Hello Group Inc

$ 6.96

0.29%

04 Dec - close price

- Market Cap 1,115,046,000 USD

- Current Price $ 6.96

- High / Low $ 6.99 / 6.93

- Stock P/E 10.52

- Book Value 68.95

- EPS 0.66

- Next Earning Report 2025-12-10

- Dividend Per Share N/A

- Dividend Yield 5.69 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.08 %

- 52 Week High 9.22

- 52 Week Low 5.05

About

Hello Group Inc. (MOMO) is a leading force in China's mobile-based entertainment and social networking landscape, celebrated for its core application, Momo, along with a suite of complementary services designed to enhance social interactions and user-generated content. Based in Beijing, the company is committed to technological innovation and user experience, appealing to a vibrant demographic of young users. MOMO's strategic focus on community-oriented features and engagement positions it well to capture growth opportunities within the expanding Chinese social media market, as it seeks to solidify its market position and drive sustained growth.

Analyst Target Price

$9.62

Quarterly Earnings

| Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | Sep 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-09-09 | 2025-06-05 | 2025-03-12 | 2024-12-09 | 2024-09-03 | 2024-05-28 | 2024-03-14 | 2023-12-08 | 2023-08-31 | 2023-06-06 | 2023-03-16 | 2022-12-08 |

| Reported EPS | -0.58 | 1.17 | 1.3 | 2.7 | 2.38 | 0.31 | 2.64 | 1.52 | 3.14 | 2.36 | 2.46 | 2.6 |

| Estimated EPS | 2.07 | 1.54 | 1.81 | 1.86 | 2 | 2.1 | 2.46 | 2.49 | 2.57 | 1.91 | 1.96 | 2.14 |

| Surprise | -2.65 | -0.37 | -0.51 | 0.84 | 0.38 | -1.79 | 0.18 | -0.97 | 0.57 | 0.45 | 0.5 | 0.46 |

| Surprise Percentage | -128.0193% | -24.026% | -28.1768% | 45.1613% | 19% | -85.2381% | 7.3171% | -38.9558% | 22.179% | 23.5602% | 25.5102% | 21.4953% |

Next Quarterly Earnings

| Sep 2025 | |

|---|---|

| Reported Date | 2025-12-10 |

| Fiscal Date Ending | 2025-09-30 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Apr 2025 | Apr 2024 | May 2023 | Apr 2022 | Apr 2021 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|

| Payment Date | 2025-04-30 | 2024-04-30 | 2023-05-22 | 2022-04-29 | 2021-04-30 | None | None |

| Amount | $0.3 | $0.54 | $0.72 | $0.64 | $0.64 | $0.76 | $0.62 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MOMO

2025-10-18 12:20:14

Hello Group Inc. (NASDAQ:MOMO) has received an average "Reduce" recommendation from five brokerages, with an average twelve-month price target of $10.00. The stock is currently trading at $6.83, and institutional investors hold approximately 50.96% of the company's shares. Recent trading activity shows several hedge funds increasing their positions in Hello Group.

2025-09-12 00:00:00

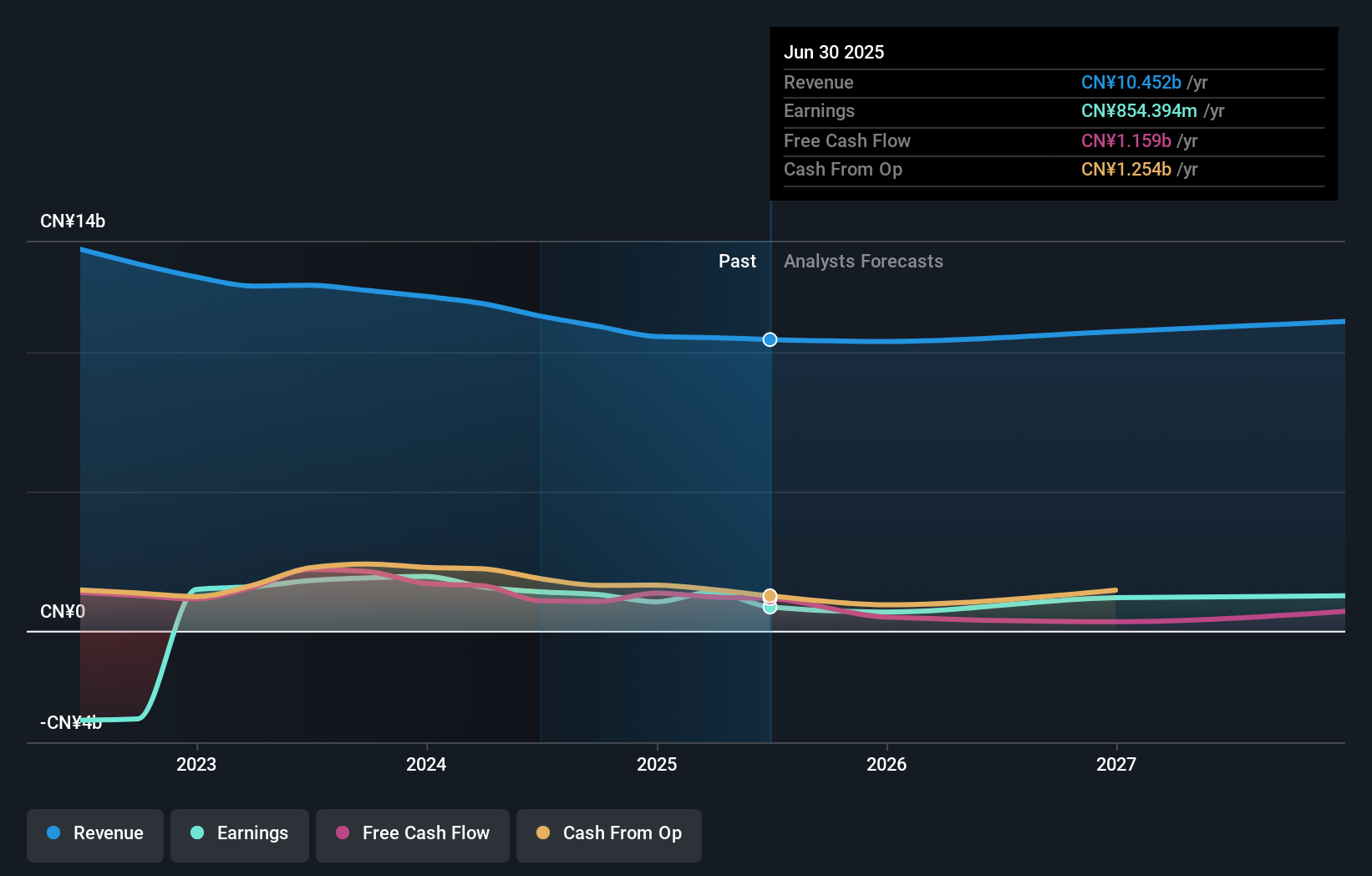

Hello Group Inc. reported a surprise statutory loss of CN¥0.84 per share, missing analyst forecasts for a profit, though revenues were in line with estimates at CN¥2.6b. Following these results, analysts significantly cut their 2025 earnings per share estimates for Hello Group to CN¥4.01, down from CN¥6.82, while revenue forecasts remained steady at CN¥10.4b. The consensus price target remained at US$9.84, suggesting that the lower earnings forecasts are not expected to impact the stock price in the near term.

2025-03-17 09:19:00

Hello Group is shifting its focus to the global dating market, particularly the Middle East and North Africa (MENA) regions, due to declining user numbers and increased competition in China. The company's social app Soulchill saw significant revenue growth in Middle Eastern markets, and Hello Group is launching new apps like Yaahlan and AMAR to further expand its international presence. Despite increased international revenue prospects, investor sentiment remains cautious, causing an 8% drop in stock value after its earnings report.

2024-09-24 05:42:00

Hello Group (MOMO) is considered significantly undervalued with a P/E ratio of 5x TTM Non-GAAP earnings and 2x TTM EBITDA, presenting a strong buy opportunity. The company benefits from its app development expertise, presence in China's market, and a recently upsized stock repurchase program. However, risks include its Cayman Islands incorporation, operational challenges in China, and potential regulatory changes.

2024-09-04 07:46:00

Hello Group (NASDAQ: MOMO) reported mixed Q2 2024 results with revenue decline year-over-year but sequential growth, alongside a drop in adjusted operating income. The company is strategically revamping its Tantan dating app to improve user experience and long-term profitability, even if it means short-term financial sacrifices and user fluctuations. They are also focusing on strengthening localized operations and expanding product offerings in the MENA region for future growth.

2024-07-09 10:16:00

Hello Group Inc (MOMO) has seen a surprising 14% stock rally over the past three months, driven by its robust financial health, strong profitability metrics, and a shift to a "Fairly Valued" status by GuruFocus. Despite challenges in revenue growth, the interactive media company maintains a competitive edge through its diversified business model and notable investments from prominent shareholders like Jim Simons. The article concludes that its stable outlook stems from its solid financial foundation and strategic market positioning.