Methode Electronics Inc

$ 8.74

1.27%

24 Feb - close price

- Market Cap 305,573,000 USD

- Current Price $ 8.74

- High / Low $ 9.15 / 8.69

- Stock P/E N/A

- Book Value 19.19

- EPS -1.78

- Next Earning Report 2026-03-04

- Dividend Per Share $0.40

- Dividend Yield 4.57 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -0.09 %

- 52 Week High 10.83

- 52 Week Low 4.84

About

Methode Electronics, Inc. designs, manufactures and markets component devices and subsystems globally. The company is headquartered in Chicago, Illinois.

Analyst Target Price

$9.25

Next Quarterly Earnings

| Jan 2026 | |

|---|---|

| Reported Date | 2026-03-04 |

| Fiscal Date Ending | 2026-01-31 |

| Estimated EPS | -0.26 |

| Currency | USD |

Previous Dividend Records

| Jan 2026 | Oct 2025 | Aug 2025 | May 2025 | Jan 2025 | Nov 2024 | Jul 2024 | Apr 2024 | Jan 2024 | Oct 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-01-30 | 2025-10-31 | 2025-08-01 | 2025-05-02 | 2025-01-31 | 2024-11-01 | 2024-07-26 | 2024-04-26 | 2024-01-26 | 2023-10-27 |

| Amount | $0.05 | $0.05 | $0.07 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 | $0.14 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MEI

2026-02-22 17:27:01

Bronstein, Gewirtz & Grossman, LLC is investigating Methode Electronics, Inc. (NYSE:MEI) for potential corporate wrongdoing. The firm is encouraging investors who purchased MEI securities prior to December 2, 2021, and continue to hold them, to join their investigation. Bronstein, Gewirtz & Grossman, LLC represents investors in class actions on a contingency fee basis.

2026-02-21 10:18:54

Methode Electronics, Inc. announced its financial results for the first quarter of fiscal 2025, reporting a decrease in net sales to $258.5 million and a net loss of $18.3 million. Despite challenges, the company's sales were in line with expectations, and its adjusted pre-tax loss was better than anticipated. Methode Electronics affirmed its guidance for fiscal years 2025 and 2026, expecting net sales to approach fiscal 2024 levels and pre-tax income to be positive in fiscal 2026.

2026-02-20 21:52:02

Shares of MasTec (MTZ), Expeditors (EXPD), and Methode Electronics (MEI) surged following a U.S. Supreme Court decision to strike down Trump-era tariffs. This ruling is expected to reduce costs for manufacturers and potentially lead to accelerated interest rate cuts. The article also provides a detailed look at Expeditors, noting its recent stock movement and past financial challenges.

2026-02-15 01:32:00

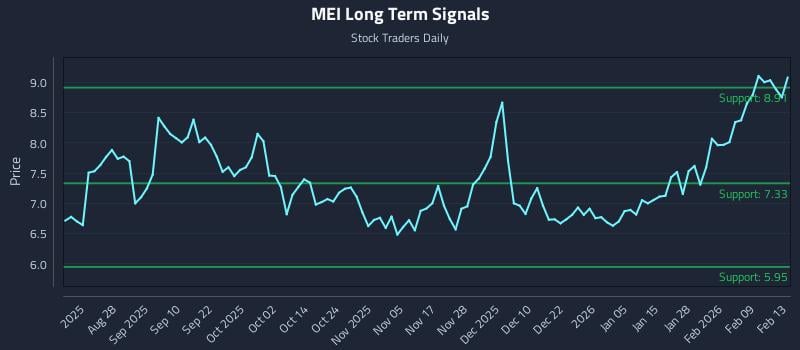

This article provides a technical analysis of Methode Electronics Inc. (NYSE: MEI), indicating neutral near-term sentiment with elevated downside risk, despite strong mid-term sentiment. It outlines three AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—along with multi-timeframe signal analysis for support and resistance levels. The analysis highlights key findings and offers institutional-grade tools and real-time signals for traders.

2026-02-14 12:27:15

Methode Electronics, Inc. (MEI) recently saw a 27% share price jump, but its revenue performance remains a concern for investors, with a 13% decline over the past year and a 9.5% drop last year. The company's low price-to-sales (P/S) ratio of 0.3x, significantly below the electronic industry average of 2.8x, reflects market skepticism due to declining revenue and a forecasted 1.4% slump in the coming year, contrasting with the industry's projected 19% expansion. This weak outlook suggests that despite the recent stock rally, the underlying financial performance does not justify a strong buying opportunity, and the share price may struggle to rise significantly without improved top-line growth.

2026-02-12 04:57:03

This article suggests selling Methode Electronics (MEI) despite its recent stock gains, citing three main concerns: stagnant long-term revenue growth, declining return on invested capital (ROIC) indicating a lack of profitable opportunities, and high debt levels that increase financial risk. The author recommends investors consider a "safe-and-steady industrials business benefiting from an upgrade cycle" instead of MEI.