Mercury Systems Inc

$ 103.02

0.07%

16 Jan - close price

- Market Cap 6,191,516,000 USD

- Current Price $ 103.02

- High / Low $ 103.84 / 101.54

- Stock P/E N/A

- Book Value 24.82

- EPS -0.56

- Next Earning Report 2026-02-03

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA N/A %

- ROE -0.02 %

- 52 Week High 103.84

- 52 Week Low 39.42

About

Mercury Systems, Inc. is a leading innovator in the aerospace and defense technology sector, specializing in the design and manufacturing of advanced components, modules, and subsystems for mission-critical applications. Headquartered in Andover, Massachusetts, the company has established a significant international footprint, serving a diverse clientele in the United States, Europe, and the Asia Pacific region. With a strong emphasis on high-integrity processing and secure cloud solutions, Mercury enhances the performance and security of defense platforms, positioning itself to capitalize on growing defense budgets and modernization efforts. As demand for advanced defense technologies escalates, Mercury Systems is well-equipped to deliver sustainable growth and value in this vital industry.

Analyst Target Price

$90.25

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-04 | 2025-08-11 | 2025-05-06 | 2025-02-04 | 2024-11-05 | 2024-08-13 | 2024-05-07 | 2024-02-06 | 2023-11-07 | 2023-08-15 | 2023-05-02 | 2023-01-31 |

| Reported EPS | 0.26 | 0.47 | 0.06 | 0.07 | 0.04 | 0.3 | -0.26 | -0.42 | -0.24 | 0.11 | 0.4 | 0.26 |

| Estimated EPS | 0.09 | 0.22 | 0.07 | -0.04 | -0.08 | 0.01 | -0.02 | 0.07 | 0.18 | 0.59 | 0.37 | 0.33 |

| Surprise | 0.17 | 0.25 | -0.01 | 0.11 | 0.12 | 0.29 | -0.24 | -0.49 | -0.42 | -0.48 | 0.03 | -0.07 |

| Surprise Percentage | 188.8889% | 113.6364% | -14.2857% | 275% | 150% | 2900% | -1200% | -700% | -233.3333% | -81.3559% | 8.1081% | -21.2121% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-03 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.07 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MRCY

2026-01-18 07:27:52

Mercury Systems has secured over US$60 million in new space and strategic weapons contracts, extending their involvement in a key program through 2031 and broadening their adoption of radiation-tolerant technologies. While these contracts enhance backlog and long-term visibility, the article notes they don't immediately resolve concerns about near-term weak organic growth and margin pressure from legacy, lower-margin work. Investors are advised to watch the upcoming Q2 FY26 results for insight into how these wins impact revenue and margins.

2026-01-16 08:28:30

Mercury Systems' stock has seen significant short-term gains, raising questions about its current valuation. Simply Wall St's analysis, using a Discounted Cash Flow model and Price-to-Sales ratio, suggests the stock might be overvalued, with a fair value estimated significantly lower than its current trading price. The article encourages investors to use "Narratives" on the platform to customize their valuation perspectives for Mercury Systems.

2026-01-15 18:28:30

Mercury Systems, Inc. (NASDAQ: MRCY) has been awarded over $60 million in contracts for U.S. space and strategic weapons programs. This includes an extension for a strategic weapons program exploiting Mercury's radiation-hardened processing expertise and a new contract for subsystems for a national security space program, featuring their radiation-tolerant wideband storage and processing subsystem. These awards highlight the increasing demand for Mercury’s advanced processing technology in critical national security missions.

2026-01-15 16:29:39

Halper Sadeh LLC, an investor rights law firm, is investigating whether certain officers and directors of Mercury Systems, Inc. (NASDAQ: MRCY) breached their fiduciary duties to shareholders. The firm encourages long-term shareholders to contact them to discuss legal rights and options, which could include corporate governance reforms, the return of funds, or financial incentives. Halper Sadeh LLC handles these actions on a contingent fee basis, emphasizing that shareholder involvement can enhance corporate transparency and value.

2026-01-15 14:28:30

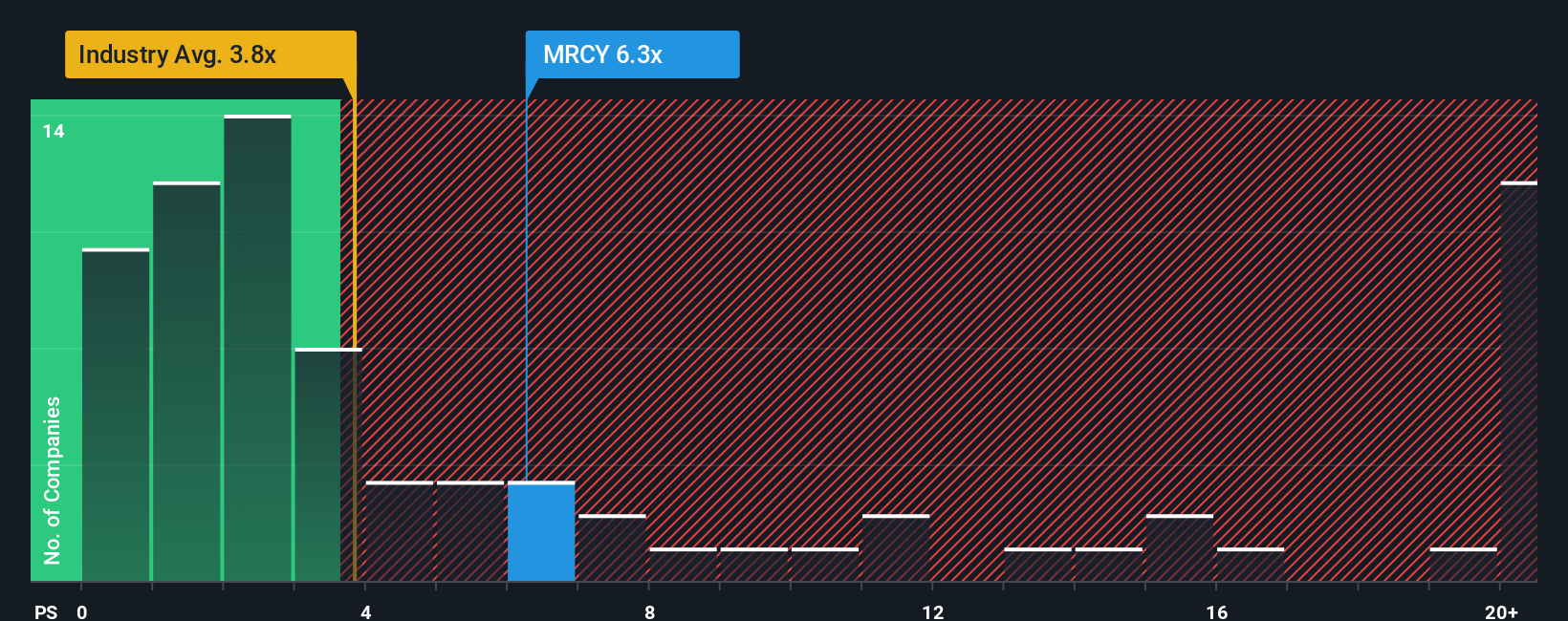

Mercury Systems' stock has seen a significant 33% price jump recently, leading to a high price-to-sales (P/S) ratio of 6.4x compared to the industry average of 3.8x. This surge appears disconnected from the company's revenue performance, which has shown a 5.9% decline over the last three years and is projected to grow by only 4.3% next year, significantly trailing the industry's 12% forecast. Analysts suggest that the current P/S ratio is not justified by the company's uninspiring revenue growth, posing potential risks for investors.

2026-01-15 12:32:13

Mercury Systems has been awarded over $60 million in contracts for U.S. space and strategic weapons programs, extending work on one program through 2031 and securing a new contract for a national security space program. The company's stock has seen strong performance with a 127.87% return over the past year, trading near its 52-week high, and recently exceeded analysts' expectations for its first fiscal quarter earnings of 2026. This has led to some analysts raising price targets, while others maintain a more cautious outlook.