Monopar Therapeutics Inc

$ 57.62

3.26%

24 Feb - close price

- Market Cap 372,888,000 USD

- Current Price $ 57.62

- High / Low $ 61.30 / 55.31

- Stock P/E N/A

- Book Value 21.25

- EPS -3.96

- Next Earning Report 2026-03-30

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.18 %

- ROE -0.26 %

- 52 Week High 105.00

- 52 Week Low 26.05

About

Monopar Therapeutics Inc., a clinical-stage biopharmaceutical company, is dedicated to developing proprietary therapies to improve clinical outcomes for cancer patients in the United States. The company is headquartered in Wilmette, Illinois.

Analyst Target Price

$112.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-10 | 2025-08-12 | 2025-05-07 | 2025-03-26 | 2024-11-07 | 2024-08-09 | 2024-05-09 | 2024-03-28 | 2023-11-09 | 2023-08-10 | 2023-05-11 | 2023-03-23 |

| Reported EPS | -0.48 | -0.35 | -0.38 | -2.75 | -0.37 | -0.5 | -0.1 | -0.12 | -0.14 | -0.16 | -0.19 | -0.23 |

| Estimated EPS | -0.3989 | -0.09 | -0.5667 | -0.42 | -0.48 | -0.47 | -0.12 | -0.15 | -0.17 | -0.18 | -0.22 | -0.2 |

| Surprise | -0.0811 | -0.26 | 0.1867 | -2.33 | 0.11 | -0.03 | 0.02 | 0.03 | 0.03 | 0.02 | 0.03 | -0.03 |

| Surprise Percentage | -20.3309% | -288.8889% | 32.9451% | -554.7619% | 22.9167% | -6.383% | 16.6667% | 20% | 17.6471% | 11.1111% | 13.6364% | -15% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-30 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -0.58 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MNPR

2026-02-23 13:35:16

BTIG analyst Jeet Mukherjee has reiterated a Buy rating for Monopar Therapeutics (MNPR), maintaining a target price of $104.00 USD. This decision reflects continued confidence in the clinical-stage biopharmaceutical company, which focuses on developing therapeutics for cancer patients. The consensus from 14 analysts indicates an "Outperform" status for MNPR, with an average target price of $112.00, suggesting a potential upside of over 101% from its current price.

2026-02-19 15:57:15

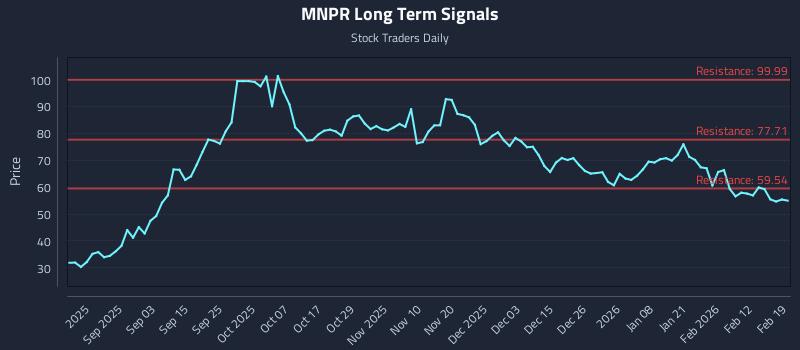

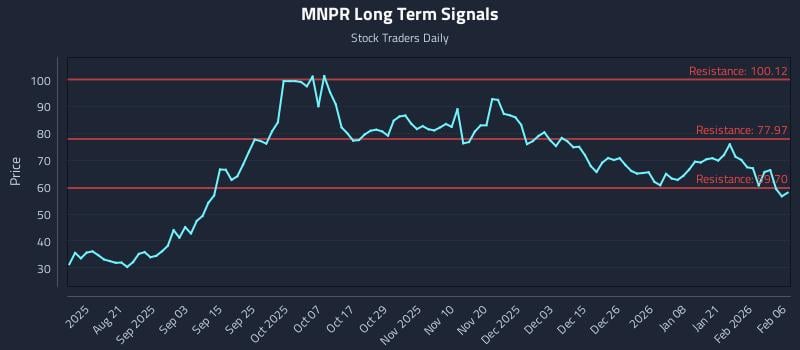

Monopar Therapeutics Inc. (NASDAQ: MNPR) is showing a mid-channel oscillation pattern with weak near and mid-term sentiment, despite a strong long-term outlook. The analysis highlights an exceptional 106.9:1 risk-reward setup targeting a 30.5% gain versus a 0.3% risk. Three distinct AI-generated trading strategies are provided: a Position Trading Strategy, a Momentum Breakout Strategy, and a Risk Hedging Strategy, each tailored to different risk profiles.

2026-02-11 13:28:52

Institutional investors in Monopar Therapeutics Inc. (NASDAQ:MNPR) experienced a US$66 million decrease in market capitalization last week, despite having benefited from long-term gains. Institutions hold a significant 49% ownership, giving them substantial influence over the company's share price. The article details the ownership structure, noting dominant stakes by institutional investors and hedge funds, alongside insider and public ownership.

2026-02-09 16:28:31

This article from MSN focuses on Monopar Therapeutics, highlighting its improved relative strength in the stock market. The content provides a brief snapshot of the company's performance, indicating positive momentum. However, the article provided is incomplete.

2026-02-08 14:59:08

This article provides a technical analysis of Monopar Therapeutics Inc. (NASDAQ: MNPR), highlighting a weak near and mid-term sentiment but a strong long-term outlook. It details three AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry, target, and stop loss points. The analysis also includes multi-timeframe signal strengths, support, and resistance levels for MNPR.

2026-02-05 16:28:52

Short interest in Monopar Therapeutics Inc. (NASDAQ:MNPR) increased by 21.1% in January, reaching 1,279,274 shares, which represents about 24.1% of its shares sold short. This elevated short interest suggests significant bearish sentiment and potential for a short squeeze, while the company's average analyst rating is "Buy" with a $107 consensus price target. Shares have been volatile, trading around $59.04, with insiders owning 20.5% and the CFO recently purchasing 1,500 shares.