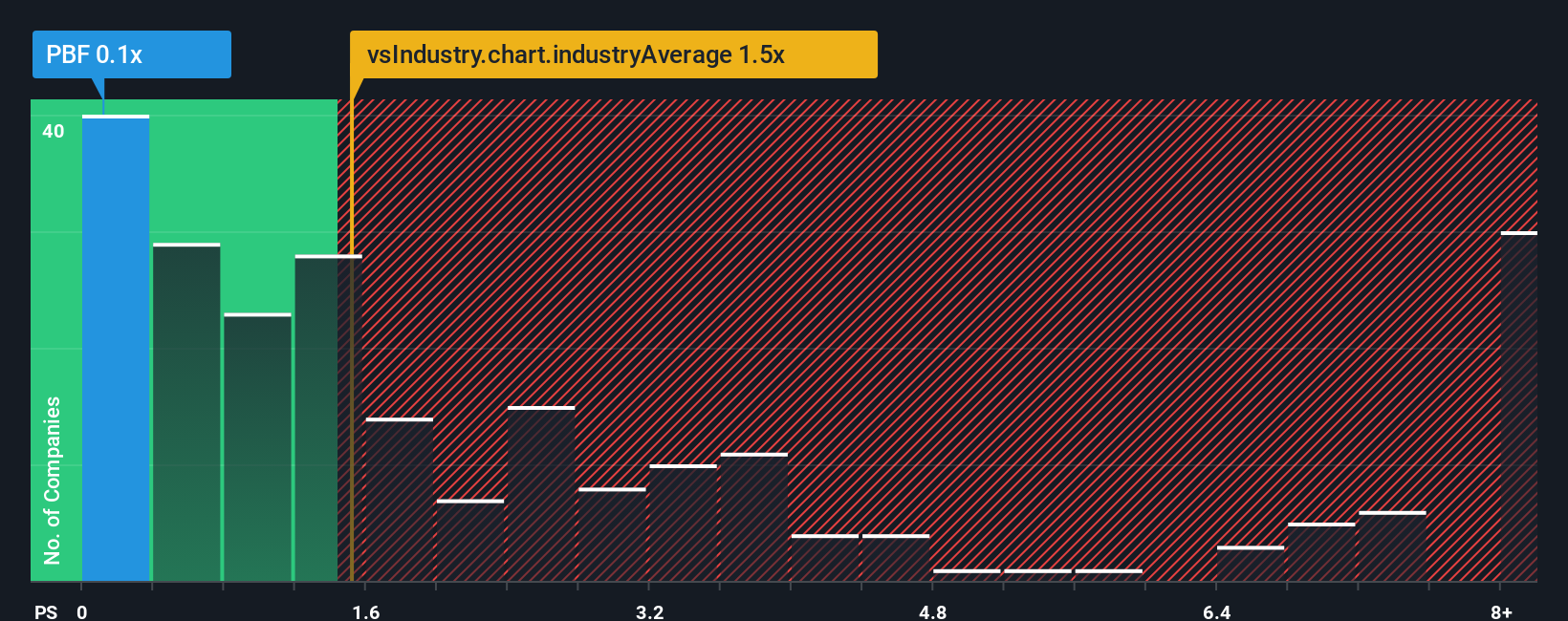

PBF Energy (PBF) returned to profitability in Q4 2025, driven by stronger refining margins and the Martinez refinery's planned restart. While the company's valuation is seen as 8.2% overvalued based on a fair value estimate of $31.92, its sales multiple suggests it might be undervalued compared to peers and industry averages. Cost reduction initiatives are expected to further improve net margins and free cash flow in the coming years.

2026-02-12 11:27:45

PBF Energy Inc. reported fourth quarter 2025 income from operations of $128.0 million and a full-year loss from operations of $54.3 million. The company announced a quarterly dividend of $0.275 per share and provided an update on the progress of the Martinez refinery restart, which is on schedule to be fully operational soon following a February 2025 fire. PBF also detailed its Refinery Business Improvement (RBI) initiative, which is expected to generate significant cost improvements in 2026, and outlined throughput expectations for its refining system.

2026-02-12 07:57:42

Hedge funds have significantly increased their short positions in PBF Energy, making it one of the most heavily shorted mid-cap stocks, despite strong quantitative buy ratings and a robust refining and logistics presence. This creates a fascinating divergence of opinion ahead of PBF's Q4 2025 earnings release, which is seen as a key near-term catalyst. The article explores how this elevated short interest interacts with PBF's investment narrative, which relies on its assets achieving sustainable profitability despite past losses and increasing regulatory challenges.

2026-02-12 06:27:55

PBF Energy (NYSE:PBF) reported a significant operational turnaround in Q4, swinging to a profit of $0.49 Non-GAAP EPS against analyst expectations of a loss. The company's income from operations was $128.0 million, a stark improvement from a $383.2 million loss in the prior year, leading to a positive pre-market reaction and the announcement of a quarterly dividend. While analyst estimates for 2026 predict some normalization with an expected loss in Q1, the strong Q4 performance reflects enhanced operational efficiency and effective navigation of the volatile refining environment.

2026-02-07 06:59:17

PBF Energy (PBF) is under scrutiny after an analyst upgrade, the restart of its Martinez refinery, and insurance recoveries. Despite a 26.66% one-month share price return, a traditional valuation model indicates PBF is overvalued at $34.49, with a fair value of $31.92. However, based on the P/S ratio, PBF trades at a significant discount (0.1x) compared to the wider US Oil and Gas group (1.6x), suggesting differing valuation perspectives.