Grupo Aeroportuario del Pacifico SAB De CV ADR

$ 243.74

-2.39%

05 Mar - close price

- Market Cap 12,617,284,000 USD

- Current Price $ 243.74

- High / Low $ 253.31 / 241.90

- Stock P/E 22.32

- Book Value 2.52

- EPS 11.19

- Next Earning Report -

- Dividend Per Share N/A

- Dividend Yield 3.53 %

- Next Dividend Date -

- ROA 0.13 %

- ROE 0.40 %

- 52 Week High 300.41

- 52 Week Low 162.42

About

Grupo Aeroportuario del Pacfico, SAB de CV, develops, manages and operates airports mainly in the Pacific region of Mexico. The company is headquartered in Guadalajara, Mexico.

Analyst Target Price

$269.07

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-24 | 2025-10-21 | 2025-07-21 | 2025-04-21 | 2025-02-24 | 2024-10-21 | 2024-07-25 | 2024-04-22 | 2024-02-26 | 2023-10-24 | 2023-07-24 | 2023-04-17 |

| Reported EPS | 2.0612 | 2.9 | 2.8197 | 2.8919 | 2.1001 | 1.97 | 2.54 | 2.84 | 2.69 | 2.72 | 2.75 | 2.81 |

| Estimated EPS | 3.08 | 2.85 | 2.94 | 2.7943 | 2.19 | 2.35 | 2.04 | 2.63 | 2.44 | 2.93 | 2.6 | 2.81 |

| Surprise | -1.0188 | 0.05 | -0.1203 | 0.0976 | -0.0899 | -0.38 | 0.5 | 0.21 | 0.25 | -0.21 | 0.15 | 0 |

| Surprise Percentage | -33.0779% | 1.7544% | -4.0918% | 3.4928% | -4.105% | -16.1702% | 24.5098% | 7.9848% | 10.2459% | -7.1672% | 5.7692% | 0% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Previous Dividend Records

| Aug 2025 | Jun 2025 | Jan 1970 | Aug 2024 | Dec 2023 | Oct 2023 | Jul 2023 | May 2023 | Nov 2022 | May 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-08-25 | 2025-06-09 | None | 2024-08-02 | 2023-12-26 | 2023-10-23 | 2023-07-24 | 2023-05-30 | 2022-11-28 | 2022-05-26 |

| Amount | $4.465587 | $4.32216 | $3.387 | $3.865677 | $2.158859 | $2.132183 | $2.166096 | $2.089443 | $3.702313 | $3.522384 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: PAC

2026-02-27 02:52:42

This article provides the transcript of the Grupo Aeroportuario del Pacífico, S.A.B. de C.V. Q4 2025 earnings call held on February 25, 2026. It includes an operator message initiating the call and indicates that the full transcript is reserved for subscribers. The article also lists recent news and financial data related to the company.

2026-02-26 15:53:30

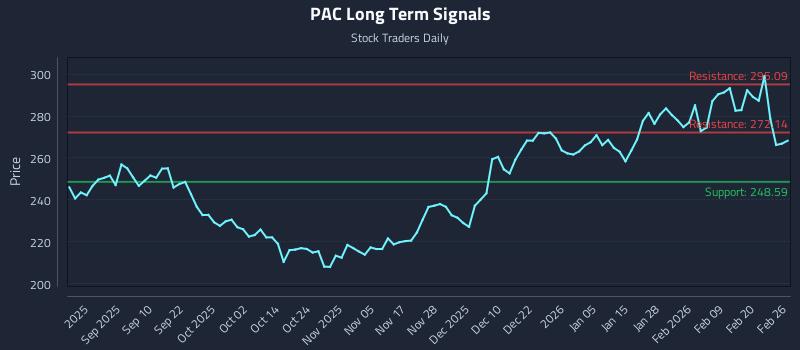

This article analyzes Grupo Aeroportuario Del Pacifico S.a. B. De C.v. De C.v. (NYSE: PAC) using AI models, highlighting weak near-term sentiment despite potential long-term strength. It details specific trading strategies for different risk profiles, including a short setup with a favorable risk-reward ratio. The analysis also covers multi-timeframe signal strength, support, and resistance levels for PAC.

2026-02-26 12:53:30

Grupo Aeroportuario del Pacífico (GAP) held its Q4 2025 earnings call, reporting a solid year despite challenges like Hurricane Melissa's impact on Jamaican airports, which led to a significant traffic decrease in those regions. The company saw overall revenue growth driven by new maximum tariffs in Mexico and strong non-aeronautical revenue performance. GAP is optimistic about 2026, forecasting moderate growth, increased revenues, and EBITDA, while focusing on strategic pillars including connectivity, commercial revenues, infrastructure, and a long-term leverage strategy.

2026-02-25 02:52:00

Grupo Aeroportuario del Pacífico (GAP) announced its consolidated results for the fourth quarter of 2025, showing an increase in aeronautical and non-aeronautical service revenues by 12.8% and total revenues by 2.8%. Despite a 0.9% decrease in total passenger traffic across its 14 airports, partly due to Hurricane Melissa impacting Jamaican operations, the company reported a strong financial position with Ps. 10,453.2 million in cash and cash equivalents. The report also detailed the inauguration of several new domestic and international routes during the quarter.

2026-02-24 09:51:50

Grupo Aeroportuario del Pacifico reported a decline in Q4 earnings despite a rise in revenue, according to MT Newswires. The company also provided revenue growth guidance for 2026. This news comes as the company also announced a refinancing of bank debt for USD$95.5 million and reported a decrease in passenger traffic for January 2026 compared to the previous year.

2026-02-24 07:51:50

Grupo Aeroportuario del Pacifico (PAC) reported a net income of $99.5 million, or $1.97 per share, and quarterly revenue of $549.5 million for the fourth quarter. For the full year, the company's profit reached $521.6 million, translating to $10.32 per share, with total annual revenue at $2.16 billion. The article provides a high-level overview of the airport management firm's financial performance.