Jabil Circuit Inc

$ 255.18

0.37%

04 Mar - close price

- Market Cap 27,259,083,000 USD

- Current Price $ 255.18

- High / Low $ 258.00 / 252.86

- Stock P/E 40.00

- Book Value 12.58

- EPS 6.38

- Next Earning Report 2026-03-19

- Dividend Per Share $0.32

- Dividend Yield 0.13 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.48 %

- 52 Week High 281.37

- 52 Week Low 108.49

About

Jabil Inc. provides global manufacturing solutions and services. The company is headquartered in Saint Petersburg, Florida.

Analyst Target Price

$264.50

Quarterly Earnings

| Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | Aug 2023 | May 2023 | Feb 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-12-17 | 2025-09-25 | 2025-06-17 | 2025-03-20 | 2024-12-18 | 2024-09-26 | 2024-06-20 | 2024-03-15 | 2023-12-14 | 2023-09-28 | 2023-06-15 | 2023-03-16 |

| Reported EPS | 2.85 | 3.29 | 2.55 | 1.94 | 2 | 2.3 | 1.89 | 1.68 | 2.6 | 2.45 | 1.99 | 1.88 |

| Estimated EPS | 2.69 | 2.95 | 2.32 | 1.83 | 1.88 | 2.22 | 1.85 | 1.66 | 2.58 | 2.32 | 1.87 | 1.85 |

| Surprise | 0.16 | 0.34 | 0.23 | 0.11 | 0.12 | 0.08 | 0.04 | 0.02 | 0.02 | 0.13 | 0.12 | 0.03 |

| Surprise Percentage | 5.948% | 11.5254% | 9.9138% | 6.0109% | 6.383% | 3.6036% | 2.1622% | 1.2048% | 0.7752% | 5.6034% | 6.4171% | 1.6216% |

Next Quarterly Earnings

| Feb 2026 | |

|---|---|

| Reported Date | 2026-03-19 |

| Fiscal Date Ending | 2026-02-28 |

| Estimated EPS | 2.41 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-03 | 2025-12-02 | 2025-09-03 | 2025-06-03 | 2025-03-04 | 2024-12-03 | 2024-09-04 | 2024-06-04 | 2024-03-04 | 2023-12-04 |

| Amount | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: JBL

2026-03-04 21:15:26

Jabil Inc. (NYSE: JBL) announced it will release its second-quarter fiscal year 2026 financial results on Wednesday, March 18, 2026, before the market opens. The company will host a conference call and webcast at 8:30 a.m. ET to discuss these results. Interested parties can access the live webcast and accompanying presentation via the Investor Relations section of Jabil’s website.

2026-03-04 19:52:24

The article discusses the mixed signals for U.S. manufacturing, with private sector hiring seeing a modest pickup in February but the manufacturing sector continuing to shed jobs. Seeking Alpha's Quant Ratings differentiate between manufacturing stocks, highlighting those with "Strong Sell" ratings based on various financial metrics. Forward Industries (FWDI:NASDAQ) and Lucid Group (LCID) are identified as having the lowest Quant Ratings among manufacturing stocks.

2026-03-04 16:51:38

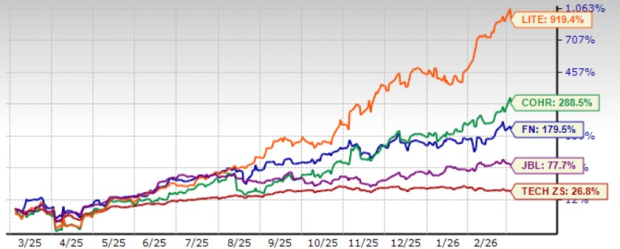

Fabrinet (FN) shares have surged 24.9% in the past month due to increasing Telecom and Datacenter Interconnect (DCI) revenues, easing datacom constraints, and scaling High-Performance Computing (HPC) business. The company posted strong Q2 fiscal 2026 results, exceeding guidance and showing substantial year-over-year growth in both revenues and earnings. Despite competition, Fabrinet's robust financial health, including a debt-free balance sheet and positive earnings estimate revisions, supports a premium valuation and suggests further growth potential.

2026-03-04 16:00:00

Jabil, Inc. opened with a 4% loss, contributing to a broader market decline, despite the company's positive one-month performance. The company exhibits a high price-to-earnings ratio and strong return on equity, and technical indicators show a mixed outlook.

2026-03-04 14:12:33

Smith Chas P & Associates PA Cpas significantly reduced its stake in McDonald's (MCD) by 41.3% in Q3, selling over 73,000 shares. Company insiders, including EVP Jonathan Banner and Joseph M. Erlinger, have also been net sellers of the stock. Despite these sales, McDonald's recently outperformed quarterly earnings estimates and declared a quarterly dividend, while analysts maintain a generally positive outlook with an average "Hold" rating.

2026-03-04 12:52:47

A director at TTM Technologies recently sold a block of shares through a pre-arranged trading plan. While not contradicting the company's growth story in AI and defense, this insider sale raises questions amidst market volatility and potential investor concerns about confidence in execution. Investors are advised to track consistent selling patterns and weigh them against other signals like earnings and new contracts.