NACCO Industries Inc

$ 56.15

0.34%

24 Feb - close price

- Market Cap 376,355,000 USD

- Current Price $ 56.15

- High / Low $ 56.96 / 55.73

- Stock P/E 12.90

- Book Value 57.16

- EPS 3.91

- Next Earning Report 2026-03-04

- Dividend Per Share $0.96

- Dividend Yield 1.91 %

- Next Dividend Date -

- ROA -0.05 %

- ROE 0.07 %

- 52 Week High 58.74

- 52 Week Low 29.45

About

NACCO Industries, Inc., is involved in the mining and natural resources businesses. The company is headquartered in Cleveland, Ohio.

Analyst Target Price

$128.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-05 | 2025-07-29 | 2025-04-29 | 2025-03-04 | 2024-10-30 | 2024-07-31 | 2024-05-01 | 2024-03-07 | 2023-11-02 | 2023-08-03 | 2023-05-04 | 2023-03-16 |

| Reported EPS | 1.78 | 0.44 | 0.658 | 1.0191 | 2.1383 | 0.8077 | 0.6081 | -5.8772 | -0.51 | 0.3354 | 0.76 | 1.84 |

| Estimated EPS | 0 | None | None | None | None | None | 0.61 | -5.88 | None | None | None | 1.84 |

| Surprise | 1.78 | 0 | 0 | 0 | 0 | 0 | -0.0019 | 0.0028 | 0 | 0 | 0 | 0 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | -0.3115% | 0.0476% | None% | None% | None% | 0% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-04 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-16 | 2025-12-15 | 2025-09-15 | 2025-06-16 | 2025-03-17 | 2024-12-16 | 2024-09-16 | 2024-06-17 | 2024-03-15 | 2023-12-15 |

| Amount | $0.2525 | $0.2525 | $0.2525 | $0.2525 | $0.2275 | $0.2275 | $0.2275 | $0.2275 | $0.2175 | $0.2175 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: NC

2026-02-20 15:57:52

NACCO Industries, Inc. (NYSE:NC) has announced a quarterly dividend of $0.2525 per share, payable on March 16th to shareholders of record on March 2nd. This dividend represents an annualized yield of 1.8%. The company's dividend growth has been flat over the past three years.

2026-02-19 21:47:32

NACCO Industries has announced that it will maintain its quarterly cash dividend at $0.2525 per share. This dividend is payable on March 16, 2026, to shareholders of record as of March 2, 2026. The announcement was made on February 19, 2026.

2026-02-19 19:26:45

NACCO Industries (NYSE: NC) announced a regular quarterly cash dividend of 25.25 cents per share for both Class A and Class B Common Stock. The dividend is payable on March 16, 2026, to stockholders of record as of March 2, 2026. NACCO Industries focuses on natural resources, delivering aggregates, minerals, reliable fuels, and environmental solutions.

2026-02-19 19:26:45

NACCO Industries has declared a quarterly cash dividend of 25.25 cents per share for both Class A and Class B common stock. The dividend demonstrates the company's stable financial position and commitment to shareholder returns, with payment scheduled for March 16, 2026, to shareholders of record on March 2, 2026. NACCO Industries specializes in natural resources development, including aggregates, reliable fuels, and environmental solutions.

2026-02-19 19:26:45

NACCO Industries (NYSE: NC) has declared a regular quarterly cash dividend of 25.25 cents per share for both Class A and Class B common stock. The dividend is set to be paid on March 16, 2026, to shareholders of record at the close of business on March 2, 2026. This announcement includes details on eligibility and the payment process for the upcoming dividend.

2026-02-03 17:31:18

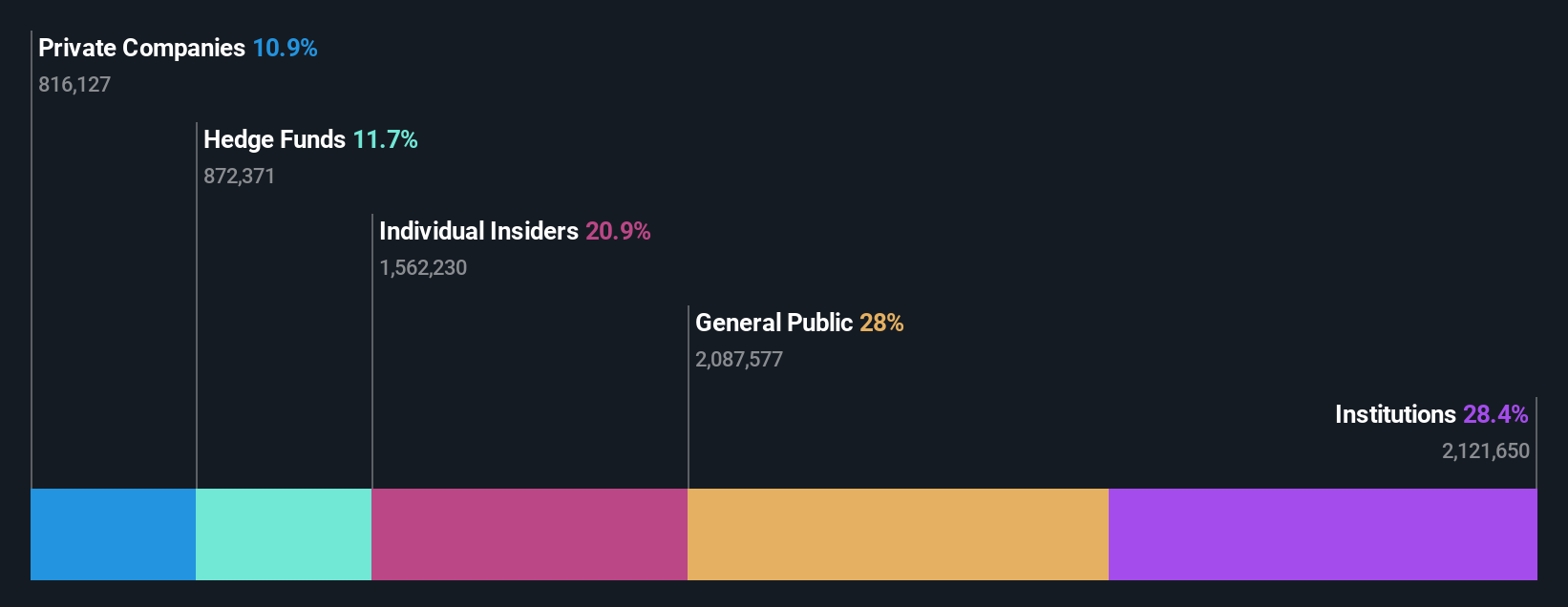

Institutional investors hold 28% of NACCO Industries, Inc. (NYSE:NC), making them the largest shareholder group, and benefited from an 11% stock increase last week. Despite their collective influence, no single shareholder, including the top 13 who own 51% of the company, holds significant control. Insiders also maintain a substantial holding, owning US$77 million in shares.