New York City REIT Inc

$ 8.68

3.15%

04 Mar - close price

- Market Cap 20,647,700 USD

- Current Price $ 8.68

- High / Low $ 8.68 / 8.02

- Stock P/E N/A

- Book Value 13.48

- EPS -35.22

- Next Earning Report 2026-03-18

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -1.13 %

- 52 Week High 16.30

- 52 Week Low 7.03

About

New York City REIT Inc is a dynamic real estate investment trust focused on the strategic acquisition, ownership, and management of a diversified portfolio of premium commercial properties in New York City's thriving market. The company's investment strategy emphasizes high-quality office, retail, and mixed-use assets, leveraging the city's robust economic landscape and distinctive urban dynamics. Managed by a team of seasoned professionals with extensive experience in real estate and financial services, NYC REIT is dedicated to delivering sustainable income and long-term value for shareholders through meticulous asset selection and proactive management. As New York continues its economic rebound post-pandemic, the firm is well-positioned to capitalize on emerging opportunities for growth and enhancement in property valuations.

Analyst Target Price

$8.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | Sep 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-19 | 2025-08-08 | 2025-05-08 | 2025-03-19 | 2024-11-12 | 2024-08-09 | 2024-05-10 | 2023-11-09 | 2023-08-11 | 2023-05-12 | 2023-03-16 | 2022-11-14 |

| Reported EPS | 13.2076 | -16.3925 | -3.3913 | -2.49 | -2.62 | -2.41 | -32.2735 | -4.1028 | -0.29 | -0.29 | -5.4795 | -0.8 |

| Estimated EPS | -1.76 | -1.74 | None | -2.06 | -2.62 | -2.99 | None | None | -0.07 | -0.07 | 0.36 | 0.37 |

| Surprise | 14.9676 | -14.6525 | 0 | -0.43 | 0 | 0.58 | 0 | 0 | -0.22 | -0.22 | -5.8395 | -1.17 |

| Surprise Percentage | 850.4318% | -842.0977% | None% | -20.8738% | 0% | 19.398% | None% | None% | -314.2857% | -314.2857% | -1622.0833% | -316.2162% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-18 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Apr 2022 | Jan 2022 | Oct 2021 | Jul 2021 | Apr 2021 | Jan 2021 | Oct 2020 | |

|---|---|---|---|---|---|---|---|

| Payment Date | 2022-04-18 | 2022-01-18 | 2021-10-15 | 2021-07-15 | 2021-04-15 | 2021-01-15 | 2020-10-15 |

| Amount | $0.1 | $0.1 | $0.1 | $0.1 | $0.1 | $0.1 | $0.04889 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: NYC

2026-03-04 19:52:08

This page provides a comprehensive resource for investors to access American Strategic Investment Co. (NYSE: NYC) SEC filings, including 10-K, 10-Q, and 8-K forms. It details the types of information found in these filings, such as financial statements, material events, and insider trading activities, and highlights recent filings with AI-powered summaries. The platform aims to keep investors informed about developments in the company's New York City commercial real estate portfolio and financing arrangements.

2026-02-28 05:52:38

This article provides news and event updates for American Strategic Investment Co. (NYC), focusing on its NYSE compliance status. It details the company's recent receipt of NYSE approval for its compliance plan after being notified of non-compliance with listing standards due to market capitalization and stockholders' equity issues. The article also lists past news items, including earnings reports and an insider purchase.

2026-02-26 12:51:47

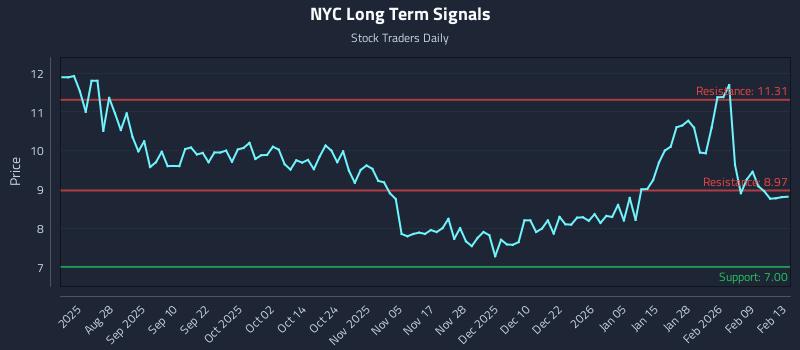

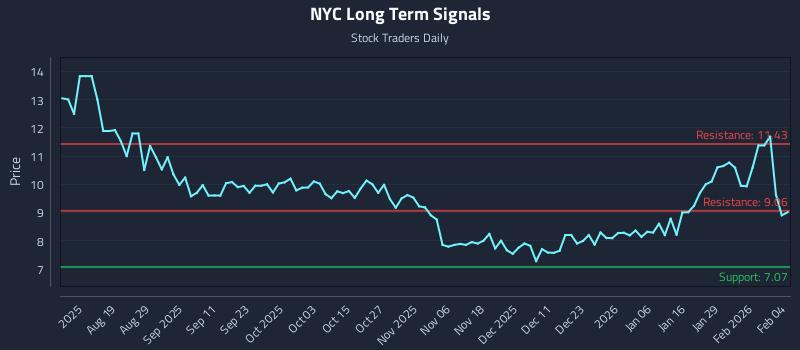

This article from Stock Traders Daily analyzes American Strategic Investment Co. Class A (NYSE: NYC), identifying weak sentiment across all horizons supporting a short bias. It details three AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss zones. The analysis indicates significant downside potential with an exceptional risk-reward ratio for a short setup, emphasizing institutional trading strategies and real-time signals.

2026-02-24 02:51:51

This document is a transcript of the Q3 2025 earnings call for American Strategic Investment Co. (NYSE:NYC). It details the company's financial performance and discussions during the call, providing insights into their quarterly results and business outlook.

2026-02-15 11:08:00

Stock Traders Daily provides a price-driven insight for American Strategic Investment Co. Class A (NYSE: NYC), indicating weak sentiment across all horizons and supporting a short bias. The analysis highlights an exceptional 65.7:1 risk-reward short setup, targeting 22.0% downside against 0.3% risk. It also outlines institutional trading strategies, including long, momentum breakout, and short positions, with specific entry zones, targets, and stop losses.

2026-02-04 10:00:00

This article analyzes the price dynamics and execution-aware positioning for American Strategic Investment Co. Class A (NYSE: NYC). It highlights near-term weak sentiment testing mid-term strength within a broader long-term weak bias, identifying resistance testing and proposing an exceptional short setup. The analysis provides three institutional trading strategies (Position, Momentum Breakout, Risk Hedging) and multi-timeframe signal analysis, generated by AI models for different risk profiles.