NexGen Energy Ltd.

$ 11.89

1.45%

16 Jan - close price

- Market Cap 7,782,732,000 USD

- Current Price $ 11.89

- High / Low $ 12.19 / 11.73

- Stock P/E N/A

- Book Value 1.15

- EPS -0.42

- Next Earning Report 2026-03-02

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.03 %

- ROE -0.31 %

- 52 Week High 12.19

- 52 Week Low 3.91

About

NexGen Energy Ltd. (NXE) is a leading exploration and development company focused on high-grade uranium projects in Canada's Athabasca Basin, a region renowned for its prolific uranium resources. Headquartered in Vancouver, the company is poised to capitalize on the increasing global demand for clean energy, driven by its commitment to sustainable mining practices and innovative technological advancements. Its flagship Rook I project not only highlights significant growth potential but also positions NexGen as a key player in the uranium supply chain, which is vital for supporting the transition toward sustainable energy solutions. With a seasoned management team, NexGen is well-equipped to navigate the evolving energy landscape while delivering shareholder value.

Analyst Target Price

$5.31

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-05 | 2025-08-07 | 2025-05-06 | 2025-03-05 | 2024-11-08 | 2024-08-04 | 2024-05-08 | 2024-03-05 | 2023-11-02 | 2023-08-08 | 2023-05-03 | 2023-02-26 |

| Reported EPS | -0.1637 | -0.1018 | -0.0624 | -0.0834 | -0.01 | -0.02 | -0.06 | -0.08 | -0.11 | -0.04 | -0.01 | -0.05 |

| Estimated EPS | -0.04 | -0.04 | -0.025 | -0.03 | -0.04 | -0.05 | -0.04 | -0.04 | -0.03 | -0.01 | -0.02 | -0.01 |

| Surprise | -0.1237 | -0.0618 | -0.0374 | -0.0534 | 0.03 | 0.03 | -0.02 | -0.04 | -0.08 | -0.03 | 0.01 | -0.04 |

| Surprise Percentage | -309.25% | -154.5% | -149.6% | -178% | 75% | 60% | -50% | -100% | -266.6667% | -300% | 50% | -400% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-02 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.02 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: NXE

2026-01-18 12:15:00

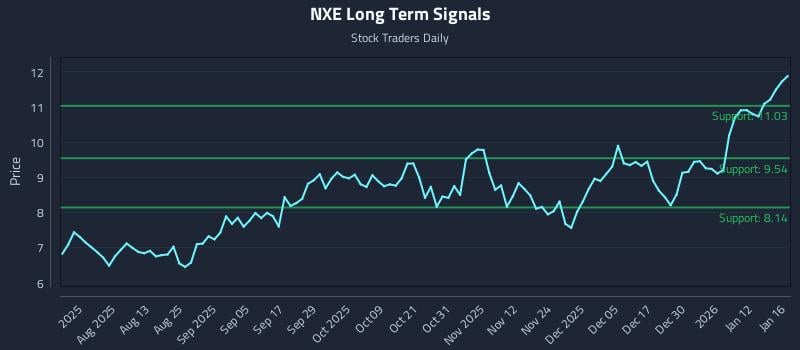

This article provides a stock analysis and trading signals for NexGen Energy Ltd. (NXE:CA) for January 18, 2026. It includes long-term trading plans with specific buy and stop-loss targets, current AI-generated ratings (Strong in Near term, Weak in Mid and Long term), and a list of recent articles related to NXE:CA. The content is geared towards providing actionable trading insights based on AI analysis.

2026-01-18 09:42:00

This article provides an analysis of Nexgen Energy Ltd. (NYSE: NXE), indicating strong sentiment across all horizons which supports an overweight bias for the stock. It details three institutional trading strategies—Position, Momentum Breakout, and Risk Hedging—along with multi-timeframe signal analysis, including support and resistance levels. The analysis, generated by AI models, also notes elevated downside risk due to a lack of additional long-term support signals.

2026-01-17 10:57:27

NexGen Energy's stock rose 10.9% after the company reported significant expansion of high-grade uranium mineralization at its Patterson Corridor East discovery during the 2025 drilling campaign. The company completed the largest drilling program in the Athabasca Basin in 2025 and is launching its 2026 exploration program, with geological similarities to its Arrow deposit. Despite the exploration success, the near-term value still depends heavily on federal permitting progress and execution at the Rook I project.

2026-01-16 17:57:15

NexGen Energy (NYSE:NXE) experienced unusually high options trading activity on Friday, with investors purchasing 38,697 call options, a 98% increase over the average. The stock traded up 1.5% to $11.90, despite missing quarterly EPS estimates and an expected negative EPS for the fiscal year. Analysts currently hold a "Moderate Buy" consensus rating for the company.

2026-01-16 06:58:35

NexGen Energy (TSX:NXE) is attracting attention after completing its 2025 PCE drilling program and launching its 2026 exploration campaign, coinciding with strong share price performance. While the company's price-to-book ratio of 11.7x suggests it is overvalued compared to industry peers, Simply Wall St's discounted cash flow (DCF) model indicates a fair value of CA$69.70, implying the stock is significantly undervalued at its current CA$16.29. This discrepancy highlights the different perspectives on valuing a pre-revenue, development-stage company, with the DCF model pointing to substantial upside if uranium development at Rook I is successful.

2026-01-15 21:58:35

NexGen Energy has successfully expanded the high-grade zone at its Canada Uranium Project and is initiating a new drilling campaign for 2026. The article also briefly mentions Unity Software's Q4 financial results, reporting a 35% year-over-year revenue increase to $609 million, exceeding estimates, despite a quarterly loss of 66 cents per share.