Mirion Technologies Inc

$ 21.92

2.00%

26 Feb - close price

- Market Cap 5,394,907,000 USD

- Current Price $ 21.92

- High / Low $ 22.01 / 21.40

- Stock P/E 195.36

- Book Value 7.63

- EPS 0.11

- Next Earning Report 2026-04-28

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.02 %

- 52 Week High 30.28

- 52 Week Low 12.00

About

Mirion Technologies Inc. (MIR) is a premier provider of cutting-edge radiation detection and measurement solutions, catering to sectors such as healthcare, nuclear energy, and defense. The company leverages advanced technology to enhance safety and operational efficiency in radiation-prone environments, underscoring its commitment to innovation through substantial investment in research and development. As the global need for reliable radiation management continues to rise, Mirion is strategically positioned to capitalize on emerging market opportunities, making it a compelling consideration for institutional investors seeking exposure in this critical domain.

Analyst Target Price

$29.30

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-10 | 2025-10-28 | 2025-07-31 | 2025-04-29 | 2025-02-11 | 2024-10-29 | 2024-08-01 | 2024-04-30 | 2024-02-13 | 2023-11-01 | 2023-08-02 | 2023-05-03 |

| Reported EPS | 0.15 | 0.12 | 0.11 | 0.1 | 0.17 | 0.08 | 0.1 | 0.06 | 0.15 | 0.05 | 0.08 | 0.06 |

| Estimated EPS | 0.16 | 0.1 | 0.1 | 0.08 | 0.15 | 0.09 | 0.07 | 0.06 | 0.14 | 0.05 | 0.06 | 0.05 |

| Surprise | -0.01 | 0.02 | 0.01 | 0.02 | 0.02 | -0.01 | 0.03 | 0 | 0.01 | 0 | 0.02 | 0.01 |

| Surprise Percentage | -6.25% | 20% | 10% | 25% | 13.3333% | -11.1111% | 42.8571% | 0% | 7.1429% | 0% | 33.3333% | 20% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-28 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.1 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MIR

2026-02-24 22:53:13

Vanguard Group Inc. increased its stake in Mirion Technologies (NYSE: MIR) by 28% in Q3, acquiring an additional 6.65 million shares, bringing their total holdings to 30.42 million shares valued at about $707.5 million. This comes as Mirion missed quarterly earnings and revenue estimates but showed a 9.1% year-over-year revenue increase and set FY 2026 guidance. Despite a recent insider share sale, analysts maintain a "Moderate Buy" rating with a target price of $28.38.

2026-02-19 22:52:08

Bornite Capital Management LP significantly reduced its stake in Mirion Technologies, Inc. ($MIR) by selling 1,551,700 shares, now holding 500,000 shares valued at approximately $11.63 million. This comes as Mirion slightly missed Q3 earnings and revenue expectations ($0.15 EPS vs $0.16 expected; $277.4M revenue vs $281.2M), although revenue increased 9.1% year-over-year. Insider selling also occurred, with Director Lawrence D. Kingsley selling 350,000 shares, while analysts maintain a "Moderate Buy" rating with a consensus target price of $28.38.

2026-02-19 22:27:12

Mirion Technologies, Inc. has released its 2025 10-K report, highlighting significant financial growth with revenues of $925.4 million and a net income of $29.8 million. The company strengthened its market position through strategic acquisitions, including Certrec and Paragon Energy Solutions, and continues to innovate in radiation safety across nuclear and medical sectors. Despite facing market, geopolitical, and cybersecurity risks, Mirion plans sustained growth through strategic investments, capital management, and ongoing product development.

2026-02-15 14:57:37

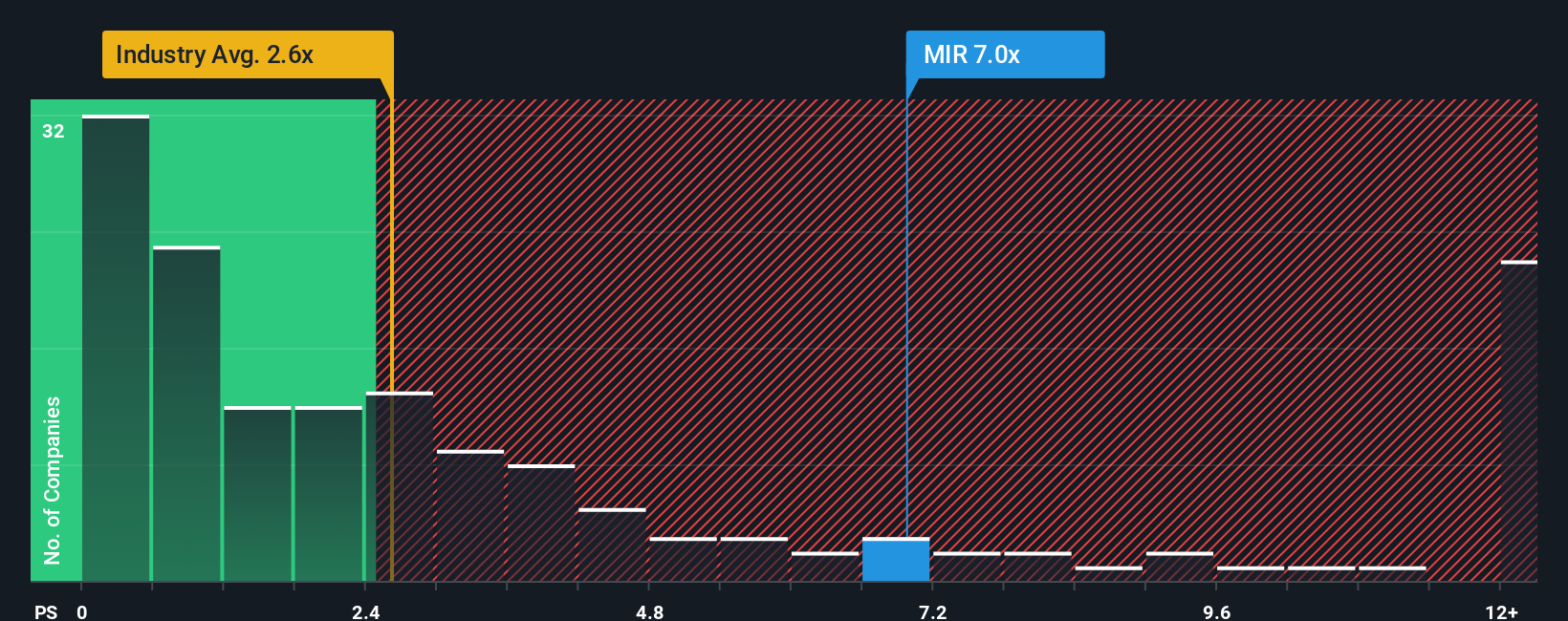

Mirion Technologies (MIR) recently experienced a significant share price drop after its quarterly revenue and adjusted EPS, along with 2026 guidance, fell short of analyst expectations. Despite this, some valuations suggest the stock is undervalued, projecting a fair value of $30.33 due to growth in nuclear power demand and acquisitions. However, its current Price-to-Sales ratio of 6x is notably higher than the industry average and its own fair ratio, indicating a potentially rich valuation.

2026-02-13 03:58:08

Three analysts have issued bullish sentiments on industrial goods companies: Boeing (BA), Mirion Technologies (MIR), and American Superconductor (AMSC). Jefferies maintained a Buy rating on Boeing with a $295 price target, Northland Securities maintained a Buy rating on Mirion Technologies with a $29 price target, and Craig-Hallum maintained a Buy rating on American Superconductor. All three companies have a "Strong Buy" analyst consensus rating with significant upside potential.

2026-02-05 23:52:12

Mirion Technologies (NYSE:MIR) experienced a 15.2% drop in short interest in January, with 18,857,131 shares shorted, representing about 7.6% of its stock. The company has high institutional ownership (78.5%), and analysts have a "Moderate Buy" consensus with an average target price of $28.38. A recent insider sale by Director Lawrence D. Kingsley involved 350,000 shares worth $8.66 million.