New Pacific Metals Corp

$ 2.61

-7.45%

04 Dec - close price

- Market Cap 480,761,000 USD

- Current Price $ 2.61

- High / Low $ 2.78 / 2.58

- Stock P/E N/A

- Book Value 0.77

- EPS -0.01

- Next Earning Report -

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.02 %

- ROE -0.02 %

- 52 Week High 3.02

- 52 Week Low 0.93

About

New Pacific Metals Corp. is a Vancouver-based exploration and development company focused on advancing mineral projects, particularly in silver and precious metals, across Canada and South America. Its flagship Silver Sand property in Bolivia boasts significant silver resources, and the company is committed to sustainable mining practices that align with responsible resource development. Backed by a seasoned management team and a strategic operational framework, New Pacific is well-positioned to capitalize on the rising global demand for precious metals, presenting a compelling investment opportunity for institutional investors seeking to diversify their portfolios in the mining sector.

Analyst Target Price

$3.50

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-12 | 2025-09-03 | 2025-05-05 | 2025-02-11 | 2024-11-05 | 2024-09-09 | 2024-05-07 | 2024-02-13 | 2023-11-07 | 2023-08-23 | 2023-05-08 | 2023-02-07 |

| Reported EPS | -0.0043 | -0.0052 | -0.0138 | -0.0043 | -0.014 | -0.01 | -0.0074 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 |

| Estimated EPS | -0.01 | -0.005 | -0.007 | -0.0065 | -0.0065 | -0.01 | -0.005 | -0.005 | -0.01 | -0.01 | -0.0087 | -0.01 |

| Surprise | 0.0057 | -0.0002 | -0.0068 | 0.0022 | -0.0075 | 0 | -0.0024 | -0.005 | 0 | 0 | -0.0013 | 0 |

| Surprise Percentage | 57% | -4% | -97.1429% | 33.8462% | -115.3846% | 0% | -48% | -100% | 0% | 0% | -14.9425% | 0% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: NEWP

2025-10-17 00:21:02

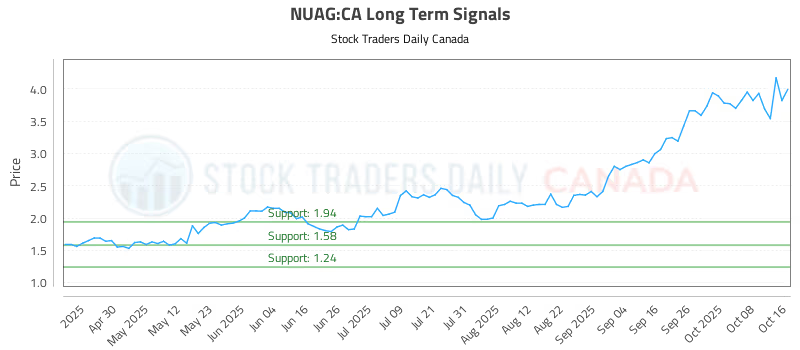

This article provides trading plans and ratings for New Pacific Metals Corp. (NUAG:CA) as of October 16, 2025. It suggests a long-term buy near 1.94 with an unspecified target and a stop loss at 1.93. The recent AI-generated signals rate NUAG:CA as Strong in the Near term and Weak in both Mid and Long terms.

2025-10-16 01:24:00

New Pacific Metals Corp. announced the filing of a prospectus supplement for its previously declared "bought deal" public offering. The offering includes 9,900,000 common shares at $3.55 per share, with an over-allotment option for an additional 1,485,000 shares. The closing is anticipated around October 21, 2025, pending regulatory and Toronto Stock Exchange approvals.

2025-10-16 01:03:42

New Pacific Metals (TSE:NUAG) has filed a prospectus supplement for a public offering to distribute 9,900,000 common shares at C$3.55 each, with an option for an additional 1,485,000 shares, aiming to strengthen its financial position. Despite a recent "Buy" analyst rating with a C$3.40 price target, TipRanks' AI Analyst, Spark, assesses NUAG as "Underperform" due to financial challenges typical of an exploration-stage mining company, including no revenue and ongoing losses. The company is a Canadian exploration and development firm focused on precious metal projects in Bolivia.

2025-10-15 21:58:50

New Pacific Metals Corp. has secured approximately C$35.1 million through a bought deal financing agreement, selling 9.9 million common shares at C$3.55 per share, with an over-allotment option for additional shares. Silvercorp Metals Inc. committed C$9.86 million, increasing its stake in New Pacific to around 28.05%. The net proceeds will primarily fund exploration and development at New Pacific's Carangas and Silver Sand projects in Bolivia, along with general corporate purposes.

2025-10-15 17:21:21

Silvercorp Metals recently increased its stake in New Pacific Metals by investing C$9.86 million to acquire 2,776,950 shares, raising its ownership to about 28.05%. This move is expected to broaden Silvercorp's asset exposure and growth opportunities, though its primary focus remains on execution for safe and efficient production amid regulatory scrutiny in China. The article explores how this increased stake could influence Silvercorp's investment outlook while highlighting potential complexities and ongoing risks like cost inflation and regional disruptions.

2025-10-15 12:10:21

New Pacific Metals (NEWP) is conducting a bought deal offering of common shares to raise approximately C$35.1 million, with Silvercorp Metals significantly increasing its stake to 28.05%. The funds will be primarily used to advance the company's Carangas and Silver Sand projects and for general corporate purposes. Despite currently reporting no revenue and negative EPS, the company maintains a strong balance sheet with no debt, but faces