LendingClub Corp

$ 15.02

1.83%

24 Feb - close price

- Market Cap 1,700,696,000 USD

- Current Price $ 15.02

- High / Low $ 15.30 / 14.70

- Stock P/E 12.72

- Book Value 13.01

- EPS 1.16

- Next Earning Report 2026-04-29

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.10 %

- 52 Week High 21.67

- 52 Week Low 7.90

About

LendingClub Corporation, is a banking holding company for LendingClub Bank, a National Association that offers a range of financial products and services through a technology-driven platform in the United States. The company is headquartered in San Francisco, California.

Analyst Target Price

$24.20

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-28 | 2025-10-22 | 2025-07-29 | 2025-04-29 | 2025-01-28 | 2024-10-23 | 2024-07-30 | 2024-04-30 | 2024-01-30 | 2023-10-25 | 2023-07-26 | 2023-04-26 |

| Reported EPS | 0.35 | 0.37 | 0.33 | 0.1 | 0.08 | 0.13 | 0.13 | 0.11 | 0.09 | 0.05 | 0.09 | 0.13 |

| Estimated EPS | 0.3393 | 0.31 | 0.15 | 0.11 | 0.09 | 0.08 | 0.04 | 0.03 | 0.01 | 0.04 | 0.04 | 0.1 |

| Surprise | 0.0107 | 0.06 | 0.18 | -0.01 | -0.01 | 0.05 | 0.09 | 0.08 | 0.08 | 0.01 | 0.05 | 0.03 |

| Surprise Percentage | 3.1536% | 19.3548% | 120% | -9.0909% | -11.1111% | 62.5% | 225% | 266.6667% | 800% | 25% | 125% | 30% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-29 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.335 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: LC

2026-02-09 00:59:12

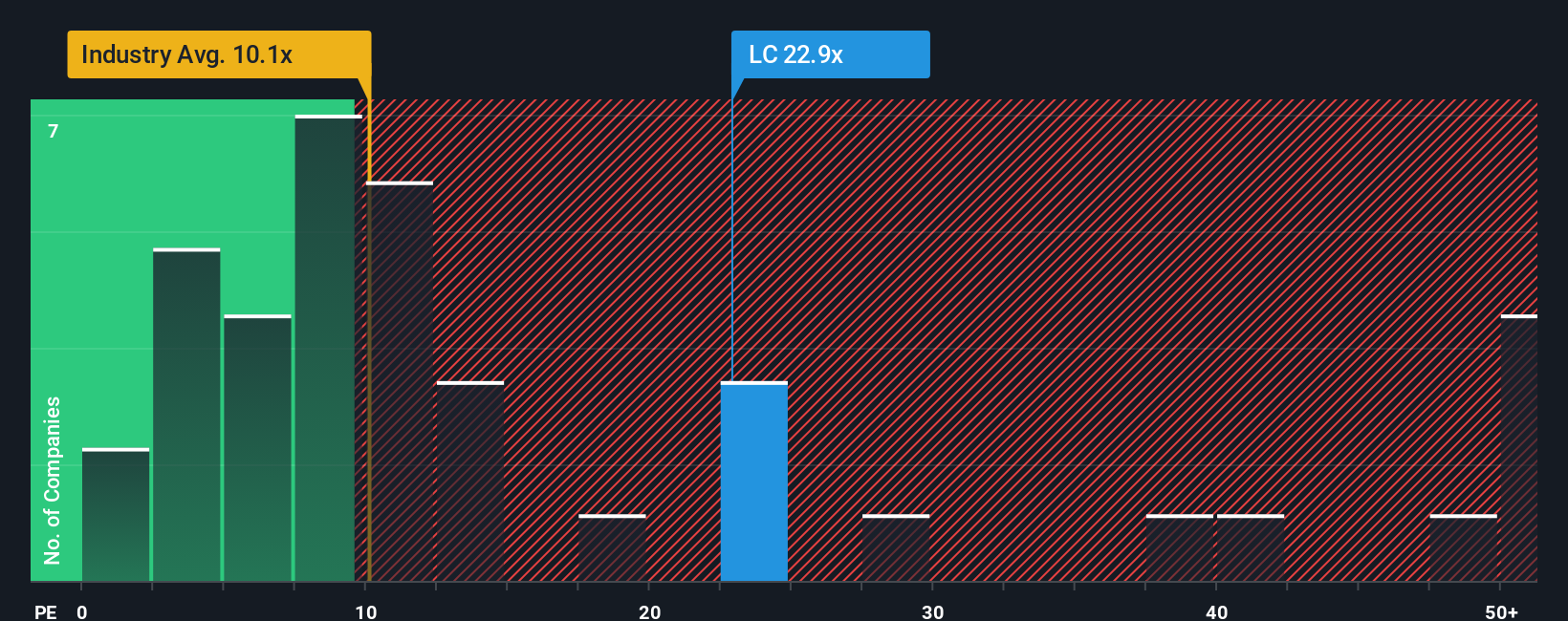

LendingClub (LC) has reported strong Q4 and full-year 2025 results, with increased net income, earnings per share, and new 2026 profit guidance, alongside lower net charge-offs and a completed share buyback. Despite a recent cool-down in short-term share price momentum, longer-term returns remain robust. The stock is currently trading at a discount to analyst targets and intrinsic value estimates, with a fair value estimate of $24.20, suggesting it is undervalued, but its P/E ratio presents a mixed picture compared to industry averages and peers.

2026-02-08 00:59:12

LendingClub reported strong 2025 results with increased net income and a share repurchase, but its 2026 earnings guidance is modest. Investors are weighing the company's digital-first bank growth story against execution risks, leadership changes, and shifting financial strategies. The article suggests investors consider multiple viewpoints and conduct thorough research given the mixed signals.

2026-02-06 15:59:08

LendingClub (LC) has experienced a significant 24.1% decline in its stock price over the past four weeks, placing it in oversold territory according to its Relative Strength Index (RSI) of 29.23. This technical indicator, combined with a 5.5% increase in consensus EPS estimates over the last 30 days and a Zacks Rank #1 (Strong Buy), suggests a potential rebound for the stock. Analysts agree that the company is poised to report better-than-expected earnings, indicating a strong fundamental basis for a turnaround.

2026-02-04 08:57:51

LendingClub's Q4 2025 results surpassed revenue and GAAP EPS expectations, yet the stock declined due to concerns over higher marketing and operating expenses. Analysts probed into these rising costs, the impact of fair value accounting changes, credit quality, macroeconomic risks, and marketing expense deferrals. The company's management addressed these concerns, providing insights into their strategy, including future expectations for normalized expenses and reaccelerating origination growth.

2026-02-03 12:58:44

LendingClub's recent earnings call highlighted strong growth in loan originations, revenue, and net interest income, along with significant profitability improvement and a commitment to maintaining best-in-class credit performance. The company is strategically investing in new products, distribution channels, and technology, including a shift to fair value accounting, which management expects will lead to higher long-term returns despite near-term volatility. LendingClub also emphasized its expanding banking franchise, customer engagement initiatives, and a $100 million share repurchase program, reinforcing its confidence in sustained growth and increased shareholder value.

2026-02-03 02:58:47

This article summarizes a bullish thesis on LendingClub Corporation (LC), highlighting its unique hybrid model as a digital bank and fintech marketplace, its machine-learning underwriting, and its dual-engine revenue model. The company's strategic shift towards balance-sheet lending and portfolio acquisitions is expected to drive more stable growth. Despite competitive pressures and regulatory burdens, LC's scale, technology, and data analytics provide significant competitive advantages.