MetroCity Bankshares

$ 27.39

2.43%

03 Dec - close price

- Market Cap 682,879,000 USD

- Current Price $ 27.39

- High / Low $ 27.48 / 26.65

- Stock P/E 10.32

- Book Value 17.46

- EPS 2.59

- Next Earning Report 2026-01-20

- Dividend Per Share $0.94

- Dividend Yield 3.52 %

- Next Dividend Date -

- ROA 0.02 %

- ROE 0.16 %

- 52 Week High 34.27

- 52 Week Low 23.61

About

MetroCity Bankshares, Inc. is a prominent banking holding company headquartered in Doraville, Georgia, operating through its principal subsidiary, Metro City Bank. The bank specializes in offering a comprehensive suite of financial products and services, primarily targeting individuals and businesses across the southeastern United States. With a strong emphasis on community engagement and exceptional customer service, MetroCity Bank strives to enhance client financial well-being while contributing to local economic development. As the company seeks to broaden its market presence, it remains dedicated to providing innovative and competitive financial solutions amidst an evolving banking environment.

Analyst Target Price

$31.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-17 | 2025-07-18 | 2025-04-18 | 2025-01-21 | 2024-10-18 | 2024-07-19 | 2024-04-19 | 2024-01-23 | 2023-10-20 | 2023-07-21 | 2023-04-21 | 2023-01-23 |

| Reported EPS | 0.68 | 0.65 | 0.63 | 0.63 | 0.65 | 0.66 | 0.57 | 0.44 | 0.45 | 0.5 | 0.62 | 0.52 |

| Estimated EPS | 0.67 | 0.63 | 0.61 | 0.61 | 0.64 | 0.59 | 0.53 | 0.48 | 0.5 | 0.5 | 0.5 | 0.6 |

| Surprise | 0.01 | 0.02 | 0.02 | 0.02 | 0.01 | 0.07 | 0.04 | -0.04 | -0.05 | 0 | 0.12 | -0.08 |

| Surprise Percentage | 1.4925% | 3.1746% | 3.2787% | 3.2787% | 1.5625% | 11.8644% | 7.5472% | -8.3333% | -10% | 0% | 24% | -13.3333% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-01-20 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Nov 2025 | Jan 1970 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | Aug 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-11-07 | None | 2025-05-09 | 2025-02-07 | 2024-11-08 | 2024-08-09 | 2024-05-10 | 2024-02-09 | 2023-11-10 | 2023-08-11 |

| Amount | $0.25 | $0.25 | $0.23 | $0.23 | $0.23 | $0.2 | $0.2 | $0.2 | $0.18 | $0.18 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MCBS

2025-10-19 11:18:03

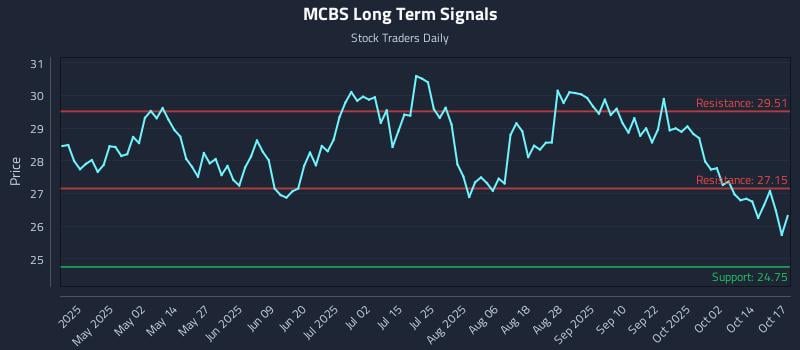

This article analyzes Metrocity Bankshares Inc. (MCBS) using AI models, indicating a weak sentiment and a strong short setup with an exceptional 30.0:1 risk-reward ratio. It outlines specific trading strategies (Position Trading, Momentum Breakout, Risk Hedging) and provides multi-timeframe signal analysis for near, mid, and long-term horizons, all showing weak signals. The analysis suggests a short bias is supported across all horizons for MCBS.

2025-10-19 04:13:00

MetroCity Bankshares (MCBS) has shown strong financial performance with an average annual earnings growth of 7.3% over five years, accelerating to 21.6% in the latest year, and its net profit margin improved to 45.5%. Despite a P/E ratio of 10.2x, which is below industry averages, the company's discounted cash flow (DCF) fair value suggests significant upside, reinforcing its position as a "defensive outperformer" compared to peers. This strong performance, high-quality earnings, and prudent operations challenge the notion that smaller banks must take on additional risk for growth.

2025-10-18 16:19:40

MetroCity Bankshares (NASDAQ:MCBS) reported quarterly earnings of $0.67 per share, meeting analyst expectations. The company also announced a quarterly dividend of $0.25 per share, representing an annualized yield of 3.8%. Institutional investors have adjusted their holdings, and MetroCity Bankshares operates as the bank holding company for Metro City Bank, providing banking products and services.

2025-10-18 03:56:32

MetroCity Bankshares reported a Q3 2025 net income of $17.3 million, a slight increase from the previous quarter and year. Key metrics included an annualized return on average assets of 1.89% and a net interest margin of 3.68%, with total loans growing to $3.20 billion. The company is also progressing with its merger with First IC Corporation, aiming to enhance market presence and operational capabilities while navigating economic conditions.

2025-10-17 16:16:37

Metrocity Bankshares Inc reported adjusted earnings of 67 cents per share for the quarter ended September 30, meeting analyst expectations and rising from 65 cents last year. Revenue increased by 2.9% to $37.97 million, surpassing analyst forecasts. The company's shares have fallen by 6.9% this quarter and 19.3% year-to-date, with analysts maintaining a "hold" rating and a median price target of $33.00.

2025-10-17 15:50:22

MetroCity Bankshares, Inc. announced its earnings results for the third quarter and nine months ended September 30, 2025. The company reported increased net interest income and net income for both periods compared to the previous year. For Q3 2025, net interest income rose to USD 31.79 million and net income reached USD 17.27 million.