Mastercard Inc

$ 542.31

-2.06%

04 Dec - close price

- Market Cap 500,578,451,000 USD

- Current Price $ 542.31

- High / Low $ 559.00 / 539.56

- Stock P/E 34.96

- Book Value 8.78

- EPS 15.84

- Next Earning Report 2026-01-29

- Dividend Per Share $3.04

- Dividend Yield 0.56 %

- Next Dividend Date -

- ROA 0.23 %

- ROE 1.85 %

- 52 Week High 600.98

- 52 Week Low 463.61

About

Mastercard Incorporated is a leading American multinational financial services corporation headquartered in Purchase, New York, with its Global Operations Headquarters in O'Fallon, Missouri. The company specializes in facilitating electronic payments, connecting merchants with card-issuing banks through an extensive range of debit, credit, and prepaid card services. With a strong emphasis on innovation in digital payments and fintech solutions, Mastercard has demonstrated robust growth since its IPO in 2006, effectively navigating the evolving landscape of consumer preferences and technological advancements. As an indispensable player in the global payment systems industry, Mastercard continues to reinforce its leadership position by enhancing its offerings and expanding its reach on a worldwide scale.

Analyst Target Price

$656.51

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-30 | 2025-07-31 | 2025-05-01 | 2025-01-30 | 2024-10-31 | 2024-07-31 | 2024-05-01 | 2024-01-31 | 2023-10-26 | 2023-07-27 | 2023-04-27 | 2023-01-26 |

| Reported EPS | 4.38 | 4.15 | 3.73 | 3.82 | 3.89 | 3.59 | 3.31 | 3.18 | 3.39 | 2.89 | 2.8 | 2.65 |

| Estimated EPS | 4.31 | 4.02 | 3.56 | 3.69 | 3.75 | 3.51 | 3.24 | 3.08 | 3.21 | 2.83 | 2.71 | 2.58 |

| Surprise | 0.07 | 0.13 | 0.17 | 0.13 | 0.14 | 0.08 | 0.07 | 0.1 | 0.18 | 0.06 | 0.09 | 0.07 |

| Surprise Percentage | 1.6241% | 3.2338% | 4.7753% | 3.523% | 3.7333% | 2.2792% | 2.1605% | 3.2468% | 5.6075% | 2.1201% | 3.321% | 2.7132% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-01-29 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 4.25 |

| Currency | USD |

Previous Dividend Records

| Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | Aug 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-11-07 | 2025-08-08 | 2025-05-09 | 2025-02-07 | 2024-11-08 | 2024-08-09 | 2024-05-09 | 2024-02-09 | 2023-11-09 | 2023-08-09 |

| Amount | $0.76 | $0.76 | $0.76 | $0.76 | $0.66 | $0.66 | $0.66 | $0.66 | $0.57 | $0.57 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: MA

2025-12-04 19:04:27

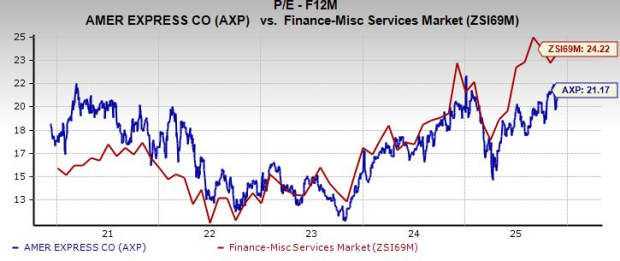

American Express (AXP) shares are trading above their long-term average P/E, attracting attention despite being valued higher than its 5-year median. The company benefits from its premium customer base, robust fee income, and closed-loop network, leading to strong financial performance and shareholder-friendly moves. While AXP exhibits solid earnings momentum and growth potential, its elevated valuation, rising expenses, and higher leverage temper near-term upside.

2025-12-04 18:08:14

American Express (AXP) shares are trading above their long-term averages with a forward 12-month P/E of 21.17X, indicating a significant market revaluation despite being below the industry average. The company benefits from a premium customer base, strong network effects, and strategic investments in AI, driving revenue and outperforming competitors like Mastercard and Visa in recent price performance. While facing rising expenses and higher debt, AmEx maintains strong brand equity, customer loyalty, and shareholder-friendly moves, suggesting it is fairly valued at current levels with a Zacks Rank #3 (Hold).

2025-12-04 12:17:24

Invesco Ltd. significantly increased its stake in Vistra Corp. by 25.2% during the second quarter, now holding 4,537,384 shares valued at $879.39 million, representing 1.34% of the company. Other institutional investors like Massachusetts Financial Services Co. and Norges Bank also hold substantial positions, pushing institutional ownership to 90.88%. Despite slightly missing Q2 earnings estimates, Vistra reported a high return on equity and raised its quarterly dividend, while analysts maintain a consensus "Buy" rating with an average price target of $233.20.

2025-12-04 11:08:43

Prudential Financial Inc. significantly increased its stake in Okta, Inc. (NASDAQ:OKTA) by 229.1% in the second quarter, bringing its total holdings to 27,477 shares valued at $2.75 million. Other institutional investors like Vanguard Group Inc. and Massachusetts Financial Services Co. MA also increased their positions. Despite insider selling activity, analysts have a "Moderate Buy" consensus rating for Okta with a consensus target price of $112.08, and the company recently reported strong quarterly earnings, surpassing analyst expectations.

2025-12-03 19:06:19

American Express (AXP) has maintained a high return on equity (ROE) despite rising expenses due to strategic investments in growth, brand visibility, and digital expansion, alongside disciplined credit management. While expenses for AXP and its competitors like Visa (V) and Mastercard (MA) are increasing, American Express leverages innovation and customer engagement to sustain strong returns and has returned significant value to shareholders through buybacks and dividends. AXP's stock has outperformed its industry year-to-date, and its valuation and earnings estimates suggest continued growth.

2025-12-03 11:43:35

Norges Bank recently acquired a new stake in Dollar General Corporation valued at approximately $154.37 million, purchasing 1,349,632 shares. Other institutional investors like Royal Bank of Canada and Massachusetts Financial Services Co. also significantly increased their holdings in DG. The article also provides a financial overview of Dollar General, including stock performance, market capitalization, and recent analyst ratings.