MYR Group Inc

$ 279.00

1.65%

24 Feb - close price

- Market Cap 4,330,871,000 USD

- Current Price $ 279.00

- High / Low $ 282.21 / 263.99

- Stock P/E 45.15

- Book Value 39.79

- EPS 6.18

- Next Earning Report 2026-02-25

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.16 %

- 52 Week High 284.98

- 52 Week Low 97.72

About

MYR Group Inc., provides electrical construction services in the United States and Canada. The company is headquartered in Henderson, Colorado.

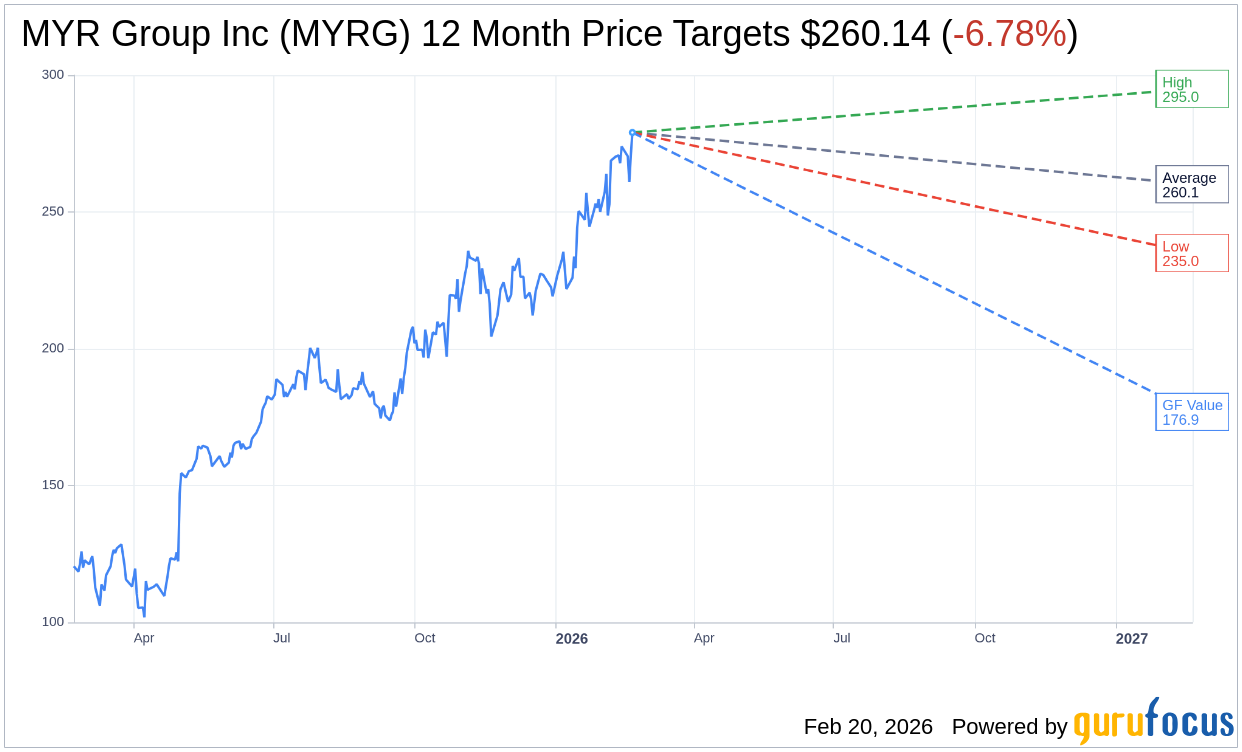

Analyst Target Price

$254.33

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-25 | 2025-10-29 | 2025-07-29 | 2025-04-29 | 2025-02-26 | 2024-10-30 | 2024-07-31 | 2024-05-01 | 2024-02-28 | 2023-10-25 | 2023-07-26 | 2023-04-26 |

| Reported EPS | 0 | 2.05 | 1.7 | 1.45 | 0.99 | 0.65 | -0.91 | 1.12 | 1.43 | 1.28 | 1.33 | 1.38 |

| Estimated EPS | 1.86 | 1.92 | 1.48 | 1.1983 | 0.8 | 0.35 | 1.13 | 1.16 | 1.5 | 1.3 | 1.28 | 1.01 |

| Surprise | -1.86 | 0.13 | 0.22 | 0.2517 | 0.19 | 0.3 | -2.04 | -0.04 | -0.07 | -0.02 | 0.05 | 0.37 |

| Surprise Percentage | -100% | 6.7708% | 14.8649% | 21.0048% | 23.75% | 85.7143% | -180.531% | -3.4483% | -4.6667% | -1.5385% | 3.9063% | 36.6337% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-25 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 1.73 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MYRG

2026-02-24 21:51:32

MYR Group Inc. is scheduled to attend the upcoming Jefferies Power, Energy, Clean Energy & Utilities Conference in March, demonstrating its active involvement in the energy sector. This participation highlights the company's commitment to staying current with new trends, innovations, and opportunities within the power and clean energy industries. The conference is a key event for professionals in these evolving sectors.

2026-02-20 22:53:53

MYR Group (MYRG) stock reached an all-time high of $283.87, representing a 134.61% increase over the past year. Despite this surge and strong investor confidence, InvestingPro analysis suggests the stock is currently overvalued relative to its Fair Value. Analysts at Cantor Fitzgerald and Clear Street have initiated coverage with Overweight and Buy ratings, respectively, citing the company's focus on utility-related electrical contracting.

2026-02-20 16:05:23

MYR Group Inc (MYRG) shares rose 3.06% in mid-day trading on February 20, reaching $279.30. This places MYRG close to its 52-week high, significantly above its 52-week low. Analyst forecasts show an average target price of $260.14 with an "Outperform" recommendation, although GuruFocus estimates a potential downside based on its GF Value calculation.

2026-02-15 06:20:00

This article from Stock Traders Daily analyzes Myr Group Inc. (NASDAQ: MYRG), highlighting strong sentiment across all horizons supporting an overweight bias. It outlines three institutional trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop-loss levels. The analysis also provides multi-timeframe signal insights, indicating strong signals across near-term, mid-term, and long-term horizons.

2026-02-13 03:27:30

MYR Group Inc. (MYRG) stock reached an all-time high of $279.15, now trading at $280.1, reflecting a 90.47% increase over the past year. The company's strong performance and "GOOD" financial health rating, along with a PEG ratio of 0.25, contribute to positive investor sentiment. Analysts from Cantor Fitzgerald and Clear Street have initiated coverage with "Overweight" and "Buy" ratings, respectively, highlighting the company's prospects in utility projects and electrical construction services.

2026-02-12 15:28:24

MYR Group Inc. (NASDAQ: MYRG) announced it will release its fourth quarter 2025 financial results on Wednesday, February 25, 2026, after the market closes. A conference call and webcast to discuss these results are scheduled for Thursday, February 26, 2026, at 8 a.m. Mountain Time. Interested parties can register online for the conference call or access the audio-only webcast via the Investors page of MYR Group’s website.