Norwood Financial Corp

$ 30.33

4.08%

25 Feb - close price

- Market Cap 281,883,000 USD

- Current Price $ 30.33

- High / Low $ 30.38 / 29.40

- Stock P/E 9.66

- Book Value 26.19

- EPS 3.14

- Next Earning Report 2026-04-16

- Dividend Per Share $1.25

- Dividend Yield 4.29 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.12 %

- 52 Week High 32.23

- 52 Week Low 20.22

About

Norwood Financial Corp. The company is headquartered in Honesdale, Pennsylvania.

Analyst Target Price

$33.50

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-22 | 2025-11-07 | 2025-07-22 | 2025-04-17 | 2025-01-27 | 2024-10-28 | 2024-07-26 | 2024-04-22 | 2024-01-29 | 2023-10-24 | 2023-07-26 | 2023-04-21 |

| Reported EPS | 0.8 | 0.89 | 0.67 | 0.63 | -1.54 | 0.4774 | 0.5235 | 0.5493 | 0.04 | 0.5128 | 0.8053 | 0.71 |

| Estimated EPS | 0.85 | 0.7 | 0.66 | 0.56 | -0.41 | None | None | None | None | None | None | None |

| Surprise | -0.05 | 0.19 | 0.01 | 0.07 | -1.13 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Surprise Percentage | -5.8824% | 27.1429% | 1.5152% | 12.5% | -275.6098% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-16 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.83 |

| Currency | USD |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-02 | 2025-11-03 | 2025-08-01 | 2025-05-01 | 2025-02-03 | 2024-11-01 | 2024-08-01 | 2024-05-01 | 2024-02-01 | 2023-11-01 |

| Amount | $0.32 | $0.31 | $0.31 | $0.31 | $0.31 | $0.3 | $0.3 | $0.3 | $0.3 | $0.29 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: NWFL

2026-02-20 20:50:56

Wayne Bank, a subsidiary of Norwood Financial Corp., has promoted Lizbeth Lamont to Community Office Manager of its Marshall's Creek Branch. Lamont brings over 20 years of customer service and 12 years of banking experience to her new role, where she will manage branch operations, supervise staff, drive sales, and build community relationships. Her promotion recognizes her dedication, leadership, and commitment to exceptional customer service and community engagement.

2026-02-12 16:27:53

Norwood Financial Corp. (NWFL) is highlighted as a top dividend stock with a strong yield of 4.11%, significantly higher than its industry average and the S&P 500. The company has a consistent history of dividend growth, increasing its payout 5 times over the past 5 years and showing an expected earnings growth rate of 9.32% for 2026. With a reasonable payout ratio of 40% and a Zacks Rank of #3 (Hold), NWFL presents a compelling option for income investors.

2026-02-12 01:57:07

Norwood Financial Corp. (NWFL), headquartered in Honesdale, is presented as a strong dividend stock with a current yield of 4.11%, significantly higher than its industry and the S&P 500. The company has a history of increasing dividends, with an average annual increase of 4.67% over the last five years, and a manageable payout ratio of 40%. Analysts anticipate solid earnings growth for NWFL in 2026, further supporting its appeal as an income investment.

2026-02-11 13:58:10

Wayne Bank has announced the promotion of Cheryl Wilkerson to Monroe County Regional Community Office Manager. Jim Donnelly, President and CEO of Wayne Bank, highlighted Wilkerson's leadership, dedication to strengthening branch performance, community support, and outstanding customer service as key factors in her promotion. Wilkerson, who joined Wayne Bank in 2007, will now oversee daily operations and provide leadership to branch teams in the Monroe County region, while also remaining active in community financial literacy and awareness programs.

2026-02-04 09:30:00

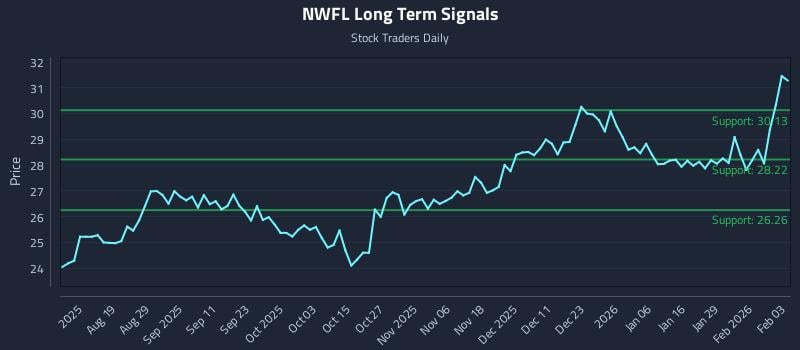

This article provides an in-depth analysis of Norwood Financial Corp. (NASDAQ: NWFL) with a strong overweight bias based on sentiment across various time horizons. It outlines distinct institutional trading strategies for different risk profiles, including position trading, momentum breakout, and risk hedging, along with detailed entry, target, and stop-loss levels. The analysis also includes a multi-timeframe signal breakdown detailing support and resistance levels.

2026-01-31 08:01:21

Wall Street Zen has upgraded Norwood Financial (NASDAQ:NWFL) from a "hold" to a "buy" rating, though MarketBeat's consensus remains a "Hold" with a $26.50 target price. The upgrade comes as the stock trades near its 12-month high, coupled with significant insider purchases totaling 9,700 shares in the last 90 days. Despite institutional investors modifying their holdings, insiders now own 9.10% of the company's stock.