MVB Financial Corp

$ 25.98

-1.03%

26 Dec - close price

- Market Cap 330,760,000 USD

- Current Price $ 25.98

- High / Low $ 26.62 / 25.73

- Stock P/E 10.60

- Book Value 26.07

- EPS 2.45

- Next Earning Report 2026-02-12

- Dividend Per Share $0.68

- Dividend Yield 2.59 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.10 %

- 52 Week High 28.96

- 52 Week Low 15.25

About

MVB Financial Corp, headquartered in Fairmont, West Virginia, is a prominent diversified financial services holding company known for its robust community banking operations, offering an array of traditional deposit products, commercial and residential lending solutions, and cash management services. The firm is dedicated to fostering economic development in its communities by utilizing cutting-edge technology to enhance customer experiences and streamline operations. With a strong focus on community involvement and strategic growth, MVB Financial is poised to seize emerging opportunities within the evolving financial services landscape, making it an attractive investment for institutional investors seeking exposure to the sector.

Analyst Target Price

$31.50

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-03 | 2025-07-28 | 2025-04-28 | 2025-02-12 | 2024-10-30 | 2024-07-29 | 2024-04-29 | 2024-02-14 | 2023-10-26 | 2023-07-27 | 2023-04-27 | 2023-02-17 |

| Reported EPS | 1.32 | 0.15 | 0.27 | 0.72 | 0.16 | 0.31 | 0.34 | 0.61 | 0.29 | 0.63 | 0.87 | 0.5 |

| Estimated EPS | 0.2767 | 0.2592 | 0.2067 | 0.35 | 0.33 | 0.36 | 0.38 | 0.33 | 0.59 | 0.58 | 0.63 | 0.51 |

| Surprise | 1.0433 | -0.1092 | 0.0633 | 0.37 | -0.17 | -0.05 | -0.04 | 0.28 | -0.3 | 0.05 | 0.24 | -0.01 |

| Surprise Percentage | 377.051% | -42.1296% | 30.6241% | 105.7143% | -51.5152% | -13.8889% | -10.5263% | 84.8485% | -50.8475% | 8.6207% | 38.0952% | -1.9608% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-12 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.34 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-15 | 2025-09-15 | 2025-06-15 | 2025-03-15 | 2024-12-15 | 2024-09-15 | 2024-06-15 | 2024-03-15 | 2023-12-15 | 2023-09-15 |

| Amount | $0.17 | $0.17 | $0.17 | $0.17 | $0.17 | $0.17 | $0.17 | $0.17 | $0.17 | $0.17 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MVBF

2025-12-22 00:10:49

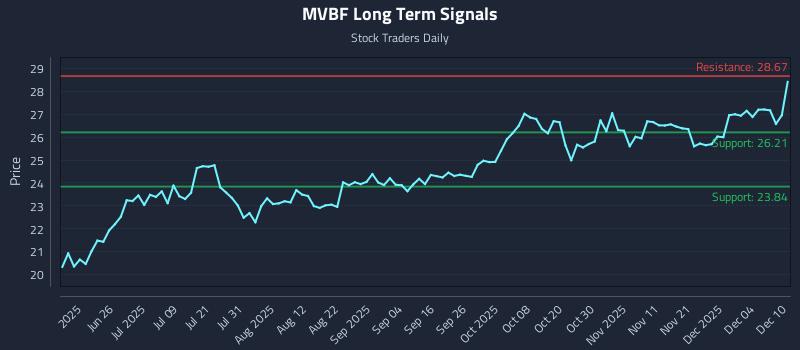

This article provides an algorithmic analysis of Mvb Financial Corp. (NASDAQ: MVBF), highlighting a near-term neutral sentiment amidst mid and long-term strength. It details specific institutional trading strategies including position, momentum breakout, and risk hedging, along with multi-timeframe signal analysis. The report identifies a strong risk-reward setup, targeting a 9.0% gain against a 0.3% risk.

2025-12-11 11:09:47

Cordella Richard James JR, a Director at MVB Financial Corp (MVBF), purchased 500 shares of the company on December 5, 2025, bringing his total ownership to 500 shares. This transaction is part of a trend of insider confidence, with 8 insider buys and 2 insider sells at MVB Financial Corp over the past year. Despite the insider purchase, the stock is considered "Significantly Overvalued" by GuruFocus, as its trading price of $27.7 exceeds its intrinsic GF Value of $19.72.

2025-12-10 22:02:00

This article analyzes Mvb Financial Corp. (NASDAQ: MVBF) using AI models to inform risk allocation. It highlights strong sentiment across all horizons, identified resistance levels, and an exceptional short setup. Three distinct trading strategies—Position, Momentum Breakout, and Risk Hedging—are provided, tailored to different risk profiles and holding periods.

2025-12-09 14:09:37

Cordella Richard James JR, a Director at MVB Financial Corp (MVBF), purchased 500 shares of the company on December 5, 2025. This transaction indicates ongoing insider confidence, with 8 insider buys and 2 insider sells over the past year. Despite the insider purchase, the stock is considered "Significantly Overvalued" based on its GF Value, with a price-to-GF-Value ratio of 1.4.

2025-12-09 14:09:04

Richard James Cordella JR, a director at MVB Financial (NASDAQ:MVBF), recently purchased 500 shares of common stock for $13,850. The purchase occurred as MVB Financial was trading near its 52-week high, with the stock gaining 39% in the last six months and offering a 2.51% dividend yield. The company also declared a quarterly cash dividend and authorized a new $10 million stock repurchase program.

2025-12-09 08:09:54

Cordella Richard James JR, a Director at MVB Financial Corp (MVBF), purchased 500 shares of the company on December 5, 2025. This acquisition brings his total holdings to 500 shares and is part of a broader trend of insider buying at the company, indicating confidence despite the stock being considered "Significantly Overvalued" based on its GF Value.