Oscar Health Inc

$ 12.30

-1.20%

24 Feb - close price

- Market Cap 3,706,962,000 USD

- Current Price $ 12.30

- High / Low $ 12.47 / 11.71

- Stock P/E N/A

- Book Value 3.29

- EPS -1.69

- Next Earning Report 2026-05-11

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.04 %

- ROE -0.44 %

- 52 Week High 23.80

- 52 Week Low 11.20

About

Oscar Health, Inc. offers health insurance products and services to individuals, families, and businesses in the United States. The company is headquartered in New York, New York.

Analyst Target Price

$15.40

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-10 | 2025-11-06 | 2025-08-06 | 2025-05-07 | 2025-02-04 | 2024-11-07 | 2024-08-07 | 2024-05-07 | 2024-02-07 | 2023-11-07 | 2023-08-08 | 2023-05-09 |

| Reported EPS | -1.24 | -0.53 | -0.89 | 0.92 | -0.62 | -0.22 | 0.2 | 0.62 | -0.66 | -0.29 | -0.07 | -0.18 |

| Estimated EPS | -0.92 | -0.5 | -0.89 | 0.81 | -0.58 | -0.18 | 0.16 | 0.27 | -0.7 | -0.47 | -0.16 | -0.09 |

| Surprise | -0.32 | -0.03 | 0 | 0.11 | -0.04 | -0.04 | 0.04 | 0.35 | 0.04 | 0.18 | 0.09 | -0.09 |

| Surprise Percentage | -34.7826% | -6% | 0% | 13.5802% | -6.8966% | -22.2222% | 25% | 129.6296% | 5.7143% | 38.2979% | 56.25% | -100% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-11 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 1.21 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: OSCR

2026-02-15 05:57:11

Oscar Health (OSCR) saw its stock rise 9.6% after announcing full-year 2026 profit guidance, targeting $18.7 billion to $19.0 billion in revenue and $250 million to $450 million in operational earnings. This positive outlook follows a $443.15 million net loss in 2025. The company also secured a new $475.0 million revolving credit facility, which, alongside rapid membership growth and technology-driven efficiency, aims to help Oscar Health achieve profitability in 2026.

2026-02-14 06:27:43

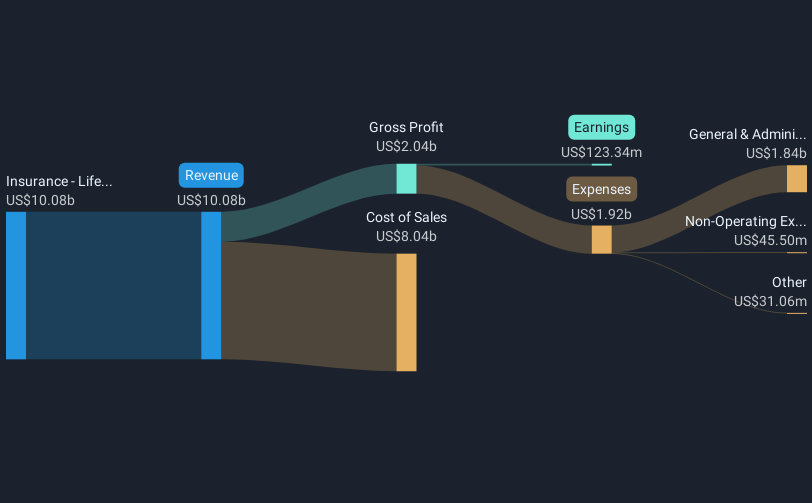

Oscar Health, Inc. has released its 2025 Form 10-K report, revealing a significant increase in total revenue to $11,701 million, but also a net loss of $(443) million, primarily due to increased medical expenses and market morbidity. The company expanded its coverage to 18 states and grew its membership to approximately 2.0 million, with strategic acquisitions aimed at enhancing its direct enrollment technology and focusing on the ICHRA market. Oscar faces challenges including regulatory changes, competitive pressures, and interest rate fluctuations, but plans to leverage its technology and strategic capital management to drive future growth and efficiency.

2026-02-13 17:28:12

Oscar Health, Inc. reported disappointing yearly results last week, with revenues missing expectations and statutory earnings falling significantly short. However, analysts have since upgraded their earnings model, now forecasting Oscar Health to become profitable in 2027 and expecting higher revenues that will grow faster than the wider industry. Despite the upgraded estimates and improved outlook, the consensus price target remains unchanged at US$15.40, indicating no long-term impact on the company's valuation from the recent performance.

2026-02-13 06:57:46

Analysts have significantly upgraded their revenue forecasts for Oscar Health, Inc. (NYSE:OSCR) for 2026, now expecting revenues of US$16 billion and a return to profitability with US$0.17 earnings per share, instead of previous loss predictions. Despite these improved business outlooks, their price target for the stock remains unchanged. The company is anticipated to continue its high revenue growth rate, outperforming the broader industry.

2026-02-12 06:57:46

Oscar Health reported a Q4 FY 2025 loss of US$353 million, bringing its trailing twelve-month loss to US$443.2 million, which challenges the company's projected turnaround to profitability. Despite bullish forecasts for strong earnings growth and a move to profit within three years, recent quarterly performance shows significant swings from profit to loss. The company's P/S ratio of 0.3x is below the industry average, reflecting slower forecast revenue growth, putting pressure on the earnings growth narrative to materialize.

2026-02-10 12:28:55

Oscar Health Inc. reported a wider-than-expected Q4 loss due to a significant increase in medical costs, causing its shares to drop. The company's medical loss ratio rose to 95.4%, driven by higher market morbidity and healthcare utilization, despite strong membership growth. Looking ahead, Oscar Health projects a return to operational profitability in 2026, backed by a new credit facility, but faces a cautious revenue outlook compared to analyst expectations.