OceanFirst Financial Corp

$ 18.71

-0.43%

24 Feb - close price

- Market Cap 1,078,369,000 USD

- Current Price $ 18.71

- High / Low $ 18.86 / 18.53

- Stock P/E 16.06

- Book Value 28.97

- EPS 1.17

- Next Earning Report 2026-04-22

- Dividend Per Share $0.80

- Dividend Yield 4.14 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.04 %

- 52 Week High 20.39

- 52 Week Low 13.65

About

OceanFirst Financial Corp. The company is headquartered in Red Bank, New Jersey.

Analyst Target Price

$22.00

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-21 | 2025-10-23 | 2025-07-24 | 2025-04-24 | 2025-01-23 | 2024-10-17 | 2024-07-18 | 2024-04-18 | 2024-01-18 | 2023-10-19 | 2023-07-20 | 2023-04-20 |

| Reported EPS | 0.41 | 0.36 | 0.31 | 0.35 | 0.38 | 0.39 | 0.39 | 0.44 | 0.45 | 0.32 | 0.46 | 0.55 |

| Estimated EPS | 0.3733 | 0.35 | 0.33 | 0.35 | 0.36 | 0.38 | 0.43 | 0.41 | 0.43 | 0.35 | 0.47 | 0.64 |

| Surprise | 0.0367 | 0.01 | -0.02 | 0 | 0.02 | 0.01 | -0.04 | 0.03 | 0.02 | -0.03 | -0.01 | -0.09 |

| Surprise Percentage | 9.8312% | 2.8571% | -6.0606% | 0% | 5.5556% | 2.6316% | -9.3023% | 7.3171% | 4.6512% | -8.5714% | -2.1277% | -14.0625% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-22 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.3992 |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-13 | 2025-11-14 | 2025-08-15 | 2025-05-16 | 2025-02-14 | 2024-11-15 | 2024-08-16 | 2024-05-17 | 2024-02-16 | 2023-11-17 |

| Amount | $0.2 | $0.2 | $0.2 | $0.2 | $0.2 | $0.2 | $0.2 | $0.2 | $0.2 | $0.2 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: OCFC

2026-02-22 20:45:25

Due to current weather conditions, OceanFirst Financial has announced the closure of all its branch locations on Monday, February 23rd. While physical branches will be closed, customers can access information about closures and delays through the online platform. Most banking services, including the Customer Care Center, ATMs, video teller machines, and digital banking, will remain fully operational.

2026-02-20 08:57:55

Thrivent Financial for Lutherans significantly reduced its stake in OceanFirst Financial Corp. (NASDAQ:OCFC) by 92.4% in the third quarter, ending with 10,103 shares valued at approximately $178,000. Despite this, other institutional investors have altered their positions, with some increasing their holdings. OceanFirst Financial exceeded quarterly earnings and revenue estimates, maintains a "Hold" rating from analysts, and offers an annualized dividend yield of 4.2%.

2026-02-19 13:57:40

Endeavour Capital Advisors Inc. significantly increased its stake in OceanFirst Financial Corp. (NASDAQ:OCFC) by 18.7% in the third quarter, making it their 8th-largest holding. OceanFirst Financial reported strong Q4 earnings, exceeding analyst estimates, and offers a 4.1% dividend yield. Despite this, analysts have a consensus "Hold" rating for OCFC, with an average price target of $21.33.

2026-02-15 11:46:00

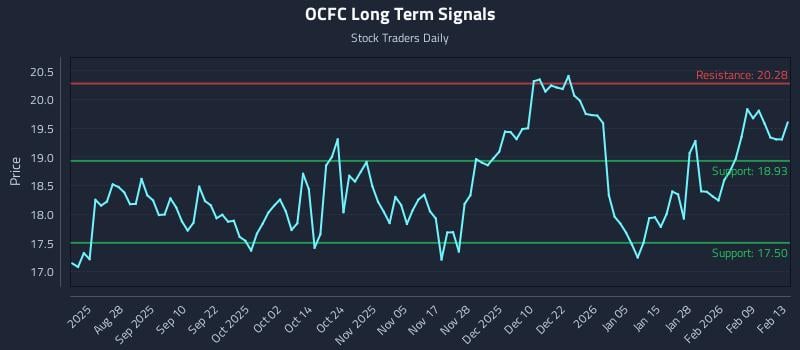

This article provides an in-depth analysis of Oceanfirst Financial Corp. (NASDAQ: OCFC), highlighting weak near-term sentiment but an exceptional 27.0:1 risk-reward setup. It outlines three distinct AI-generated trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—along with multi-timeframe signal analysis. The report also details support and resistance levels for various time horizons.

2026-02-15 11:27:26

OceanFirst Financial (OCFC) stock is experiencing sideways trading amidst hopes for rate cuts and lingering regional bank concerns. While the share price has seen a modest increase recently, indicating cautious recovery, it remains in a "no man's land" between its 52-week peak and lows, reflecting investor deliberation over its valuation, credit quality, and funding costs. The future of OCFC will depend on interest rate trajectories, credit quality in commercial real estate, and disciplined capital allocation.

2026-02-11 05:57:46

Halper Sadeh LLC, an investor rights law firm, is investigating several companies—Clear Channel Outdoor Holdings (CCO), OceanFirst Financial Corp. (OCFC), Marine Products Corporation (MPX), and Flushing Financial Corp. (FFIC)—for potential violations of federal securities laws and breaches of fiduciary duties. The firm is concerned that proposed sales and mergers for these companies may not offer fair deals to ordinary shareholders, potentially favoring insiders. Shareholders are encouraged to contact Halper Sadeh LLC to understand their rights and options.