3M Company

$ 156.21

-2.91%

05 Mar - close price

- Market Cap 84,740,760,000 USD

- Current Price $ 156.21

- High / Low $ 160.97 / 154.80

- Stock P/E 26.82

- Book Value 8.87

- EPS 6.00

- Next Earning Report 2026-04-21

- Dividend Per Share $2.92

- Dividend Yield 1.84 %

- Next Dividend Date 2026-03-12

- ROA 0.08 %

- ROE 0.76 %

- 52 Week High 176.62

- 52 Week Low 119.77

About

The 3M Company is an American multinational conglomerate corporation operating in the fields of industry, worker safety, US health care, and consumer goods. The company produces over 60,000 products under several brands, including adhesives, abrasives, laminates, passive fire protection, personal protective equipment, window films, paint protection films, dental and orthodontic products, electrical and electronic connecting and insulating materials, medical products, car-care products, electronic circuits, healthcare software and optical films. It is based in Maplewood, a suburb of Saint Paul, Minnesota.

Analyst Target Price

$178.73

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-20 | 2025-10-21 | 2025-07-18 | 2025-04-22 | 2025-01-21 | 2024-10-22 | 2024-07-26 | 2024-04-30 | 2024-01-23 | 2023-10-24 | 2023-07-25 | 2023-04-25 |

| Reported EPS | 1.83 | 2.19 | 2.16 | 1.88 | 1.68 | 1.98 | 1.93 | 2.39 | 2.42 | 2.68 | 2.17 | 1.97 |

| Estimated EPS | 1.8 | 2.07 | 2.01 | 1.77 | 1.54 | 1.9 | 1.68 | 2.11 | 2.31 | 2.35 | 1.76 | 1.6 |

| Surprise | 0.03 | 0.12 | 0.15 | 0.11 | 0.14 | 0.08 | 0.25 | 0.28 | 0.11 | 0.33 | 0.41 | 0.37 |

| Surprise Percentage | 1.6667% | 5.7971% | 7.4627% | 6.2147% | 9.0909% | 4.2105% | 14.881% | 13.2701% | 4.7619% | 14.0426% | 23.2955% | 23.125% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-21 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 1.99 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Jan 1970 | Mar 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-12 | 2025-12-12 | 2025-09-12 | 2025-06-12 | 2025-03-12 | 2024-12-12 | 2024-09-12 | 2024-06-12 | None | 2024-03-12 |

| Amount | $0.78 | $0.73 | $0.73 | $0.73 | $0.73 | $0.7 | $0.7 | $0.7 | $17.3875 | $1.51 |

Next Dividend Records

| Dividend per share (year): | $2.92 |

| Dividend Yield | 1.84% |

| Next Dividend Date | 2026-03-12 |

| Ex-Dividend Date | 2026-02-13 |

Recent News: MMM

2026-03-05 20:50:19

Honeywell International Inc. (HON) stock closed down 3.08% on March 5, despite positive analyst ratings, following the announcement of its aerospace segment spin-off. The planned spin-off, named Honeywell Aerospace and set to trade as HONA in Q3 2026, aims to unlock shareholder value but has introduced market uncertainty. Technical indicators suggest mixed signals, while fundamental analysis highlights the company's strong revenue and profit in the Consumer Goods Conglomerates industry.

2026-03-05 13:52:20

Vanguard Group Inc. recently reduced its stake in DXP Enterprises by 4.0% in Q3, now holding 945,946 shares valued at $112.63 million. Despite this reduction, institutional ownership in DXP Enterprises remains high at 74.82%, with several other institutional investors significantly increasing their positions. DXP Enterprises reported strong quarterly earnings, beating analyst expectations, and maintains a consensus "Buy" rating from analysts with an average target price of $124.50.

2026-03-05 12:52:45

HC Wainwright has revised its Q1 2026 earnings per share estimate for Crescent Biopharma (CBIO) to ($0.76) from ($1.33), maintaining a "Buy" rating and a $22 price target. This optimistic adjustment comes despite Crescent Biopharma missing consensus estimates for its Q4 earnings, reporting a loss of ($4.01) per share against an expected ($2.22). The stock still holds a consensus "Buy" rating with an average target price of $28.00 and significant institutional ownership, indicating ongoing investor and analyst interest despite financial volatility.

2026-03-05 11:51:55

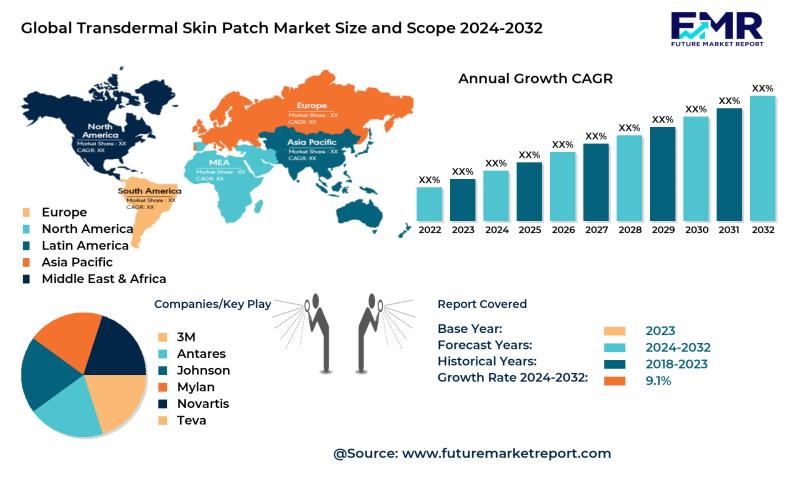

A new study report on the Transdermal Skin Patch Market Demand 2024-2032 provides a comprehensive overview of the market size, trends, competition, and forecast. The report details key segments, market share, topological analysis, and primary and secondary drivers, alongside insights into leading businesses, product types, and end-user market segmentation. It covers market growth scope, import/export dynamics, and includes a competitive analysis for the global Transdermal Skin Patch industry.

2026-03-05 11:51:17

GW&K Investment Management LLC decreased its stake in Halozyme Therapeutics (HALO) by 11.4% in the third quarter, selling 162,799 shares. This comes as company insiders have also been net sellers recently, with CEO Helen Torley selling 20,000 shares. Halozyme Therapeutics reported a significant earnings miss for the last quarter, though its revenue increased year-over-year, and analysts anticipate future earnings per share growth.

2026-03-05 11:22:00

Solventum (SOLV) reported strong Q4 2025 financial results, exceeding expectations with adjusted diluted EPS of $1.57 and 3.5% organic sales growth, despite a total sales decline due to a divestiture. The company also provided an optimistic full-year 2026 guidance, projecting 2.0% to 3.0% organic sales growth and adjusted EPS between $6.40 and $6.60. Solventum, a healthcare firm with MedSurg, Dental Solutions, and Health Information Systems segments, is streamlining its portfolio for future growth.